The process of income tax returns is not just limited to submitting the return online. A taxpayer also needs to verify the income tax return after it has been filed. Today, we will discuss the process and online and offline options for verifying an ITR.

Make sure to file your returns on time to avoid penalty charges. If you have already filed or submitted your tax return online, the next step is to verify your return through the available modes, such as ATM, bank account, Demat account, net banking and Aadhaar OTP.

Latest Update In ITR Verification

- The CBDT department has reduced the time limit for verification of ITR data transmitted electronically from 120 days to 30 days. If ITR verification is completed within 30 days from the date of ITR uploading, the date of ITR uploading will be treated as the date of filing the ITR. However, if ITR verification occurs beyond 30 days, the date of ITR verification will be considered as the date of filing of the ITR.

Same as in the old days, an assessee can also get their return submission verified by sending a self-attested ITR-V form to the CPC office in Bangalore. However, the process has now been simplified through several alternative options for verification of an ITR submission.

6 Methods to Verify Income Tax Return (ITR) Online & Offline

Have a look at the easy 6 methods to verify income tax returns by online and offline.

Verify ITR Through a Pre-validated Bank Account

- Visit the e-filing portal (https://www.incometax.gov.in/iec/foportal/) and log in to your account.

- Go to Profile Settings and click the option to pre-validate your bank account. (Service only limited to certain banks)

- Select EVC as your ITR verification method to verify through your pre-validated bank account.

- Once you successfully file your ITR, an e-verification code (EVC) will be sent to your bank account registered mobile number.

- Enter this code for verification on the e-filing website.

ITR Verification Through Aadhaar OTP

If you have an Aadhaar card with your mobile number attached to it, you can also verify your ITR using your Aadhaar card. Here’s how.

- Log into your income tax e-filing portal account.

- Choose Aadhaar OTP as the preferred verification method while filing your ITR.

- Once the return is filed, the OTP will be sent to your Aadhaar-registered mobile number.

- Enter this OTP for verification on the e-filing website.

Verify ITR Through Demat Account Verification

If you have a Demat account, you can use it for verifying your IT return. Here’s how.

- Log into your e-filing website account.

- Go to the Profile Setting section and choose EVC using a Demat Account under verification mode.

- If your Demat account is pre-validated, you will receive an EVC (e-verification code) to your Demat-registered phone number after the ITR is filed successfully.

- Provide this code in the field for verification of your return.

ITR Verification By Using the Net Banking Option

- Log in to your net banking account of the same bank that is added to your income tax account.

- Click on the e-filing option.

- You will be redirected to the e-filing portal of the Income Tax Department, where you can proceed to submit and verify your return.

ITR Verification Offline Through Bank ATM

If you are not comfortable with online ITR verification or want to do it physically, you can do so by visiting the ATM of your bank. The facility is, however, available only in select banks.

Here’s how to do it:

- Insert your ATM or debit card into the machine.

- Select PIN for the e-filing option to proceed.

- The EVC (e-verification code) will be sent to your registered mobile number.

- Once you receive the EVC, log into your e-filing portal account and verify your income tax return using the verification option “already generated EVC through Bank ATM”.

By using these methods, you can easily file and verify your ITR online without having to send physical verification like in the old days.

Recommended: Quick to Check Income Tax Return (ITR) Status Online

ITR Verification Without e-Filing Login

The income tax department has recently introduced a feature to verify your e-file without logging which is also the last step to filing the returns.

The following are the Steps:

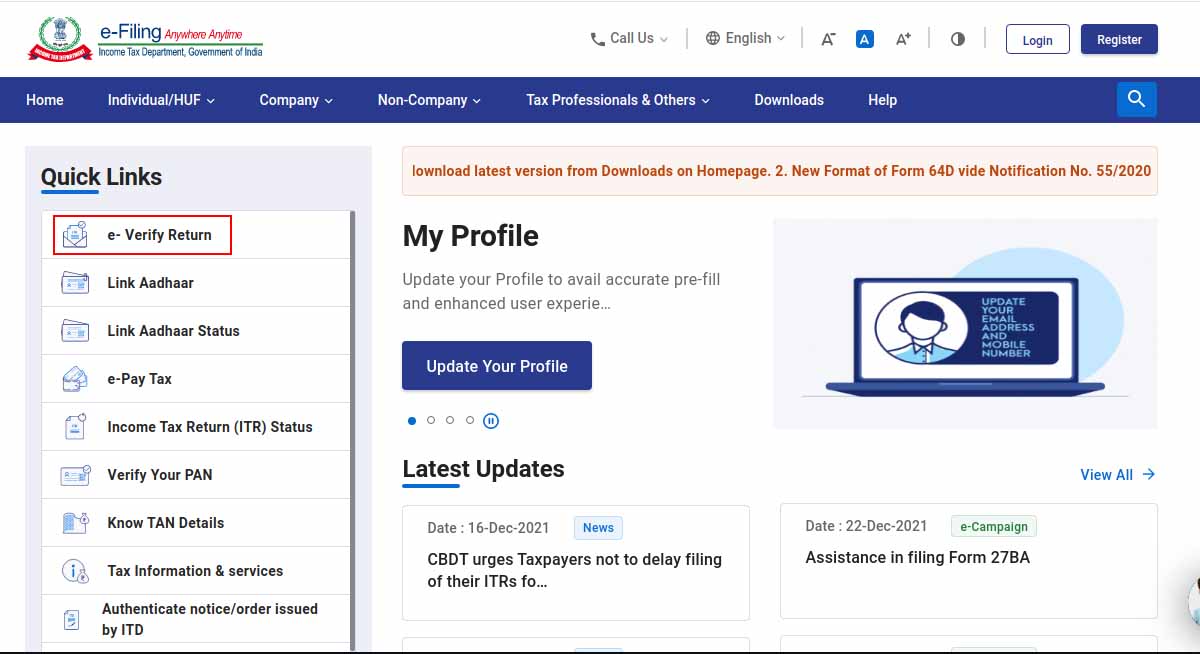

Step 1: Open the website https://www.incometax.gov.in/iec/foportal/

Step 2: Now, in the ‘Quick links’ tab, opt for the ‘e-verify return’ option

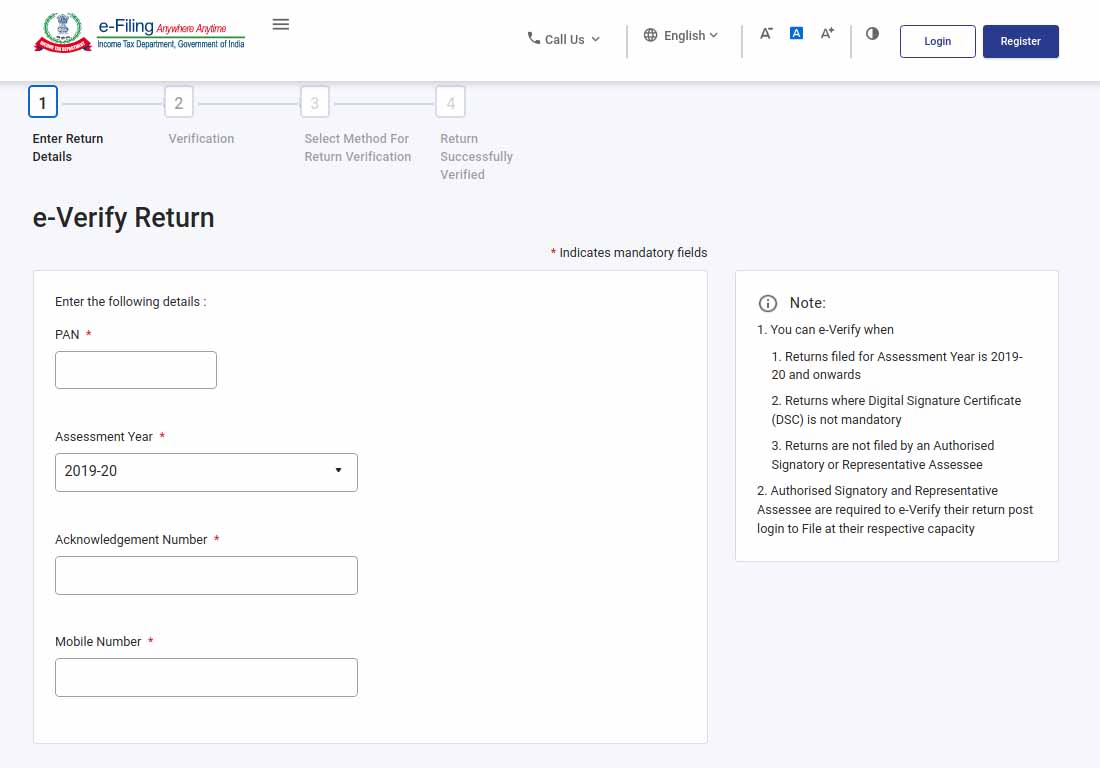

Step 3: Now input the required details such as PAN, Assessment year (2025-26), acknowledgement number and mobile number, after which click on the continue tab

Step 4: Now there will be 3 options appearing in front of you, i.e.

- Option 1: I already have an EVC to e-verify my return.

- Option 2: I do not have an EVC, and I would like to generate an EVC to e-verify my return

- Option 3: I would like to use Aadhaar OTP to e-verify my return

One has to select any of the options that appear and verify the tax return.

Also if the taxpayer wants to use the Aadhaar OTP as a verifying method he can use the number registered with the Aadhaar. If in case the user does not have the EVC (Electronic Verification Code), then it can be generated through a pre-validated bank account or the demat account.

Things to Note Down:

- The facility will only e-verify returns filed for FY 2018-19 and not the previous year’s returns

- Also, the verification where no DSC is required can use the feature

- Any authorised signatory or representative assessee cannot file the return

CBDT Permitted ITR e-Verification for the Last 5 Years

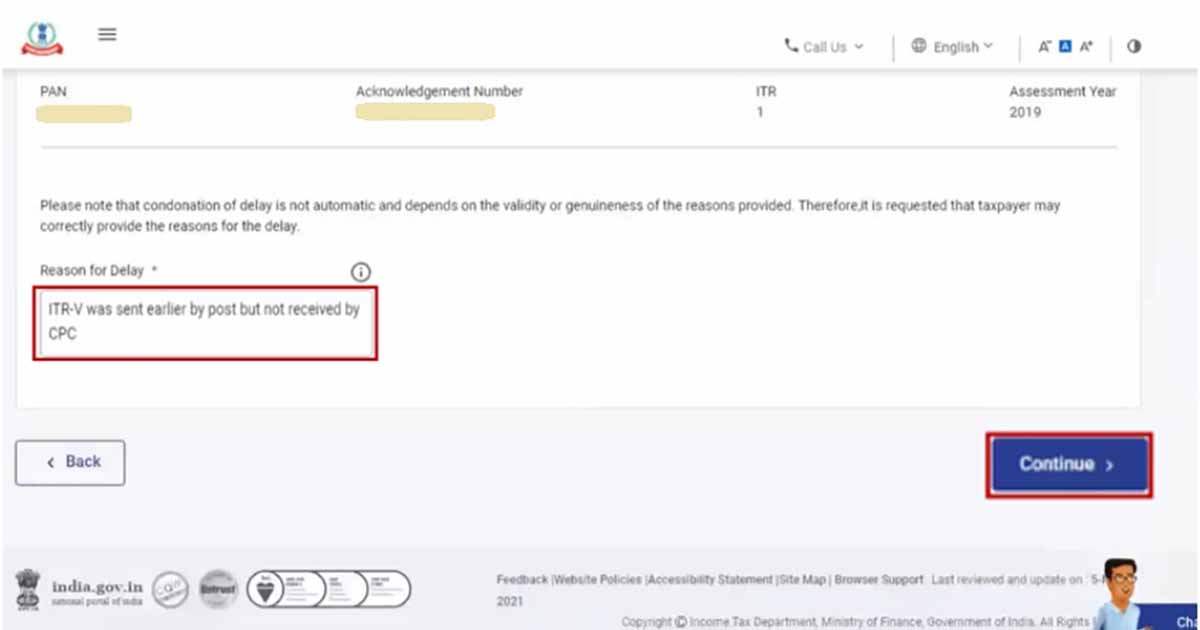

With this, according to an order issued by CBDT, If the ITR-5 is not furnished on time, then the return can be considered as not-filed or in other words invalid. To resolve the complaints related to it at once, CBDT has given permission for the e-verification of electronically filed income tax return data for the assessment years.

The CBDT stated in an order that a large number of electronically filed income tax returns are still pending. The reason for this is not sending the ITR-5 (Verify) form to the Centralized Processing Center (CPC) Bengaluru (Bengaluru) by the respective taxpayers. Under this, either the ITR-5 Form has to be signed and sent to CPC Bengaluru or it can be verified through EVC / OTP.

Guaranteed FIX

All who are facing issues with ITR, getting error:

#itr/ITR 1/creation info/intermediary city:expectedmaxLength:25.

Download offline utility from

https://www.incometax.gov.in/iec/foportal/downloads/income-tax-returns

Download JSON from the portal and import in utility to file ITR

I am getting a error ” bad request post” foitrvalidations2223medswrvice.iec.svc.cluster.local:8381/inrintval/2223/api/1.0.0/HTTP/1.1

So unable to proceed for verification

The date should be before 01/04/2021 for AY 2021-22.