Taxpayers and businessman can track the return filing status in a convenient way by logging on to the official GST government website. The GSTR filing is a mandatory process for the businessman.

After filing GST returns, the taxpayer must ensure that his return is uploaded on the government official and in any case, the returns are not filed or showing pending then there must be a quick action.

Types of GST Return Application Status

There are 4 types of GST return application status available for the taxpayers to make them acknowledge the actual status of their return filing. While every status means different according to the category, the status displayed beside every GST return filed previously and other reference details.

Types of GST Return Application Status:

- FILED – VALID: Return Filed

- FILED – INVALID: Return Filed tax but short paid or not paid

- TO BE FILED: Return due but not filed

- SUBMITTED BUT NOT FILED: Return Validated but filing pending

Online Procedure to Track GST Return Application Manually After Login

Now let us find out the procedure of tracking GST return filing status online, through the help of official government GST portal:

- Step 1 – The taxpayer can track the GST return manually after visiting the official GSTN portal i.e. https://gst.gov.in

- Step 2 – Now provide the login credentials for accessing the account

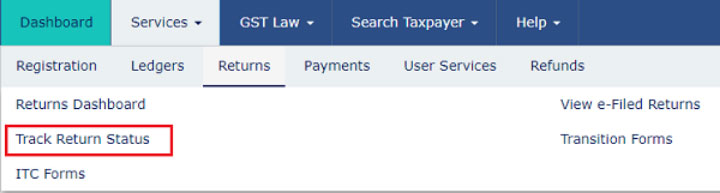

- Step 3 – After which click on the Services > Returns> Track Return Status tab

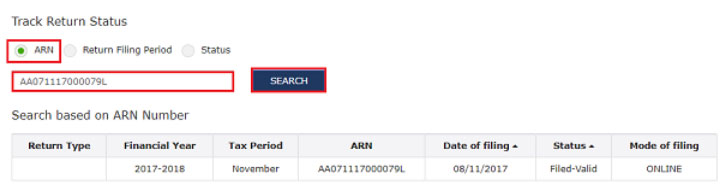

If ARN is available:

- Step 1 – Enter the ARN details after selecting the ARN option

- Step 2 – Now click on the search tab

All the relevant return status will be displayed on the screen.

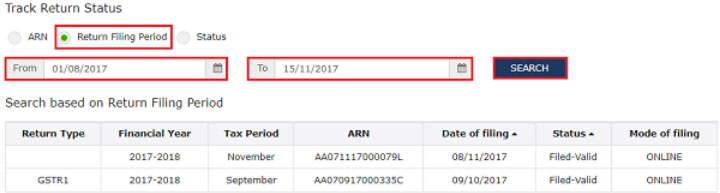

If searching for return filing period:

- Step 1 – Select the return filing period through the calendar available

- Step 2 – Now click on the search tab

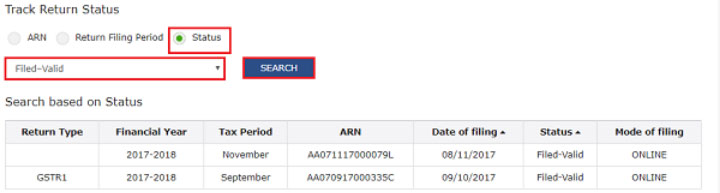

If searching is for the status:

- Step 1 – Click on the status of the return option in the drop-down list

- Step 2 – Now select the search tab

Read Also: Mismatch in GST Return Filing Brings Notices Again

Online Procedure to Track GST Return Application Manually Without Login

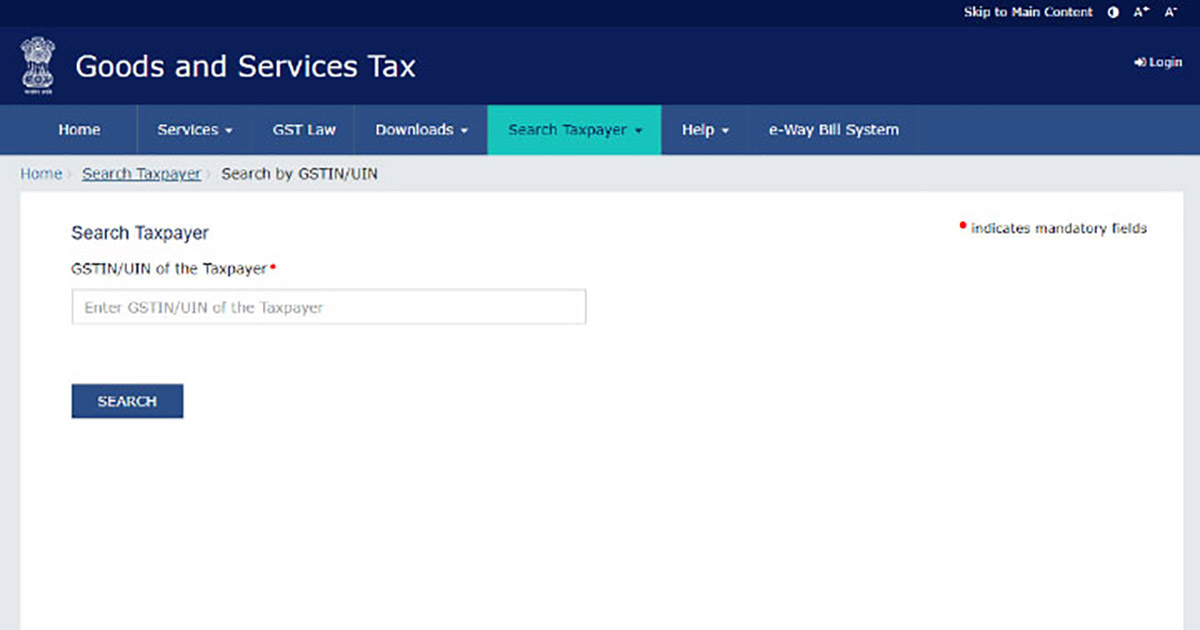

Step 1 – Visit the official GSTN portal i.e. https://gst.gov.in

Step 2 – Now click on the Search Taxpayer option on the menu bar

Step 3 – An option of ‘Search by GSTIN/UIN’ will appear, click on it

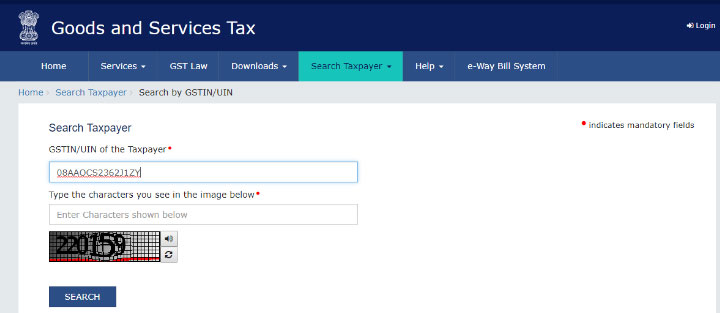

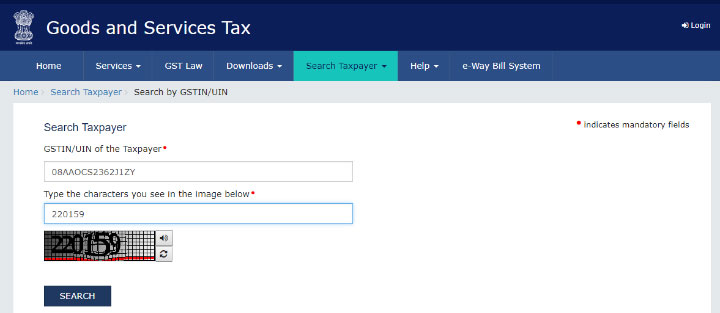

Step 4 – Enter the GSTIN ID of the business firm

Step 5 – Enter the exact captcha code given, and then click the search tab

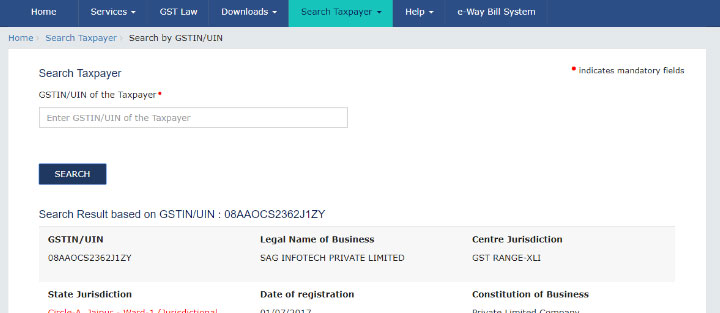

After all these procedures, there will appear all the normal details shown of the company including:

- Legal Name of Business

- Centre Jurisdiction

- State Jurisdiction

- Date of registration

- Constitution of Business

- Taxpayer Type

- GSTIN / UIN Status

- Date of Cancellation

- Field Visit Conducted?

- Nature of Business Activities

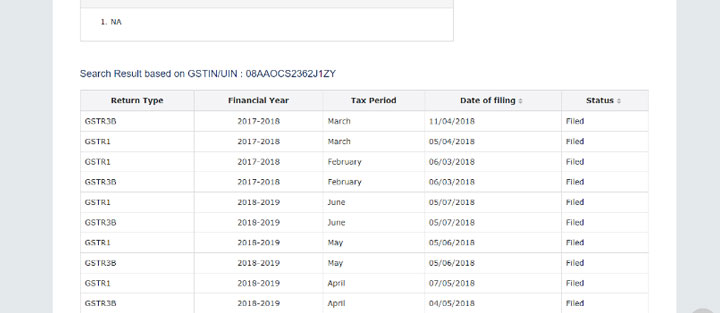

Along with these details, there will be a list of all the GST returns filed in the recent time along with the subheading namely:

- Return Type

- Financial Year

- Tax Period

- Date of Filing

- Status

Although the information provided by this method will be plain and simple and one cannot find additional details of the return status like the status type. In addition to this, there is a manual method of tracking GST return status available. For the manual tracking of return status, there is an Application Reference Number (ARN).

After the submission of GST return on the govt. portal, the taxpayer will be provided with an Application Reference Number (ARN) by which he can track the status manually.

Note: The above method of tracking GST return filing status is without login into the GST portal, therefore, the status will be shown in a direct way without any further details.