Are you still using the old, manual process of payroll management, where all the data is manually entered and managed in Excel sheets or physical paper? Then, you can definitely save good money and time by learning about the best HR payroll software in India.

Online payroll software is a digital, cloud-based application that can be used for storing and managing a variety of data in your organisation, such as employee attendance & leave records, salary computation, data storage and online access, and tax computation, among other things.

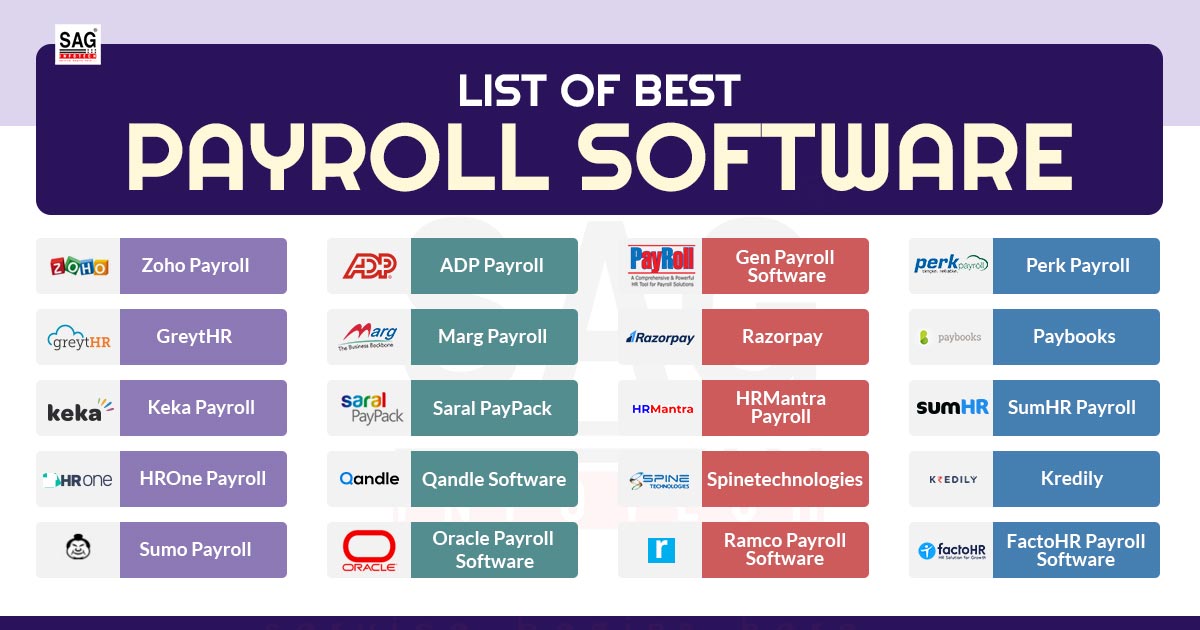

While using a payroll system can be the best decision you make to improve productivity, efficiency, and reduce costs in your HR operations, choosing the best payroll software is equally important. Here’s the list of the top payroll software in India, in terms of user experience, features, service, etc, that you can choose from.

Fill Form for Best Payroll Software

What is Payroll HR Management Software?

The payroll software is used to compute and process employee pay, generate tax forms, as well as ensure administration advantages. Integrating Payroll compliance software services within a larger infrastructure of human resource software or budget/accounting is also feasible.

The use of payroll software enables the process of payroll to be integrated into one platform and gives different tools to enable payroll functions in an accurate way. Payroll software diminishes the mistakes and errors that are caused by humans while computing the payroll software. It indeed permits the employees to self-service the functions, which lessens the work of the administrative.

What is the Process of Making the Rank?

Towards the concern of the best payroll compliance software in India, we revealed 385 platforms that are presently available in contrasting their peculiarities, simple use, client service, integrations, and mobile support with an exclusive SmartScore rating algorithm.

Advantages of Top Payroll HR Software

Our comprehensive measurements reveal that payroll tools contribute to lots of advantages, like saving time and money and reducing compliance uncertainties.

Saving Time: With the help of using top-quality payroll compliance software, you can save your important time and money. The design of the applications is made consciously, which specifies that the HR employees can simply learn to handle the same. It is revealed by a manufacturing firm that using the payroll solution takes less time to manage the payroll. It takes 2 days to execute the payroll chores manually, while through the payroll HR software, the time taken for payroll chores gets reduced to half a day.

Lessens Risk & Enhances Preciseness: Payroll software immensely assists companies with their tax needs and furnishes tax reports. By manually doing the payroll executions head towards mistakes and omissions, along with the errors that truly affect the companies.

Moreover, the companies see the risk of penalties if they do not undergo a proper process of tax regulations. Payroll management solutions can finish the tax reports and filings for the businesses and inform you towards the last dates. Along with that, payroll also initiates the complex chores of monitoring the revisions in the tax code.

Makes Brief Reports: The payroll software supports you to monitor the information over time and simply makes the reports for the auditors, accountants, and internal decision-makers. For instance, these reports consist of employee participation in 401 (k) plans, year-end tax remittances, and reviews of quarterly expenses.

Regulation Compliance: Following the rules and laws in the taxation industry is difficult, but the latest payroll software offers tools that help streamline tax computations and filings. By following the new payroll HR management software, the businesses can prevent the penalties and fines from the statutory bodies.

What Kind of Buyer Are You?

Towards the requirement of the software, the payroll is one element for various firms; however, it is not always the same. There are distinct levels of buyers, and these classes shall assist you in finding out the best payroll HR software that fulfils your company’s requirements.

Small businesses: Small business owners require easy-to-handle payroll processing, and that’s why they are always in search of a solution that is 100% dedicated and economical.

Midsize businesses: Human resources professionals in midsize firms or bigger who have more than 50 employees shall provide advantages exceeding the normal payroll functions. Towards the segment, the onboarding, direct deposit, tax filing, and the additional specifications like monitoring attendance and time monitoring shall be precious and towards that, the customer shall need a more complete human resources management system.

Large businesses: These are the bigger clients who handle more than human resource management, to the enterprise resource planning (ERP) package, which provides solutions like payroll processing, talent management, and human capital management systems. This shall provide you with assurance about the alliance for payroll and HR functions, along with the accounting and department-specific systems.

Check the Best & Powerful Payroll Software in India

If you are seeking the best payroll software in India, then you have come to the correct place. This article discusses the top employee management payroll software, which is favoured by the majority of companies.

It is hard to head towards success for the companies as timely and organised payment is a difficult thing to perform. Handling the employee’s schedule becomes difficult for companies. Payroll management software provides you with assurance for smooth processing and payment to the employees. Towards handling the payroll of the employees, the payroll management software provides various benefits.

Zoho Payroll

Payroll software by Zoho is another popular utility tool used by businesses for effectively managing their HR operations. The software is designed to make the job easier for HR teams by allowing them to manage employee data online on a secure server with global accessibility. It has a user-friendly interface with many crucial features like employee information & data recording, salary computation, payroll calculation, easy tax calculation and filing, etc.

Features of Zoho Payroll

- Import Previous Employment Details

- Salary History and Change Designation

- Work in Multiple Areas

- Notification for Upcoming Tax Submissions

- Easily Apply Pre or Post-Tax Deductions

| Price | Starting ₹50 Per Employee/Month |

| Product Page | https://www.zoho.com/in/payroll/ |

| Our Rating | 4.2/5 |

GreytHR Payroll

GreytHR is a complete, online, cloud-based HR and payroll software solution designed to help small & mid-size businesses with their daily payroll needs. The software can be used by any business, irrespective of the industry or size, for managing their HR operations and securely recording their employee data in a globally accessible manner. The software is being used by companies in over 150 Indian cities and has received an overall positive user experience.

GreytHR Payroll Features

- Automate Reimbursements & Loan

- PF Calculations with ECR Generation

- Form 24Q Generation in a Single Click

- Facility to use the Mobile Application

| Price | No Information |

| Product Page | https://www.greythr.com/ |

| Our Rating | 4.3/5 |

Oracle Payroll Software

Oracle Payroll for India offers features that enhance efficiency and provide control over payroll processes. Automated workflows and dashboards streamline tasks, ensuring accurate payroll processing. The RetroPay feature simplifies adjustments to employee earnings and deductions. Integration with HCM Data Loaders streamlines mass loads and updates. Pre-built and customizable analytics provide real-time, enterprise-wide data, enabling quick and informed decision-making. These features simplify payroll processes, boost productivity, and drive greater value to businesses by providing actionable insights.

Oracle Payroll for India is a cloud-based solution designed to streamline payroll processing, ensuring accuracy and compliance. It offers so many features in payroll processing such as salary allowances and bonuses, statutory and voluntary deductions, investment declaration, tax regime selection, proration and arrears processing, termination payroll processing, reconciliation, and operational reporting. The system also handles statutory compliance, including income tax, professional tax, provident fund, employee state insurance, labour welfare fund, and national pension scheme. It provides support for tax exemptions, captures data for statutory reporting forms, and facilitates electronic funds transfer. Oracle Payroll for India simplifies payroll management while ensuring adherence to legal requirements.

Oracle Payroll for India offers many benefits, including automated retroactive calculations, driving efficiency, increasing accuracy, enhancing employee experience, decreasing compliance risk, simplifying payroll processing, providing more flexibility and control, leveraging the HCM Suite, and reducing the Total Cost of Ownership (TCO).

Oracle Payroll Software Features

- Automated Retroactive Calculations

- Increase Accuracy

- More Flexibility and Control

- Leverage HCM Suite

| Price | No Information |

| Product Page | https://www.oracle.com/in/human-capital-management/payroll/#india |

| Our Rating | No Information |

Gen Payroll Software for HR Services

Gen payroll compliance software is used by HR teams all over India for managing their day-to-day payroll operations and effectively managing their organisation’s employee data & records. This is an online (cloud-based) software that you can access from anywhere and at any time, wherever you need to access your company’s employee data, leave records, salaries, etc.

As one of the comprehensive payroll systems in India, The payroll software reduces the compliance cost of businesses. It has advanced features like an employee profile, unique employee ID, easy data upload, and form 16, 16AA & 12BA download.

The software indeed has various specifications for the employees like applying online for leave checking salary information, tracking their attendance and leave in a month, creating and managing investments, etc the data inside the payroll can be obtained via the contact information, personal information, salary data, attendance, investment details, PF & ESI data, salary certificates along with the preparation of TDS forms and ITR (Income Tax Return) 1 return. SAG Infotech has enabled a biometric time attendance system to manage several HR operations automatically.

Gen Payroll Software for HRMS System

- Employee Self-Services

- Smart Biometric For Time and Attendance

- Auto Calculation Employee PF and ESI

- Salary Calculation in a Single Click

- Auto Record Employee Attendance

- Easily Calculate TDS and Reimbursements

- Import/Export Tax Regime

| Price | ₹15,000 Starting |

| Product Page | https://saginfotech.com/GenPayroll.aspx |

| Our Rating | 4.5/5 |

Ramco Payroll Software

Ramco payroll software is a robust tool that handles most of the burden for enterprises, eliminating the need for manual calculations and confusing withholdings. With Ramco Payroll software, all you need is basic employee wage information and hours worked, and the software takes care of the rest. Stay effortlessly compliant with changing tax laws with this efficient software, as it automatically updates itself whenever there are modifications in tax regulations, ensuring accuracy and saving you valuable time. It even simplifies the completion of employment tax forms and sends you timely reminders for filing deadlines.

Ramco’s Digital Managed Payroll Services offer several outstanding benefits that you will not find anywhere. It has an automated helpdesk through chatbots, and employees can easily address queries related to payroll, leave, expenses, and approvals.

The AI-enabled payroll automation ensures error-free and accurate processing, with data validation and anomaly detection. You will discover here frictionless employee self-service options through voice, bot, mail, and mobile support, enabling quick resolution of queries and service requests.

Analytics capabilities enable powerful insights from employee data, enhancing employee satisfaction and improving the payroll process. Role-based dashboards offer segment-wise reporting for informed decision-making, and pre-built integrations with leading HR/ERP systems ensure seamless data flow for efficient payroll management.

Features of Ramco Payroll for HR

- Face ID

- Touchless Attendance Management System

- Biometric and Swipe Cards

- AI-based service

| Price | N/A |

| Product Page | https://www.ramco.com/products/payroll/payroll-software/ |

| Our Rating | 4.8/5 |

Keka Payroll

Keka HR is one of the best HRMS software used by multiple businesses throughout the country. It’s a cloud platform designed to deliver a great employee experience while making life easier for HR professionals through many ready-to-use features such as employee data & analytics, payroll & expense tracking, performance recording, hiring & onboarding, project timesheet, attendance & leave, and a lot more. Try the free trial version to find out more.

Features of Keka Payroll for HR

- Track Leave Easily

- Schedule Rebates

- Advanced Leave Management

- GPS / Selfie Attendance

- One-One Meeting

- Custom Reports Builder

| Price | Starting ₹6,999 |

| Product Page | https://www.keka.com/ |

| Our Rating | 4.5/5 |

ADP Payroll

ADP Vista HCM SM secures to manage the hardships faced by every type of business. This platform is made by Automatic Data Processing Inc.

Once the HR payroll software is built as per the needs of your business, then you can prepare the payroll and the linked compliances like TDS, PF, and ESI deductions through a single click.

ADP Payroll Features for Small Business

- Annual and Quarterly Reports

- Viewing Pay Reports and Tax Forms

- Employee Personal Information

| Price | No Information |

| Product Page | https://in.adp.com/ |

| Our Rating | 4.3/5 |

Marg Payroll Software

This payroll employee management software has a user-friendly interface. The software has a feature that allows it to be simply integrated through the biometric machine. It shall monitor the process and maintenance of all the details of transferring the salary.

Small and mid-sized businesses shall get supported by HRXpert from Marg, where the management becomes efficient towards things such as employee attendance, salary, and payroll functions.

Features of Marg Payroll Software

- ESS to access salary details, payslips & leaves

- ESI computation, PF calculation with ECR generation

- Integrated SMS and email alerts

- PDF and MS-Excel Reports

- Instantly Generate Reports and Letters

| Price | ₹14,868 Starting |

| Product Page | https://margcompusoft.com/payroll_software.html |

| Our Rating | 4.6/5 |

Saral PayPack

To fulfil all your requirements, the Saral PayPack provides you with combined payroll solutions. Towards your search operations, the software is the only solution that solves your issues related to payroll. It is the correct option for making your payroll work automatically.

The features, such as a Multi-stage security architecture, supporting the user to secure at the File Level, Software Level, and Feature Level, have been furnished by the Saral PayPack. Every screen and Option can be described as user-wise to give access only to the limited co-users.

Features of Saral PayPack Software

- Unlimited Companies and Employees

- Available on the Mobile Application

- Integration with Biometrics

- Customized Report

- Report on Audit Trail

| Price | ₹36,600 (Single User) |

| Product Page | https://www.saralpaypack.com/payroll-software/ |

| Our Rating | 4.2/5 |

Razorpay

Razorpay was built in 2014 and is said to be an effective online payment management software in India, both for small and big businesses at present. Razorpay tech payment solutions are furnishing its services to more than 350000 businesses in the country.

The perfect payroll software for small and medium businesses is Razorpay Payroll. This product has been incorporated to fulfil all the objectives which are suitable for payroll, from onboarding employees to automating compliance payments & their return filings.

This software removes the manual interpretation in operating the payroll. It indeed automatically does the compliance payments such as TDS, PF, ESI, and PT, as well as their periodic filings, salary disbursement, reimbursements, leaves management, etc.

Features for Razorpay

- TDS, ESI, PT & PF Payment

- Payroll Customisable Option

- Manage Leave and Attendance

- Claim Expenses and Upload Bills

| Price | No Information |

| Product Page | https://www.saralpaypack.com/payroll-software/ |

| Our Rating | 3.5/5 |

HRMantra Payroll

HRMantra is an HR/Payroll software designed to help organisations boost their performance and reduce the cost of their HR operations. As a complete human resource management tool, it allows HR professionals to create and manage employee records, create PMS, grant access based on employee position, create learning tools, and manage new hiring. The software integrates many advanced features like automatic calculation of loans, salaries, bonuses & tax, allowing HR teams to increase the productivity of their operations.

HRMantra Payroll Features

- Employee Code Creation

- HR Analytics Tool

- Generate HRM Report

| Price | No Information |

| Product Page | https://www.hrmantra.com/pricing.aspx |

| Our Rating | 3.4/5 |

Choosing the right HR software is the key to the success of your HR team. So, do your research and find the best payroll software that can increase the efficiency of your business without costing a lot. Try a free demo of payroll software for a trial version to experience what a brilliant HR system is like.

Perk Payroll Software

If looking for payroll software, you can go for the cloud-based perk payroll software, which is scalable and maintenance-free. Encourage your employees by furnishing them with timely, accurate paychecks. There are advantages that you can get from the perk payroll software, such as working smarter, simplifying complexity, staying ahead, staying safe, feeling relaxed, saving money, optimizing resources, being accessible to staff, not getting boxed, and supporting.

The platform provides complete employee record management, automates the time, and handles attendance, manages leave Management 24×7 Employee Self Service (ESS) Platform, precise payroll generation, Loan Disbursal Paperless Expense Reporting, Workflow, and Approvals.

Features of Perk Payroll

- Reimbursements and Taxes

- Loan Management

- Backup Facility

- Mobile Application

| Price | 1,500 / Month (includes 30 Employees) + 50 / Month (Per Employee) |

| Product Page | https://perkpayroll.com/ |

| Our Rating | N/A |

Paybooks Payroll Software

Get an easier payroll and facilitate businesses with cloud payroll software and payroll outsourcing services by taking the services from Paybooks. Managing HR, Payroll, and Compliance was never simple before, but in the current times, through the assistance of the paybook system, you can attain direct salary payment, built-in compliance, manage leave, and biometric attendance.

The platform provides a self-service app for the employees, which gives features like payslips and reports, leaves management, and plans income tax. The paybooks tool furnishes the payroll with compliance, provident fund, professional tax, employee state insurance, income tax, TDS, Digitally signed Form 16, and additional compliance reports.

Paybooks Features

- Biometric Devices

- Auto-Generated Salary Slips

- Digitally Signed Form 16

- Mis Reports

- Compliance Reports

| Price | Regular Plan: 2,999/month (Up To 30 Employees) + ₹50/Month (For Every Additional Employee) Premium Plan: ₹4,999/Month (Up To 30 Employees) + ₹75/Month (For Every Additional Employee) |

| Product Page | https://paybooks.in/ |

| Our Rating | 4.9/5 |

SumHR Payroll Software

sumHR provides all the requirements for HR in one HR software. This software facilitates all the needs of the employees and HR. It gives a smooth onboarding experience with crisp checklists and interesting content. You could develop every policy accessible from a central repository. Set up helpdesks to prompt employee assistance.

The platform digitises the information of HR and empowers the employee it allowing Employee profiles, company directories, org charts, and more could be accessible.

The user-friendly platform allows easy running of payroll with no stress it is robust, and the process is reliable, which not only automates the computations but also facilitates the complications for HR along with the employees.

Features of SumHR Payroll

- Biometric attendance

- Automatic MIS reports by email

- 360° performance reviews

- Mobile App

- Online notice board

| Price | Startup Plan: INR 29 per user Basic Plan: INR 49 per user |

| Product Page | https://www.sumhr.com/ |

| Our Rating | 3.7/5 |

HROne Payroll Software Features

HRone would be the intelligent HR solution that has been developed to assist in saving the time of HR, facilitate human interactions to surge employee happiness and furnish actionable understandings to predict the risks and possibilities.

In the current times, there would be a need for a fully automated HR solution as there is a lot of workload and a need for a reliable process is much more.

HRIS Software enables you to describe the policies according to the structure of your company. Whether it is the purpose of rolling out the offer letter or confirmation, dull database management, or clearance, you can do it easily and at a quicker pace.

HROne Software Features

- Biometric integration

- Create Org structure

- Auto-Shift Policy

- Auto CTC breakups

Qandle Software

Qandle platform is the modern workplace for HR It consists of 36 apps that cover all your needs across the core HR, talent management, payroll, and business expenses. No need for installation. Easy set-up in 2 weeks. Past data and company policies are imported with a few clicks.

It has the latest technologies, a strong mobile focus, and superior analytics for better decisions, which assist both the employee and HR in a proper way. Integrated, error-free, compliant, and full-service payroll. Free support from payroll and compliance experts.

The platform manages the business and travel expenses administration for all employees and managers. The software is compliant with bank-grade security (PCI DSS). End-to-end (SHA-2, 2048-bit) encryption of all transmitted data.

Qandle Software Features

- Employee Database & Record

- Asset Management

- Task Management

- Remote Screen Tracking

- Recruitment (incl. ATS)

| Price | Startup Plan: INR 2,950 (upto 50 employees) + INR 59/moper additional employee |

| Product Page | https://www.qandle.com/ |

| Our Rating | 4.5/5 |

Spine Technologies

When you think about an effective payroll system, you can choose the spine technologies, which consist of the Demographics of employees, a structured employee database with integrated statutory compliances, PF, ESIC, TDS, challans, etc, leave integration and pay structures. There’s much more you get when you approach India’s best payroll system.

The platform consists of Dashlets, HRIS, Pay structures, leave management, statutory compliance, loan management, budgeting, Maker and checker, and reports. Since it is known that the employee enjoys self-service, the platform comes up with an identical feature, now there is no need to go to HR to view and amend or update your personal or bank details.

Spine Technologies Payroll Features

- Employee Life Cycle

- Performance Management System

- Workflow

- Time & Attendance

Sumo Payroll

There are various effective payroll applications, one of them is Sumopayroll. It is a leading cloud-based HR and Payroll software, established in 2015, and is made within the higher technology. The platform provides the kind of solution that resolves the complexities of HR functioning with statutory laws, and precise and on-time employee payroll compliance is important to run the businesses.

Hence, this product has been made as per the requirements of the companies that enhance the working efficiency of the company. It provides features like payroll processing, employee management, HR management, time and expense tracking, employee self-service, and bank deposits.

Features of Sumo Payroll

- Provident Fund

- Loans or Advances

- Generate Monthly, Quarterly & Annual Reports

- Payroll Forms (16, 5, 3A, etc)

| Price | Startup Plan: Free: Upto 10 employees and INR 15/emp if above 10 |

| Product Page | https://www.sumopayroll.com/ |

| Our Rating | N/A |

Kredily Payroll Software

Kredily developed a powerful HRMS and Payroll software for businesses that assists firms to automate their HR and payroll working without any expenditure. It removes the error-prone, manual, and time-consuming spreadsheet/Excel-based workflows.

It empowers and engages your employees. The software monitors attendance and optimizes the expenditure of your business. It is also India’s first salary payment gateway. This is a payslip generator, that generates payslips in less time. It consists of a customizable salary structure, chosen from the list of predefined recurring, variable and ad hoc components, or create your own Salary Structure.

Apart from that, it follows government compliance, manages taxes, and also acts as a tax calculator.

Kredily Payroll Features

- Employee Self-Onboarding with Docs

- Login Using OTP

- Web Clock For Attendance

- Bank Transfers through NEFT

| Price | Startup Plan: 1499/Month/up-to 25 employees |

| Product Page | https://kredily.com/ |

| Our Rating | N/A |

FactoHR Payroll Software

FactoHR payroll software is a comprehensive cloud-based solution designed to streamline and simplify payroll processing tasks for your company’s HR department. FactoHR makes payroll management easy and efficient.

The software prioritizes security, offering encryption at rest, audit trails, and fine access control to protect critical employee data. It ensures high accuracy through plug-and-play integration and a validation engine, minimizing human intervention and ensuring precise data output.

FactoHR Payroll Features

- Employee Self Service

- Payslip in Vernacular Language

- Create Multiple Groups

- Customize Option for Salary Slip

| Price | N/A |

| Product Page | https://factohr.com/payroll-software/ |

| Our Rating | N/A |

FactoHR also provides flexibility with scale, allowing formula-based calculations, process customization, and unlimited component creation. With its mobile app and employee self-service portal, employees can access their salary details, payslips, and tax declarations conveniently. Overall, FactoHR payroll software offers a reliable and user-friendly solution for efficient payroll management.

FAQs About Best Payroll HR Management Software

Q.1 – Why Do I Require You to Buy New IT Infrastructure to Use Payroll oftware?

No, You don’t require to buy. All you need is a computer device either it would be a desktop with good internet connectivity and then you go proceed.

Q.2 – There are 25 Employees in My Organization. Do I Still Require to Purchase Payroll Management Software?

If you could understand the expense management module of the payroll solution then it will be good for your company’s daily expenses. However, if you ever processed the wrong salary then payroll management is what you actually meant for you.

Q.3 – What Should I Buy in Between On-Premise Software & Cloud Payroll Management Software?

If we talk about on-premise software then it is best suited for the firms whose having their own IT team and anointed support for IT applications. They also have online HRMS & payroll software which is ideal for organizations that do not have a committed IT to resource team. Additionally, it has a payroll salary software that needs considerable investment through license buy, yearly maintenance cost, etc. Whereas Cloud payroll solution provides the freedom to pay on a monthly/ yearly basis and although, pay to use the model.

Q.4 – Is There any Yearly Maintenance Fee that Has to Pay?

Annual maintenance fees are relevant in terms of when on-premise software licenses are bought by the organization. In case you are paying subscription fees for a cloud payroll solution, you do not have to pay yearly subscription fees on them.

Q.5 – There are Multiple Modules in Employee Payroll Software. But I Don’t Need them all so Can it be Possible to buy Modules Particularly?

Yes, you can buy certain modules as per your company requirements. In case your topmost requirement is to process employee salaries, then you need to select the payroll management module. Here, you can keep a record of your employee’s punch ins/ outs with the time and attendance management module. Basically, you can select the module you want to have or purchase the complete employee payroll software accomplished with each and everything.

Q.6 – What are the Benefits of Payroll Management Software in an Organization?

Payroll management software assists firms with exact payroll calculation processing. As a result get satisfied employees along with zero revenue loss. However, the business can also be taken care of and tracked expenses by employees and make sure of reimbursements in real time. Tax and perks are evaluated automatically to ensure that the firm complies with the policies you made. Additionally, payroll software assists with deep business insights for budgeting and forecasting. Where such firms control costs across various departments.

Q.7 – How Does Payroll Management Software Assist Employees?

Payroll software is a great deal for the employees as it ensures they get their salary on time without any hassle. The software brought transparency to the payroll process along with payslips shared over mail. Also, it grants access to the self-service portal where employees can view their refund claim status, manage tax declaration, download pay slips, and many more.

Q.8 – Which is the Best Payroll Software in 2023 for Small Businesses?

Currently, you can see the best payroll software for the management of small businesses in hassle-free and multiple convenient methods. The businessman can easily select the top HR payroll management software. Every software has a unique specialty such as Gen Payroll software mostly used by PF and ESI compliance and Zoho for cloud-based compliance.

- Zoho Payroll

- GreytHR Payroll

- Keka Payroll

- ADP Payroll

- Gen Payroll Software

- Marg Payroll Software

- Saral PayPack

- Razorpay

- HRMantra Payroll

- Perk Payroll

- Paybooks

- SumHR Payroll

- HROne Payroll

- Qandle Software

- Spine Technologies

- Sumo Payroll

- Kredily