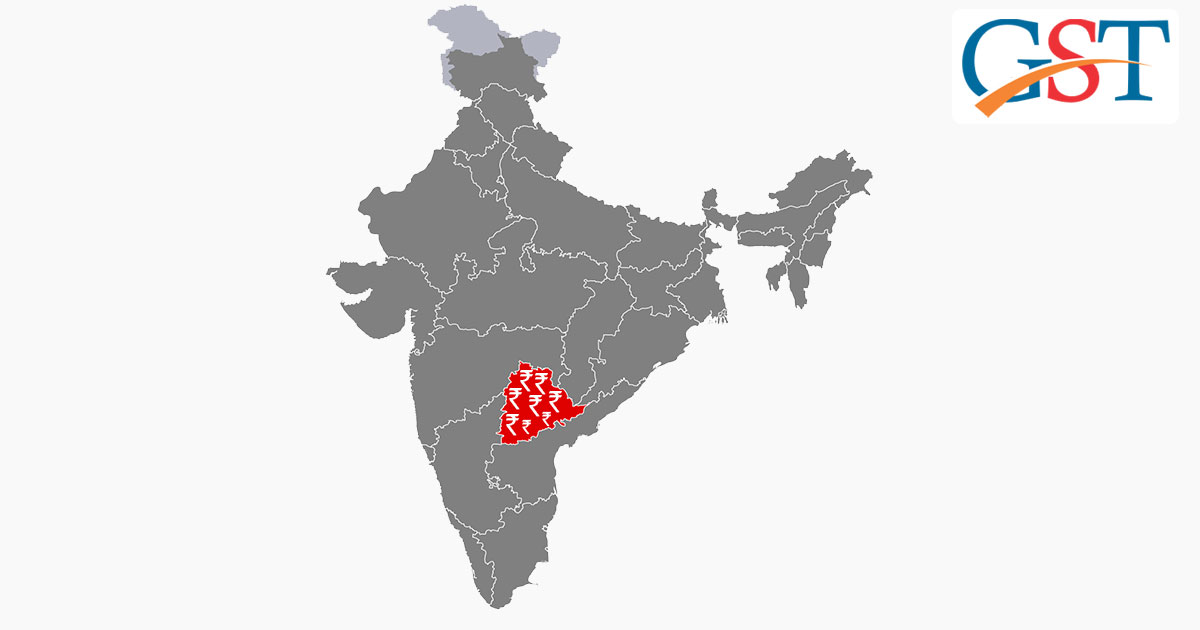

When it comes to proceeds from the soon to be a year old GST, the Indian state of Telangana is setting benchmarks which other states have found hard to emulate. In a stellar performance, Telangana has created a record by collecting Rs 1,876.93 crore of IGST and SGST in April this year. However, Mr Somesh Kumar, the Commercial Taxes Principal Secretary, credits this feat to a simple and good piece of software. In an unofficial press meet, Mr Somesh Kumar said,”We have developed a software and are tracking GST payments regularly”. Awestruck by Telangana’s Bahubali Performance, some northern states have requested the state if they could share the magical piece of computer code with them. Reportedly, the state collected Rs 1,021.32-crore GST in April, surpassing its earlier highest collection of Rs 903.67 crore in March.

Read Also: GST Council Targets Rs 12 Trillion in FY19

Below table gives a detailed picture of the State proceeds from GST in Month on Month basis.

| Month | IGST (in Crore) | SGST(in Crore) | Total(in Crore) |

|---|---|---|---|

| August 2017 | 418.00 | 840.79 | 1,258.79 |

| September 2017 | 669.35 | 805.24 | 1,474.59 |

| October 2017 | 784.00 – | 847.61 | 1,631.61 |

| November 2017 | 798.56 | 750.71 | 1,549.27 |

| December 2017 | 768.01 | 741.12 | 1,509.13 |

| January 2018 | 800.76 | 855.38 | 1,656.14 |

| February 2018 | 790.67 | 794.59 | 1,585.26 |

| Total | 5,828.35 | 6,539.11 | 12,367.46 |

| IGST Settlement | 705 | 0 | 705 |

| Grand Total | 6,533.35 | 6,539.11 | 13,072.46 |

| Grand Total (FY 2017-18) | 6,533.35 | 6,539.11 | 13,072.46 |

|---|---|---|---|

| April 2018 | 855.61 | 1,021.32 | 1,876.93 |

| Total | 7,388.96 | 7,560.43 | 14,949.39 |