In the country, there would be implications for the businesses, the Supreme Court kept a Gujarat High Court decision that permits the companies to makes obligatory 10% pre-deposit through the Electronic Credit Ledger (ECL), which includes accumulated input tax credit (ITC), for filing an appeal under the Goods and Services Tax law.

In the case of Yasho Industries vs. Union of India, a bench headed by Justice B.V. Nagarathna rejected the revenue’s appeal and upheld the Gujarat High Court’s ruling. The bench affirmed that pre-deposit payments made through the Electronic Credit Ledger (ECL) are valid and meet the requirements of Section 107(6)(b) of the Central Goods and Services Tax (CGST) Act, 2017.

Yasho Industries, through ECL using Form GST DRC-03, had deposited the required 10% of the disputed tax amount of Rs 3.36 crore, but the department refused to acknowledge the credit ledger payment as valid. The company contested the same before the HC, which held in its favour.

The verdict of the Apex court is a success for taxpayers, particularly for small and medium enterprises, who frequently face hardship with cash flow constraints in litigation.

Through permitting the use of Electronic Credit Ledger (ECL) for obligatory pre-deposits, the ruling eliminates a financial load and eases the process of appeals by eliminating interpretation.

Taxpayers are not liable to pay in cash when a legitimate ITR is available, ensured by the decision. A tax expert said that the decision is a much-needed breather to industries that are struggling with cash flow.

Currently, if a company is facing issues and required to make a pre-deposit, then it often signifies the shelling out of actual cash even when they secure a GST credit amount lying in the credit ledger. It blocks the working capital.

The new judgment, via permitting them to use their current credit to make these 10% pre-deposits, will free up their cash. If they win their case, then they shall not be required to proceed via the longer refund claiming procedure, as the adjustment shall be within their credit ledger. Concerning immediate cash flow and preventing future nuisances, it is effective.

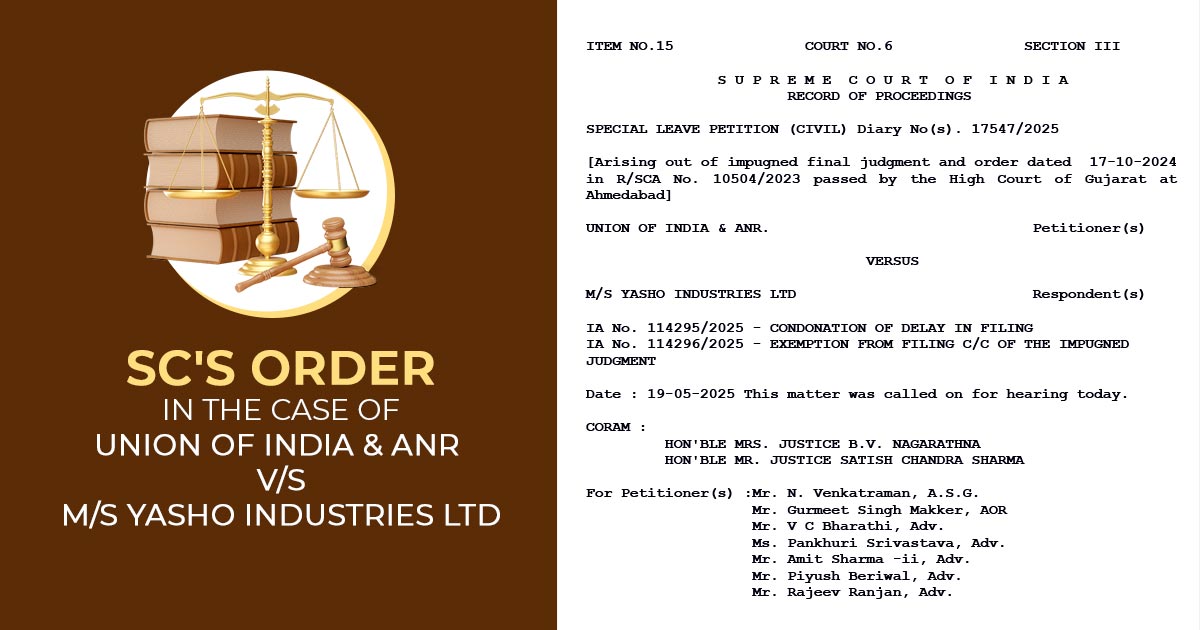

| Case Title | Union of India & ANR vs. M/S Yasho Industries LTD |

| Diary No(s). | 17547/2025 |

| For The Petitioner | Mr. N. Venkatraman, Mr. Gurmeet Singh Makker, Mr. V C Bharathi, Ms. Pankhuri Srivastava, Mr. Amit Sharma, Mr. Piyush Beriwal, and Mr. Rajeev Ranjan |

| For The Respondents | Mr. Abhishek A Rastogi, M/S. Tas Law, Ms. Trishala Trivedi, Mr. Utsav Trivedi, Ms. Pooja M Rastogi, Ms. Garima Gupta, and Ms. Shivani Bhushan |

| Supreme Court | Read Order |