The Apex Court expressed disapproval of the practice wherein parties obtain anticipatory or regular bail orders from courts after voluntarily proposing to deposit certain amounts, but later renege on their statements and approach higher courts, claiming that the condition imposed while granting bail was onerous or that the counsel concerned lacked the authority to make such a statement.

A bench of Justices KV Viswanathan and N Kotiswar Singh said that “We strongly deprecate this practice…we have to be conscious of the sanctity of judicial process. We cannot allow parties to play tucks and tricks with the Court…we cannot permit parties to take advantage of a device resorted to by them to secure orders of release”.

Read Also: Supreme Court Questions Lower Courts on Bail Denial in GST Section 132 Case

The same claims raised by the practice of parties before the Apex court were becoming commonplace and resulting in the foreclosure of consideration of cases by High courts on merits, the court cited.

“There cannot be any dispute that excessive bail is no bail, and onerous conditions ought not to be imposed while bail is granted. As to what is an onerous condition would depend on the facts and circumstances of the individual case. What is troubling is when attempts are made to foreclose consideration of bail applications on merits by voluntarily offering deposits of amounts and thereafter reneging on it by stating that the counsel had no authority or the condition is onerous. We are not able to countenance this practice.”

The bench, while describing the practice of parties, recorded that-

“When parties move applications for anticipatory/regular bail, a voluntary offer is made by their counsel that they would deposit substantial amounts to show the bona fide and secure their liberty. Thereafter, what happens is, the Courts hearing the bail applications are foreclosed from considering the merits of the matter and orders are made recording submission of counsel about willingness to deposit amounts and orders for anticipatory/regular bail are granted. Thereafter, a grievance is made before a higher Court that the condition imposed for bail is onerous and illegal…”

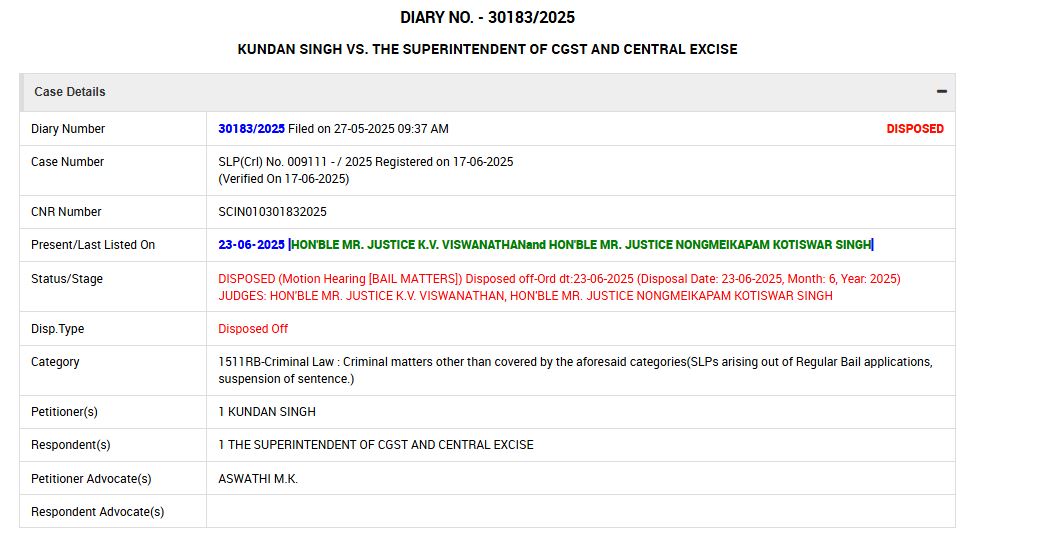

The Court was dealing with the bail case of an accused under the CGST Act, where allegations of tax evasion to the extent of Rs 13.7 crores. On 27th March 2025, he was arrested.

Before the Madras HC, the bail appeal of the applicant was submitted, his counsel cited that, earlier, the applicant had deposited Rs 2.8 crores and was willing to deposit an additional sum of Rs 2.5 crores without discrimination to his contentions. The HC, while considering the submissions, granted bail to the applicant, though directing to deposit Rs 2.5 crores (release as per the deposit of Rs 50 lakhs).

HC has modified its order and furnished the liberty to the applicant to deposit the whole amount of Rs 2.5 crores post his release. The bail application was regarded to be dismissed if unable to do so. The applicant, while contesting this order, approached the Apex court.

For the applicant Senior Advocate V Chidambaresh, cited that courts, while granting bail, cannot impose onerous conditions. The counsel of the applicant does not secure the power to propose the amount of deposit before the HC, he said.

The court, in answer, cited that no averment for the counsel not being allowed to propose the voluntary deposit was incurred in the amended application of the applicant. “If the offer for monetary deposit had not been made at the outset, the High Court may have considered the case on merits and may have granted or not granted relief to the petitioner.

Today, the petitioner is approbating and reprobating. We are conscious of his rights under Article 21, but we have to be equally conscious of the sanctity of the judicial process”, the bench mentioned.

It set aside the orders of the HC asking the applicant to surrender before the Trial court within one week and remanded the case to the HC for consideration on merits. But after that, acknowledging the averments in the amended application for the wife of the applicant being pregnant and his having responsibility for his aged father, the court was willing to keep the order of release as an interim measure.