For the filing of income tax returns, salaried individuals can utilize forms ITR-1 and ITR-2. The individual resident taxpayers with an annual income of up to INR 50 lakh are required to file ITR-1 while the others who do not earn from business or profession will go with the ITR-2 for filing income tax returns.

In the ITR-1, one can report details such as income from salary, income from other sources, one house property, and the income of up to INR 5k from agriculture. While the ITR-2 bounds individuals to mention information like income from more than one house property, unlisted equity shares, capital gains and directorship in any company.

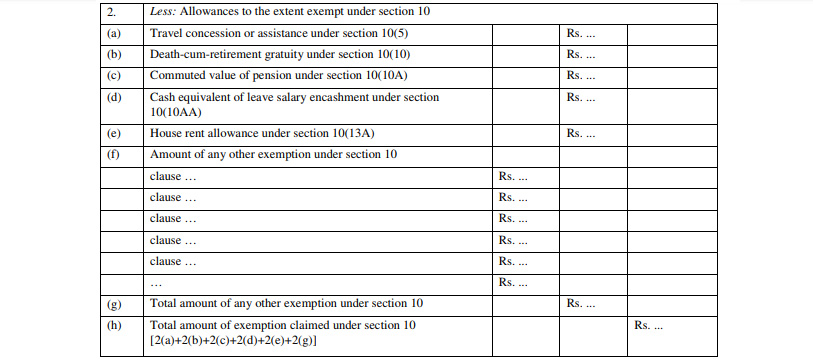

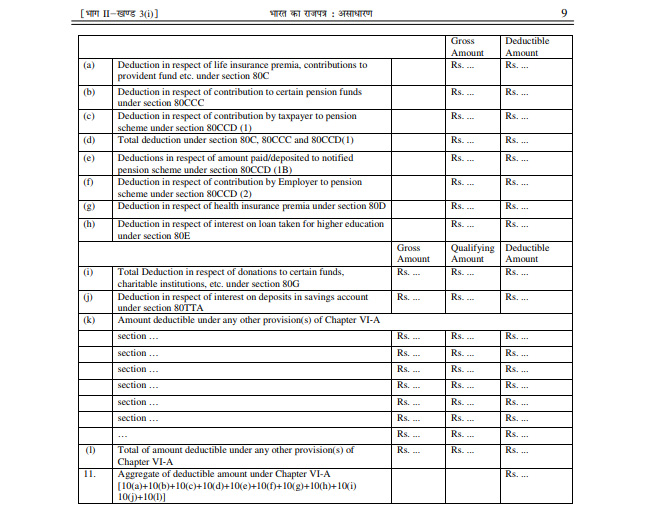

Form 16 now keeps an improved salary TDS certificate which allows taxpayers for mentioning of more detailed information of provided several tax-exempt allowances and deductions under the income tax law. While the part B of Form 16 has also been rectified in order to mention particulars in details like the provided several rebates and deductions under the income tax law.

Given below are the snapshots of provided exemptions and deductions under the Income-tax law:

Exemptions Allowed

Deductions Allowed – Chapter VI-A

ITR Filing of Taxpayers:

ITR-1: The exact figures of the comprehensive sections of the salary are must fill by the taxpayers such as

- Salary

- Perquisites

- Profit instead of salary

In addition to this, all the exempted allowances under section 10 would also be required to be mentioned likewise

- Gratuity

- Leave travel allowance

- House rent allowance

Along with it, there is a need for separate mentioning of allowed deductions under chapter VI-A from section 80c to 80U. For example

- PPF investment, life insurance premium, tuition fee for children under section 80c.

- Donations under section 80D

- Medical insurance premium under section 80D

ITR-2: As like the ITR-1, while filing for the ITR-2, taxpayers required to mention all the exempt allowance and deductions in detail. In addition to this, there is a need for reporting complete break up of several aspects of salary which cumulatively makes a specific amount likewise salary, prerequisites and profits in place of salary. To get this information one can go through the annexure provided with Form 16 from an employer.

If in case, the taxpayers are getting a salary from more than one employers in a financial year, he/she requires to present employer wise details. With improved Form 16, one can easily report details of one or more employers while filing for the ITR-2.

The filling up of details required in ITR-1 and ITR-2 would no longer be a tedious task for employers. Because the revised Form 16 format to file ITR makes easier to get all the required details.

In case of filing for ITR via online mode, these details automatically occupied to your ITR which not only helps in reducing efforts but also guarantee an accurate e-filing.