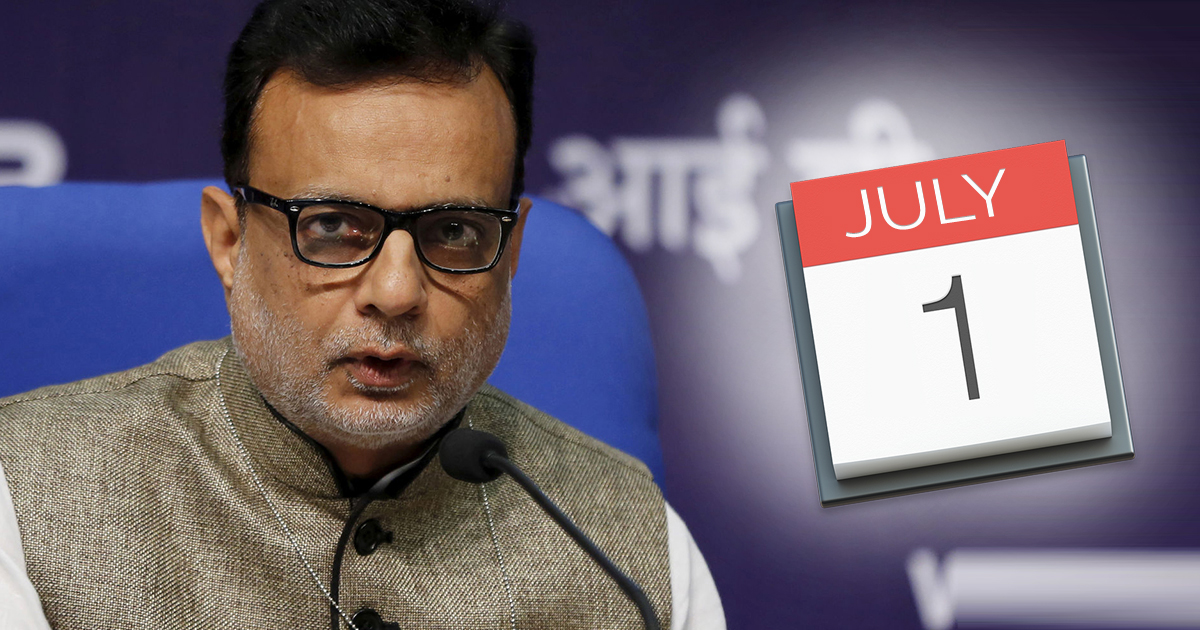

The rumours of GST implementation are viral on the media sources that the new GST regime will be delayed. The Centre government has clarified the doubts of delay in GST roll-out and said that GST will be implemented on proposed date i.e., from 1st July. The revenue secretary Hasmukh Adhia and the Central Board of Excise and Customs (CBEC) says that new indirect taxation regime is on track and it will be implemented from 1st July.

Revenue secretary Hasmukh Adhia tweeted that, “The rumours about GST implementation being delayed are false. Please do not be misled by it (sic).” CBEC said, “Preparations are in full swing for a smooth implementation… from 1st July 2017.”

The government has reminded again and again that there will be no changes in the implementation for the biggest tax reform on 1st July. Union Finance Minister Arun Jaitley said that, as such, there are no reasons for further postponing the new indirect taxation regime.

The state government officials said that the new GST regime will be calling issues and any further delay is not a good solution nor it will solve problems. The government is also trying to establish new taxation reform before the festive season later in this year and will occur with the state elections of Himachal Pradesh and Gujarat.

The state governments and the Central Board of Excise and Customs (CBEC) said that the department has accelerated the awareness program on the upcoming of new indirect tax regime so as to reach to the ‘last trader’. The government has given authority to CBEC for reorganizing the current Central Excise and Service Tax field formations on the basis of requirements of the pan- India GST regime.