Traversing the complexities of GSTR-1 presents a challenge, particularly when encountering Table 8 errors. If you’re wrestling with resolving these errors, take comfort in knowing you’re not alone. But fear not we’re here to support you.

Within this extensive guide, we’ll lead you through steps to create a seamless, precise summary. This will empower you to adeptly address and fix Table 8 errors in your GSTR-1 filing. Let’s streamline the process for a stress-free resolution of these concerns.

Define GSTR-1 Return Form

Form GSTR-1 serves as a monthly or quarterly statement filed by normal and casual registered taxpayers who make outward supplies of goods and services. It encompasses details of these outward supplies.

Every registered taxable individual, excluding input service distributors, composition taxpayers, those liable to deduct tax under Section 51, or those liable to collect tax under Section 52, must electronically submit Form GSTR-1. This form includes details of outward goods and/or services supplied during a specific tax period.

Even in the absence of business activity (Nil Return) during the tax period, filing Form GSTR-1 remains mandatory. Quarterly filing of Form GSTR-1 is an option available under specific conditions:

If your turnover at the time of the former financial year was up to Rs. 5 Crore or

If you are registered at the time of the current financial year and expect your aggregate turnover to be up to Rs. 5 Crores

Please note: If you’ve opted for the Quarterly Return option, both Form GSTR-1 and Form GSTR-3B must be filed every quarter exclusively.

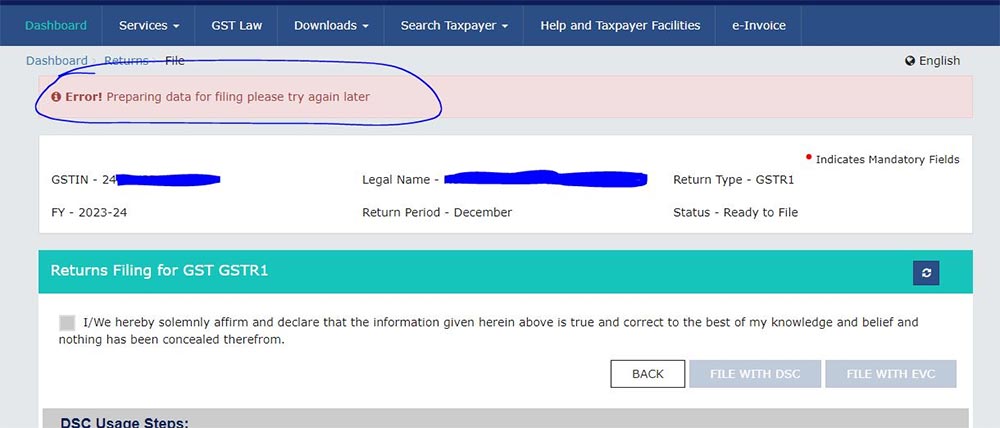

How to Resolve Error in Table 8 (GSTR-1) Form

Taxpayers are encountering challenges when organizing the Table 8 summary. This time, Table 8 has undergone a fresh redesign, incorporating alterations in the declaration of e-commerce data. To resolve the issue, open Table 8 in GSTR 1, save the file and subsequently generate the summary. This process should rectify the error.

The Significance of the Update

Improved Data Precision: The revamped Table 8 strives to enhance the precision of e-commerce data representation, staying in sync with the dynamic demands of the GST framework.

Efficient Reporting Procedure: Employing the specified steps enables businesses to simplify the reporting of e-commerce transactions in GSTR-1, minimizing the chances of inaccuracies.

Guaranteed Compliance: Abiding by the revised procedures assures businesses of staying compliant with the most recent GST regulations, preventing penalties and potential audit complications.