Due to coronavirus, the shortage is imposed in Punjab by 43%. The union government is ignoring to provide the goods and services (GST) compensation. The state is still starving over Rs 9,044 cr i.e 43% so to engage the yearly target of Rs 15,868 cr GST collection.

However, the union government has given Rs 1385.96 cr to the Punjab government to bridge the gap contesting towards the Goods and Service Tax (GST). This is the amount given by the union government out of Rs 4000 cr which they had borrowed from October. On December 1 the first weekly installment of Rs 475.80 crore was given, on December 7 and December 14 the 2nd and 3rd installments were given of Rs 455.08 cr.

There is no compensation received from the government since April for GST which had to make the development stressful.

“Certainly there is going to be a shortfall in GST collection this year because of the Covid-19 pandemic. I cannot comment at this stage where we will end up exactly.” said Punjab taxation commissioner Nilkanth S Avhad.

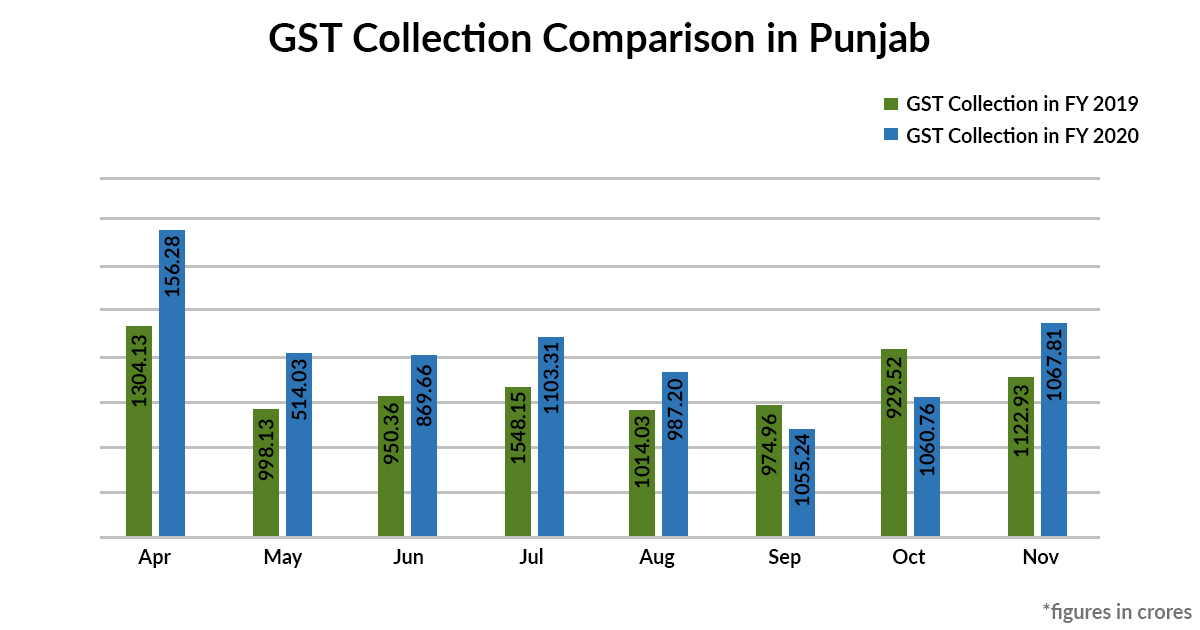

For the November month, the Punjab government has received Rs 1067 cr GST along with the protected GST revenue for the month which had stood with Rs 2403 cr. For the months of September Rs 1,055 crore and October Rs 1060 cr. This year seems to be dipped in the context of GST revenue from the last year i.e Rs 6814 cr against Rs 8842 cr in 2019.

From April to November, the collection is quite stronger as the state has been able to collect Rs 3689 cr. “There was a big fall earlier but now there is a good growth.”

From the VAT and central sales tax (CST), the state has received Rs 765 cr, the majority of that has been received via petrol and diesel. Last year’s collection was Rs 448 cr in November, which enhances over 70% in this November. The total VAT and CST change from April to November this year is Rs 3802 cr that is a prolonged of 4.90% relevant to 2019 in a similar period.