GSTR 9 is an annual return form for all taxpayers, which has to be filed before 31st December every year. The annual form consists of all the SGST, CGST and UTGST transactions and has to be included in the form GSTR 9 mandatory. The GSTR 9 will be filed by 31st December 2026 for the financial year 2025-26. The government has also released the offline as well as online utilities for the GSTR 9C and GSTR 9A.

The offline utility comes with an Excel sheet to file up as per the details, and the online utility can be filed after logging into the account of the taxpayer.

Recently, the government has given the facility of previewing the details filed in GSTR 9 via the Excel utility. The taxpayers can only view the draft file and match the data before filing on the GST portal. Yet, there is no amendment facility given by the portal. Let us know all the steps to file the details and obtain the GSTR 9 Preview Excel sheet.

Full Process to Preview GSTR 9 Draft in Excel on GST Portal

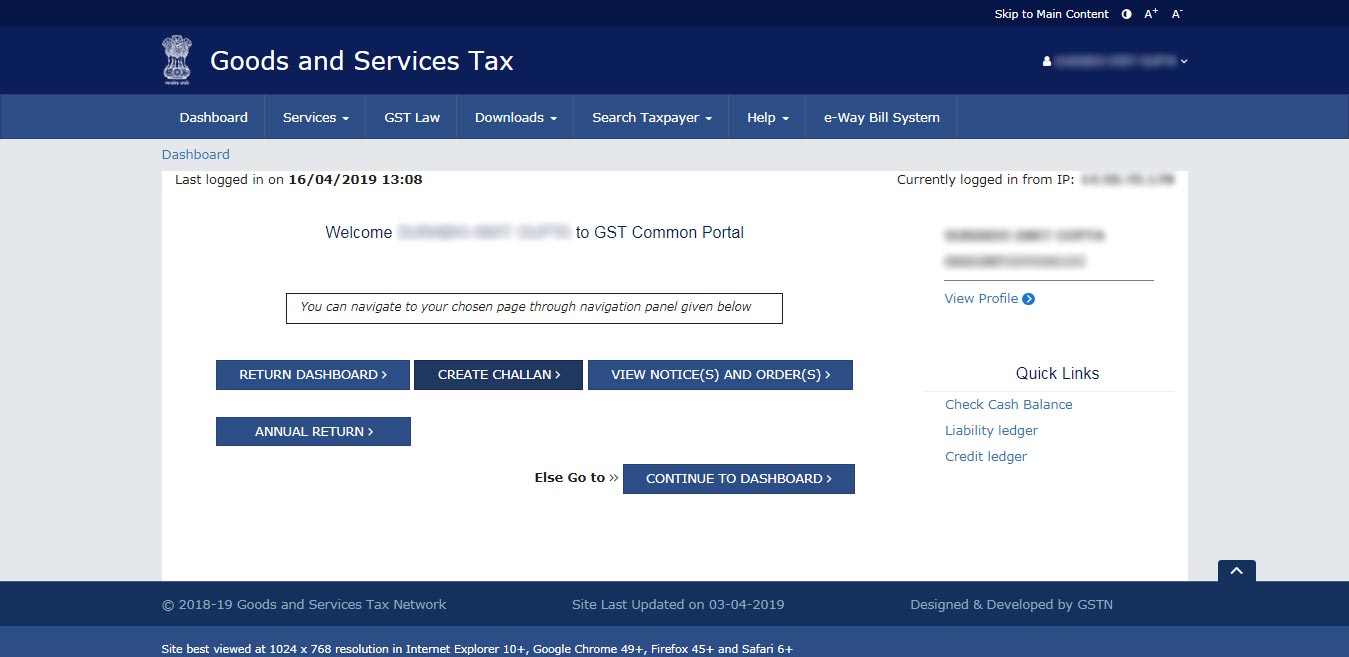

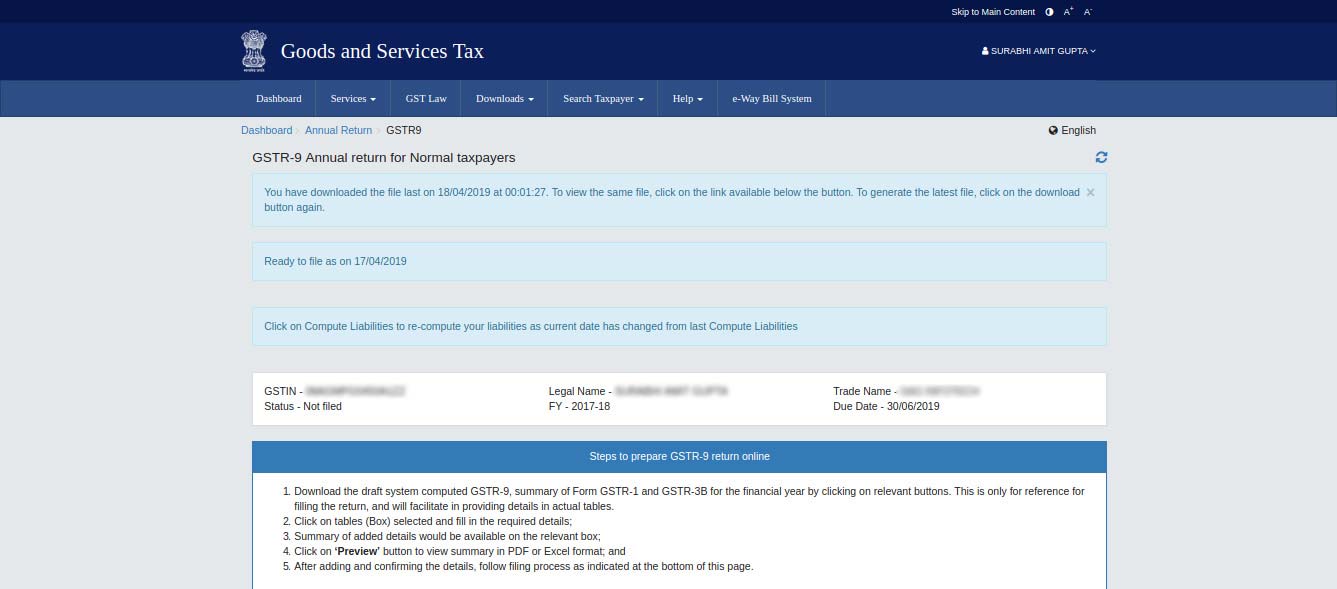

Step 1: Log in with your username ID & password on www.gst.gov.in to get started

Step 2: Now, coming to the dashboard, click on the ‘Annual Return’ tab

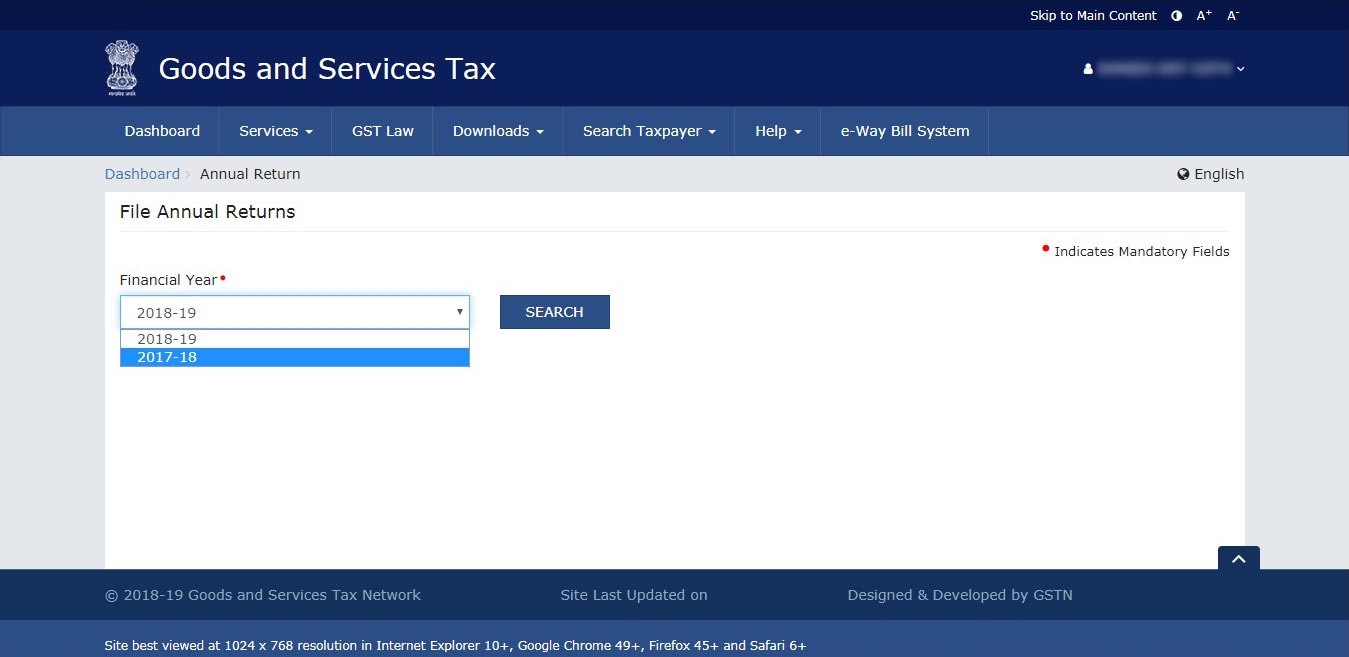

Step 3: Opt for the financial year regarding the filing of returns, now click on the FY 2023-24

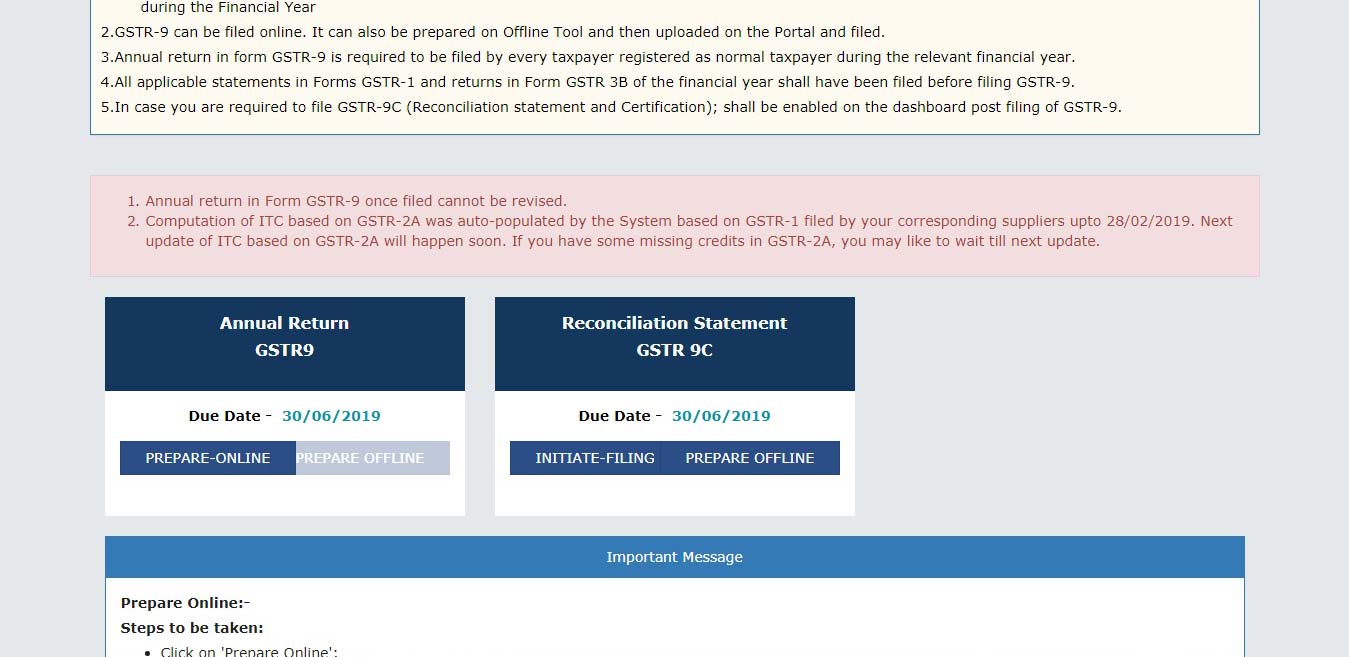

Step 4: Click on the GSTR 9 ‘Prepare Online’ tab

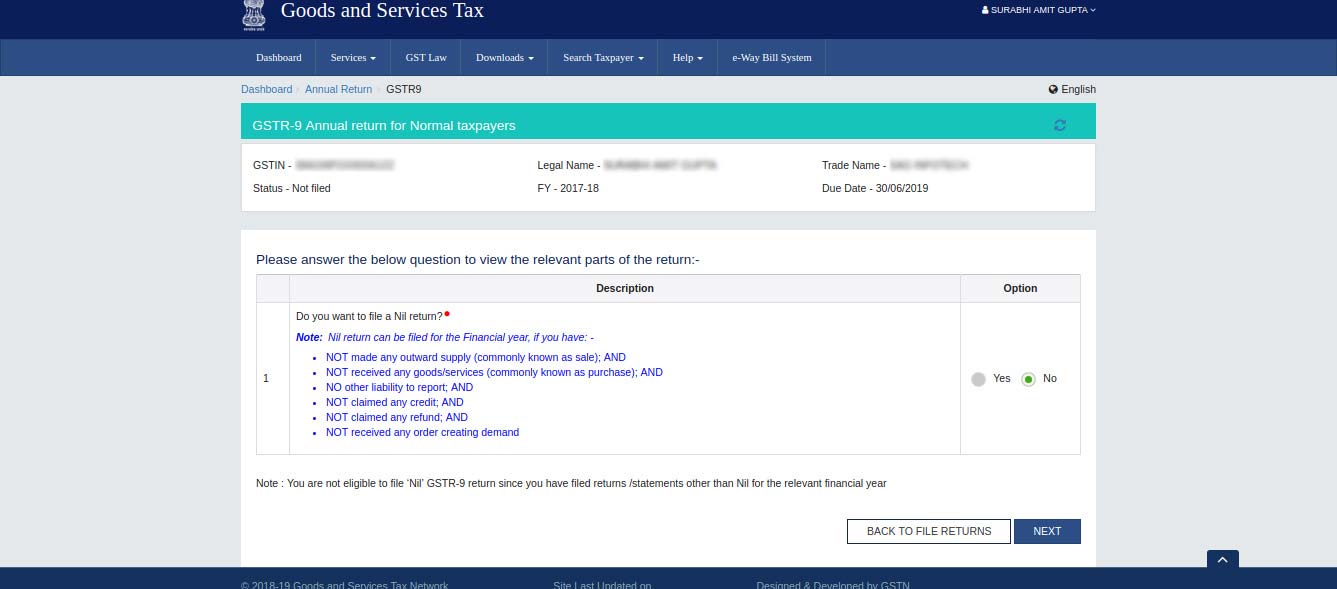

Step 5: Now there will be a new window asking for Nil Return Filing with an option to choose b/w Yes or No, after then click ‘Next’

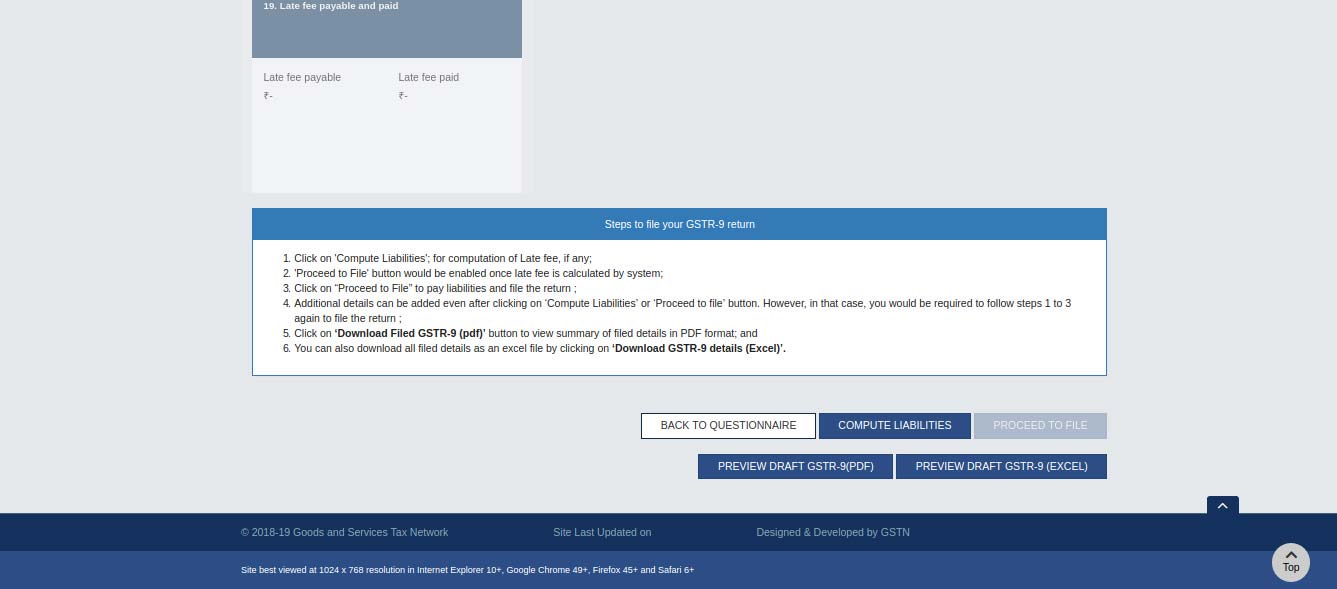

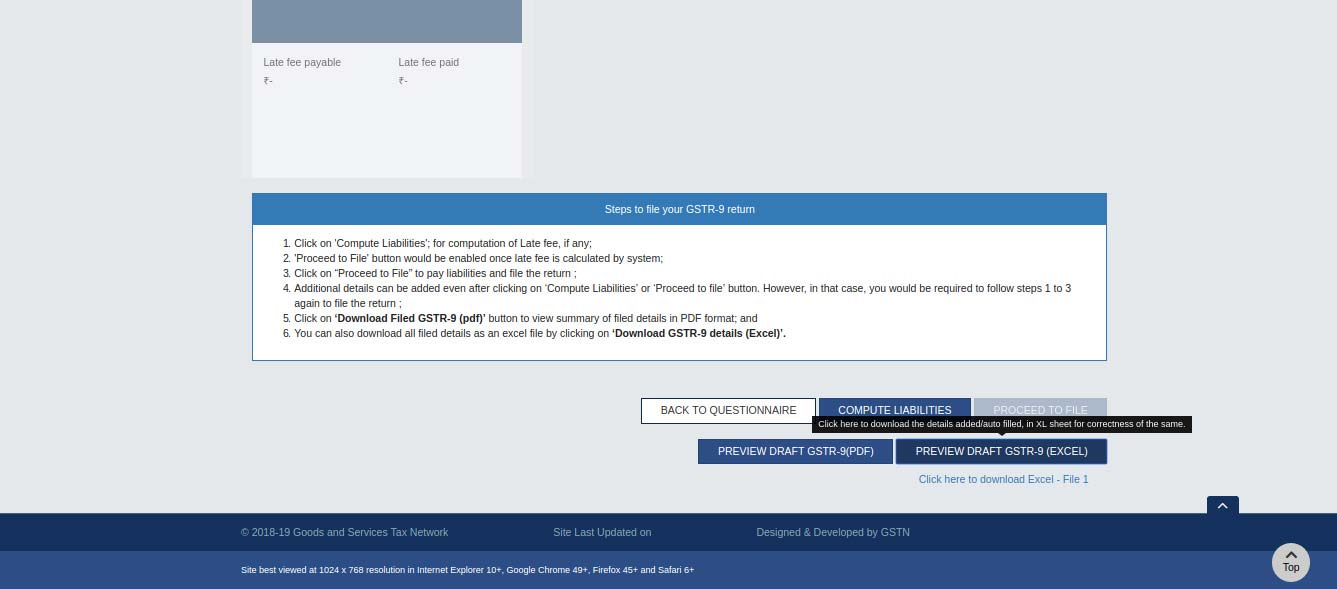

Step 6: In the new window, opt for the tab mentioning ‘Preview Draft GSTR 9 – Excel’ on the footer

Step 7: A message displayed on your dashboard regarding the details of downloading the draft Excel format of GSTR 9.

Step 8: After clicking on ‘Preview Draft GSTR 9 – Excel’, the below-given link ‘Click here to download Excel-1’ will be activated on the footer. Click and download.

Gstr 9 Filling Fy 2017-18 is possible if yes late fees wl b applicable.