Summary of GST PMT-06 Challan Form

A single challan called Form GST PMT-06 is used to pay interest, taxes and penalties. This challan can be created online through the GSTN official portal, where you can also make payments and get immediate receipts. If you are registered for the QRMP scheme, you must use this challan to submit monthly.

Advantages of GST PMT-06 Form

Following is a list of the benefits and purpose of the GST Payment Challan:

- The electronic cash ledger of the taxpayer will be credited the same day as any online payments made using this GST PMT-06 form.

- GST experts may also pay on their client’s behalf.

- Creating a single challan online instead of three or four copies

- An instant online payment system, no more waiting in queues to make payments, and a more transparent payment system

- A taxpayer is allowed to create an unlimited number of challans in a single day.

Payment Modes for GST QRMP Scheme Holders

When submitting your payment via GST PMT 06, you may choose from one of the following options for any month:

- Fixed-sum method

- Self-assessment method

Who can Generate the GST PMT-06 Form?

Anyone can create the challan in Form PMT-06 on the shared site, including regular taxpayers, non-resident taxable persons who are or are not providing OIDAR service, and casual taxable persons.

According to Rule 87(2) of the CGST and SGST Rules, 2017, the individual must enter the specifics of the amount that will be submitted by him or her toward tax, interest, penalties, fees, or any other.

Time Limit for Making Payments via GST PMT-06

The taxpayer has 15 days from the time the challan is produced to fulfil any outstanding payments. In the first two months, the taxpayer who has registered for the QRMP services must pay the required tax amount. The payment for one month must be made by the 25th of the following month.

Step to Complete GST PMT-06 Challan Payment via Gen GST Software

PMT-06 is integrated with the new QRMP payment scheme feature.

GST portal has launched a new facility in PMT-06 Challan for making the payment under the QRMP scheme, now there you get a new option of Monthly payment Quarterly return as a reason for the challan.

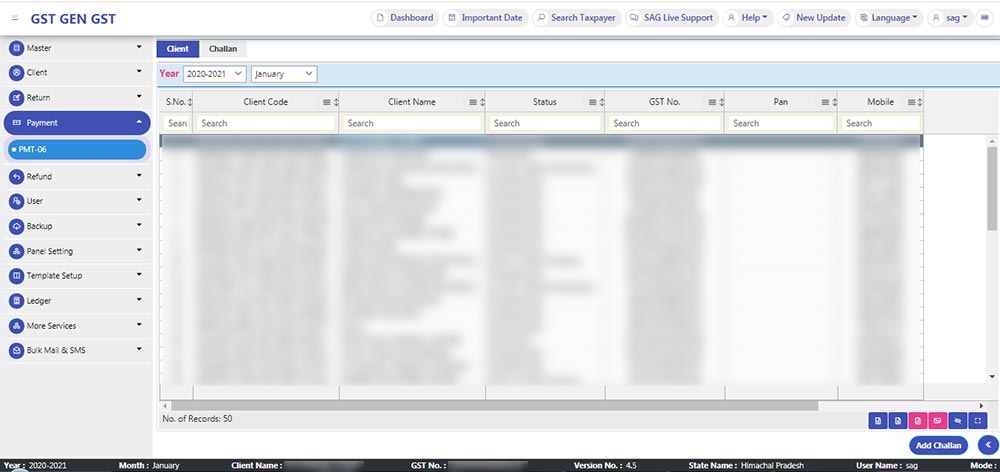

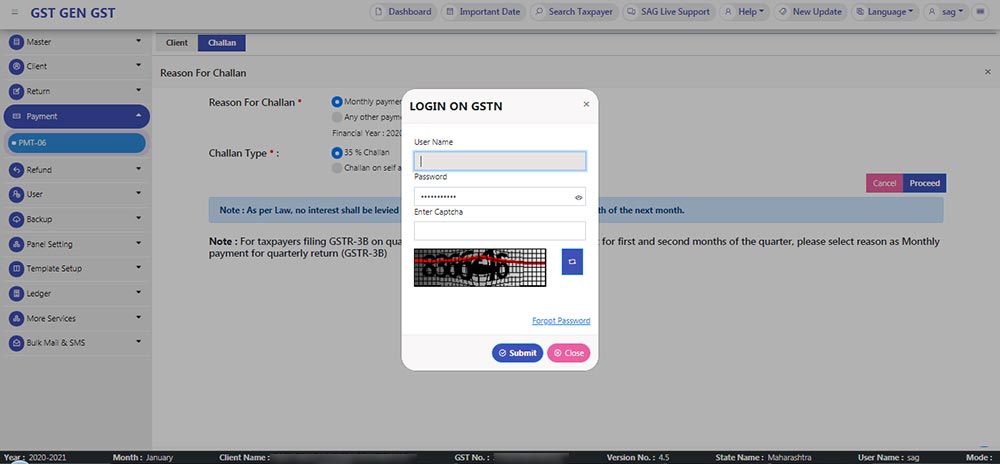

Step 1: We have incorporated the same into our Gen GST return filing software too, for that First go to Payment –> PMT-06. We can add challan over here.

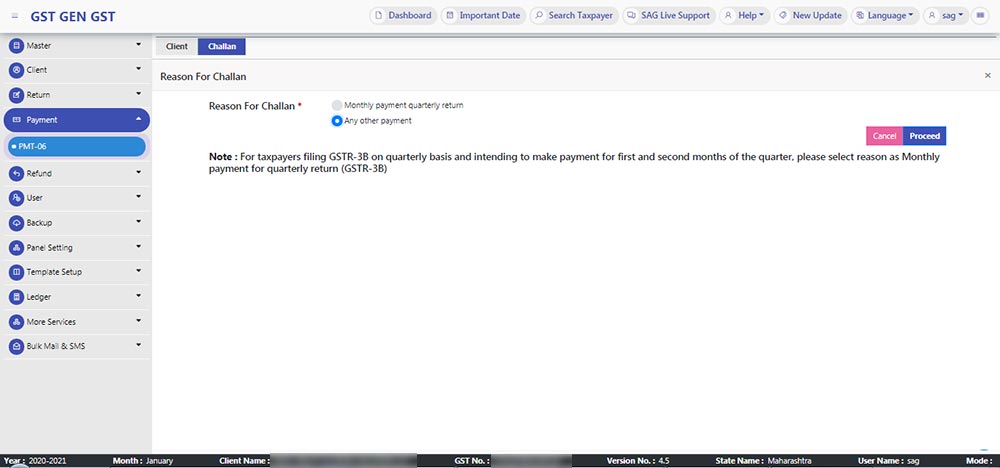

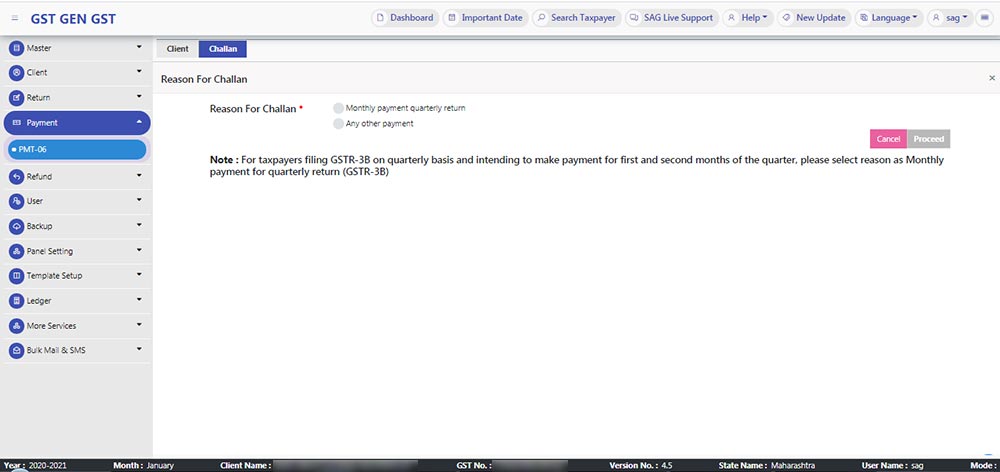

Step 2: In this, you have to choose the ‘Reason for Challan’ creation.

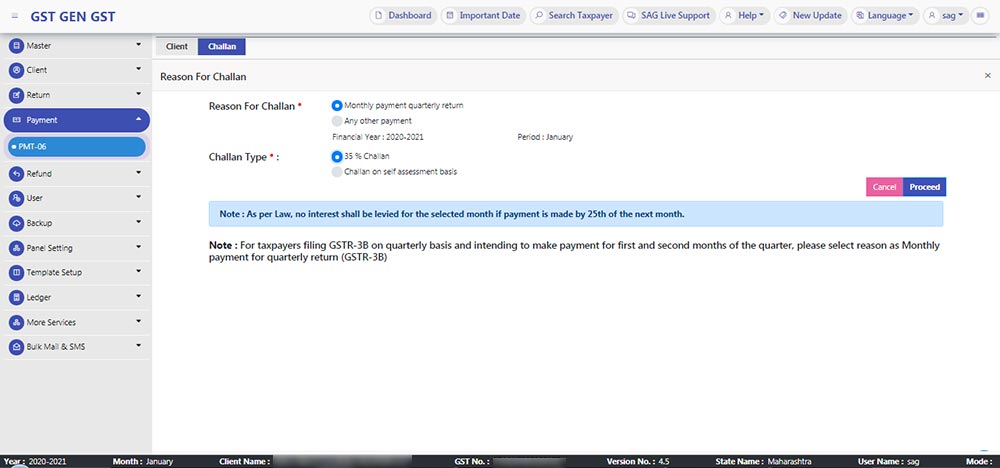

Step 3: Then click on the monthly payment quarterly return option and in that 35% challan under ‘Challan Type’ and click on the proceed button.

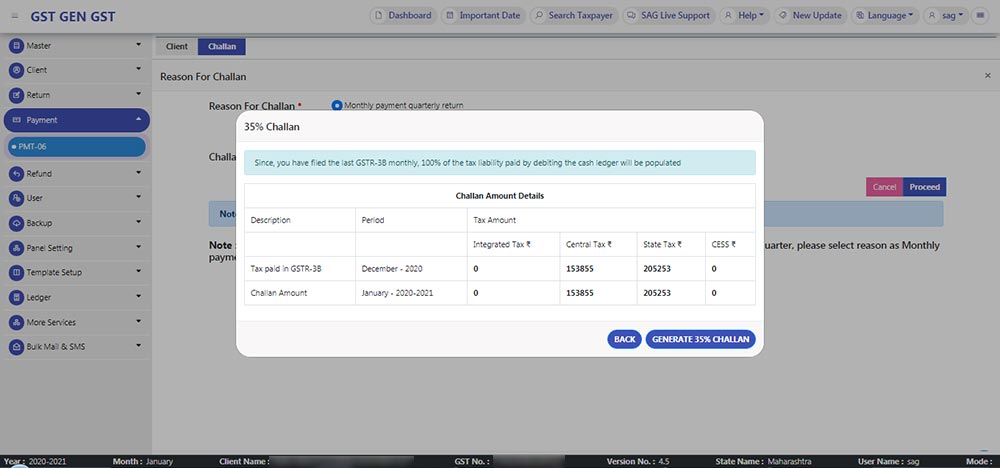

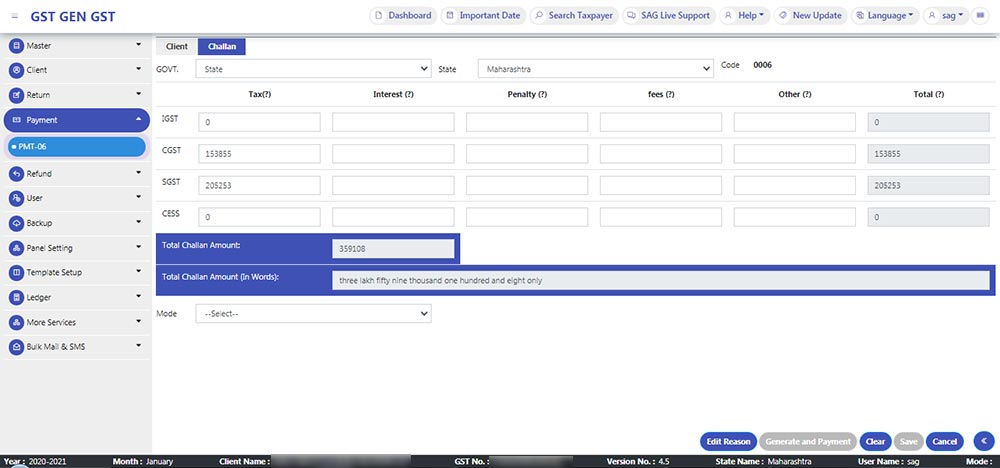

Step 4: After that, a screen is pop up from the portal site for showing the ‘Challan Amount Details’, it is auto-filled and non-editing.

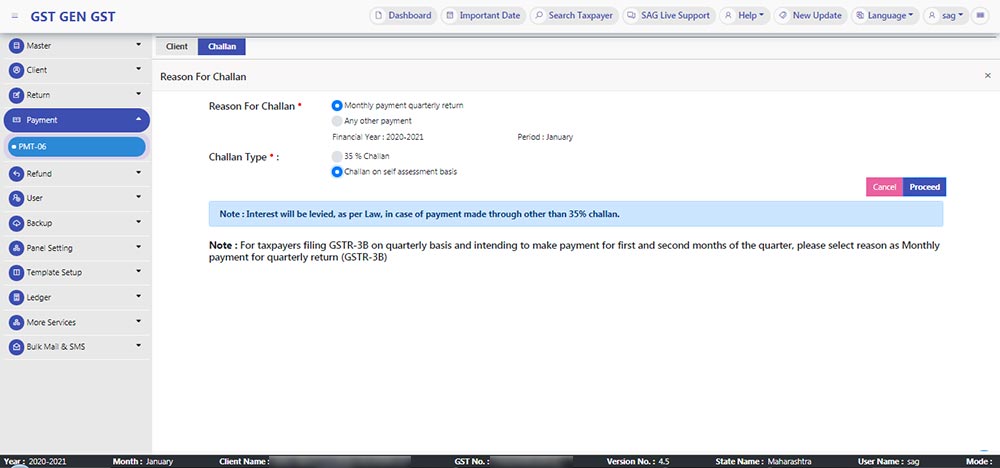

Step 5: On the other hand, if you want to make challan on a self-assessment basis, just click on Monthly payment quarterly return as the Reason for challan and select Challan on the self-assessment basis as Challan Type, after click on ‘proceed’.

Step 6: If you want to make challan other than the QRMP scheme, then you may choose ‘Any other payment’ option under Reason for Challan & click on proceed button.