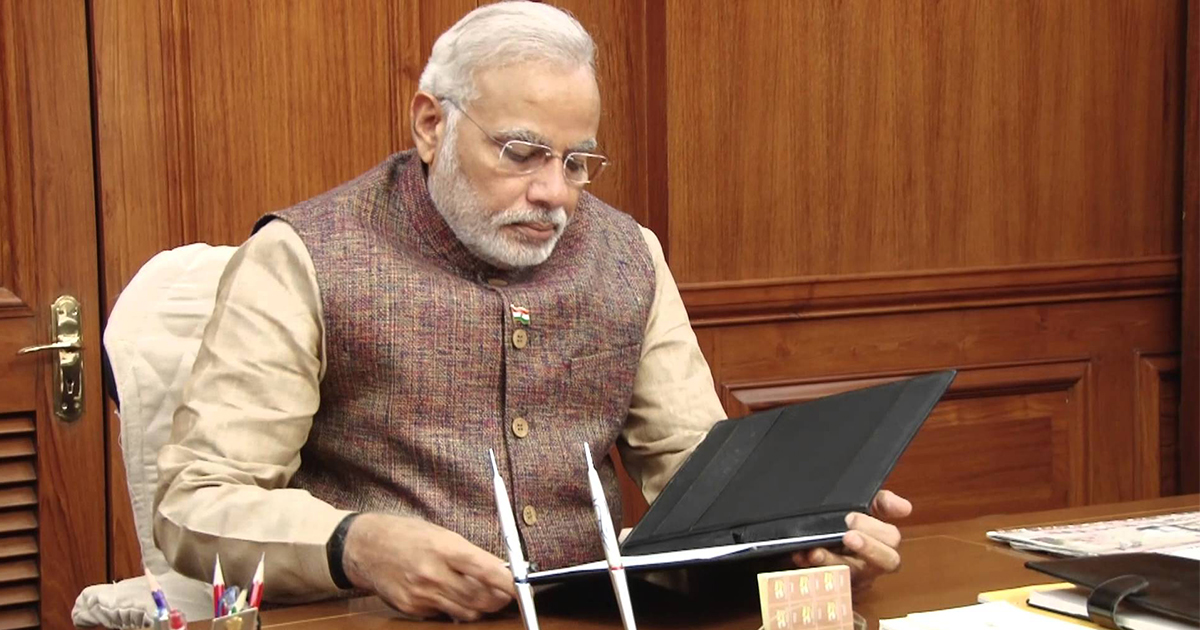

On 6th June 2017, the Prime Minister Narendra Modi will take a look on the preparedness of the Goods and Service Tax (GST), which is scheduled to roll out from 1st July. The Prime Minister of India has been continuously in touch with the GST council and has been taking reviews of upcoming tax scheme in order to make sure that the reformed tax regime runs hassle free after the implementation.

Read Also: GST India: Banking Sector and Its Upcoming Struggles

The Government officials shared that, “It will be a review of the state of preparedness”. The Central Government is in no mood to delay the scheduled GST implementation and has been putting efforts to make sure that the switch-over to GST will be beneficial for both industries and consumers.

The GST Council is in the favor of implementing new taxation structure system from 1st July, whereas some industries and states like West Bengal have demanded to the Government, to postpone it until September. Several industries such as electrical, ayurvedic are also disappointed with the announcement of GST rates and requesting from the government to revise taxation rates.

Goods and Service Tax Regime will replace several central taxes such as excise duty, cesses, countervailing duty and will also replace state taxes such as Octroi, VAT (Value Added Tax) and purchase tax and will be designated as a common unified tax. The GST Council has finalized four- slab rate structure for both goods and services, and the final rates are 5%, 12%, 18% and 28%. Luxury and sin goods will attract extra cess along with the tax rates.

New thought of GST is beautiful. But it requires some modifications in e-commerce sector, and facility in banking functions. It gives solution to olden days struggles like c form h form F form etc. If facility available in filing returns it will be easier for tax payers. Now transition leads to India ahead as compared to previous management by corrupt people earlier.