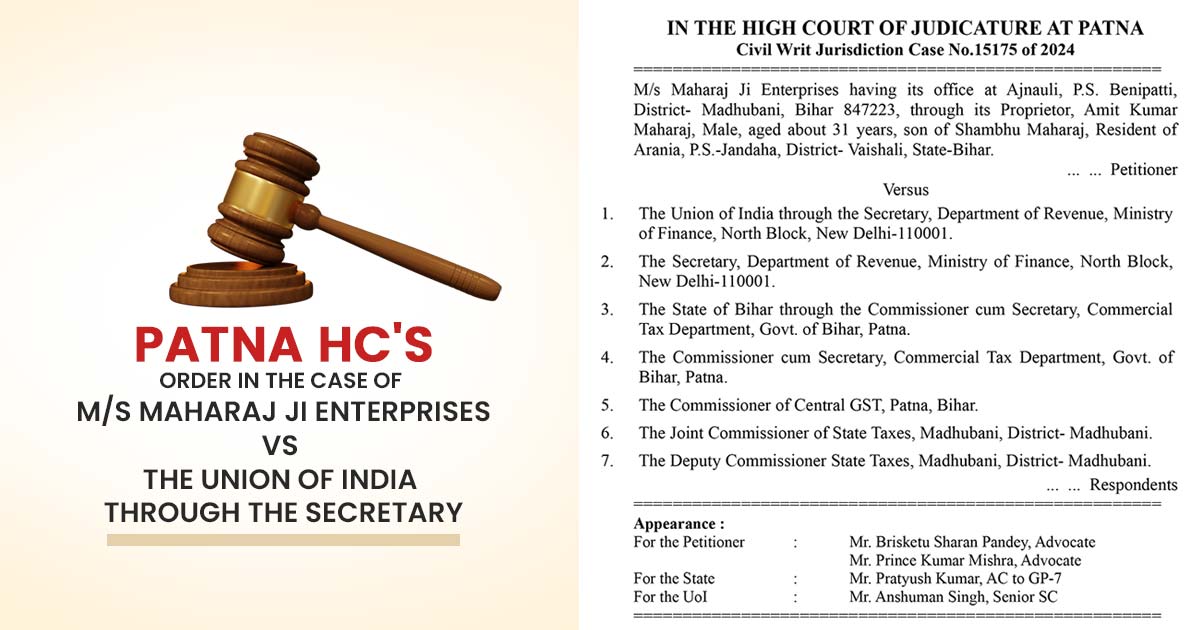

The Patna High Court delivered a ruling in the case of M/S Maharaj Ji Enterprises versus the Union of India, along with several other state departments and officials, under Civil Writ Jurisdiction Case No. 15175 of 2024, dated July 16, 2025. The court clarified that a new Goods and Services Tax (GST) registration can be obtained even if a previous registration has been cancelled.

However, this is contingent upon the officer providing valid, documented reasons by Section 29(2)(b)/(c) of the GST Act and relevant circulars. This ruling underscores the importance of proper procedural compliance by tax authorities in the registration process.

Fresh registration is not barred, as per the Reference made to CBIC Circular No. 95/14/2019-GST dated 28.03.2019, but the Proper Officer needs to validate that if the conditions cited in Section 29(2)(b) and (c) are continuing, and especially record a finding to that effect. Rejection of registration application quashed. Post recording essential findings by law, the case was remanded to the Proper Officer for fresh consideration.

Case – U/s 29(2)(c) of the CGST Act, the earlier GST registration was cancelled in this case because of non-filing of returns. No appeal was furnished by the applicant or a revocation application against the cancellation. A new GST registration application was filed.

Without assigning any reasons or making any reference to the required legal provisions, the Proper Officer denied the fresh registration application. Subsequently, the rejection was explained in a counter-affidavit founded on reasons not originally revealed in the show-cause notice.

The applicant, this unreasoned rejection was arbitrary and breaches the principles of natural justice and CBIC Circular No. 95/14/2019-GST dated 28.03.2019.

Issue- Whether a new GST registration can be refused on the ground that the previous registration was cancelled and no revocation/appeal was filed. Whether the rejection order was valid in law when it did not possess any reasoned findings, nor did it comply with the conditions of CBIC Circular No. 95/14/2019-GST.

Ruled that- The applicant has regulatory remedies for taking revocation of cancellation of the earlier GST registration or to file an appeal against such cancellation, the court considered. The applicant did not take any remedy and submitted a fresh application for GST registration. Even after the same, the court ruled that a fresh application for registration is not restricted under the CGST Act, 2017, when there is no filing of a revocation application and the conditions u/s 29(2)(b) and (c) (concerning tax compliance and furnishing of returns) continue to apply.

Additionally, the Court referred to CBIC Circular No. 95/14/2019-GST dated 28.03.2019, which provides that, “Fresh registration is not barred, but the Proper Officer must verify whether the conditions mentioned in Section 29(2)(b) and (c) are still continuing, and specifically record a finding to that effect.” But, in this case, no findings like these were recorded via the Proper Officer while denying the fresh registration.

It was discovered under the Court that the rejection order was a non-speaking, unreasoned order. In the counter affidavit filed by the department, the reasons revealed were not shown in the original rejection notice or in the clarification notice. No reference to Section 29(2)(b) in the rejection communication was there, which was obligatory under the circular and statute.

As per the Patna High Court, issuing an unreasoned order without furnishing the applicant a chance to be heard or addressing the regulatory needs constitutes a breach of the principles of natural justice. It was instructed to the proper officer to use his mind, acknowledge the provisions of Section 29(2)(b) and the CBIC Circular, and pass a reasoned and speaking order after granting a chance of hearing.

| Case Title | M/s Maharaj Ji Enterprises vs. The Union of India through the Secretary |

| Case No. | Case No.15175 of 2024 |

| For the Appellant | Mr. Brisketu Sharan Pandey, Mr. Prince Kumar Mishra |

| For the State | Mr. Pratyush Kumar |

| Patna High Court | Read Order |