In a movement to restrain the abuse of PAN numbers and stop fraudulent uniqueness, the state has drawn income tax compliance regarding PAN Aadhaar linking. As per the new update, over 12 crore PAN cards remain unlinked with Aadhaar, and almost 11.5 crore have been halted due to non-compliance.

For people who were assigned PAN based on Aadhaar enrolment ID before 1st October 2024, the government has extended the deadline for linking to 31st December 2025. From January 1, 2026, all such unlinked PANs will be treated as inoperative, making them ineffective for financial and tax transactions.

As the PAN Card is a validating document for representation in the Income Tax Department from the taxpayer, it has become quite necessary now for all types of financial transactions, thus sparking misuse of such a document.

According to the government rules, it is strictly mentioned that one person cannot possess two PANs. And now, when the government has identified such a large number of fake PAN cards which were allocated to those who have deliberately hidden their financial status from the tax department, it has decided to throw a blowback to those who follow such kind of practices.

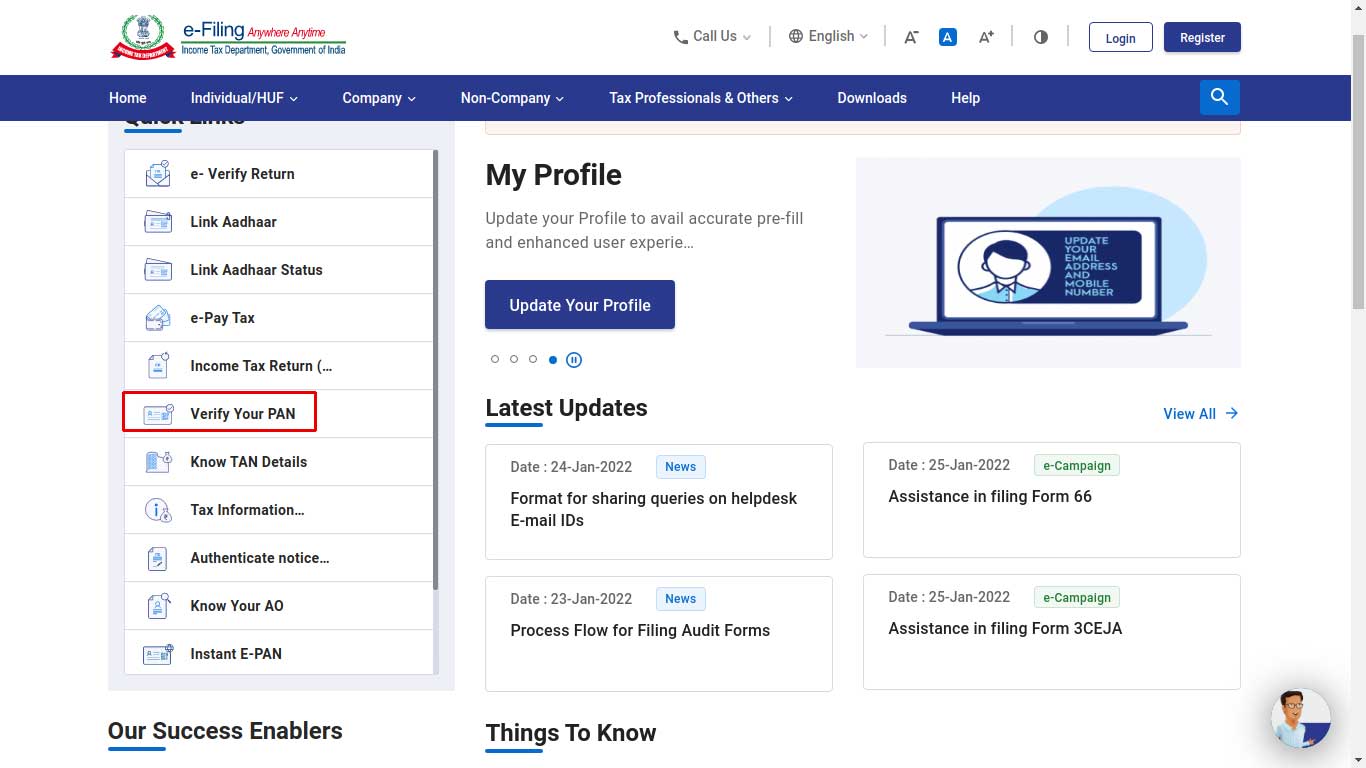

First Step: Go to the official website of Income Tax “https://www.incometax.gov.in/iec/foportal/” and click on Verify Your PAN under the services menu.

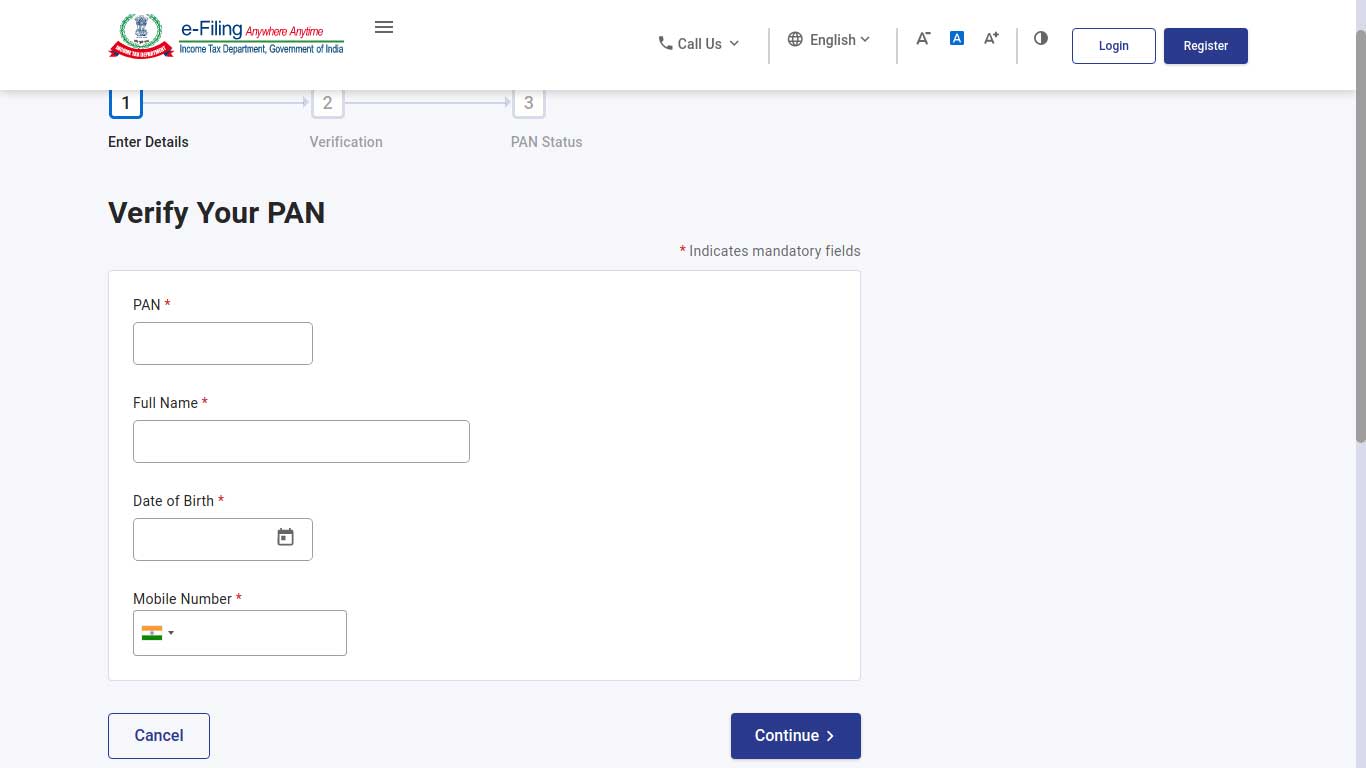

Second step: After clicking the Verify Your PAN tab. A form will appear in a new window, fill the form with complete details and click submit.

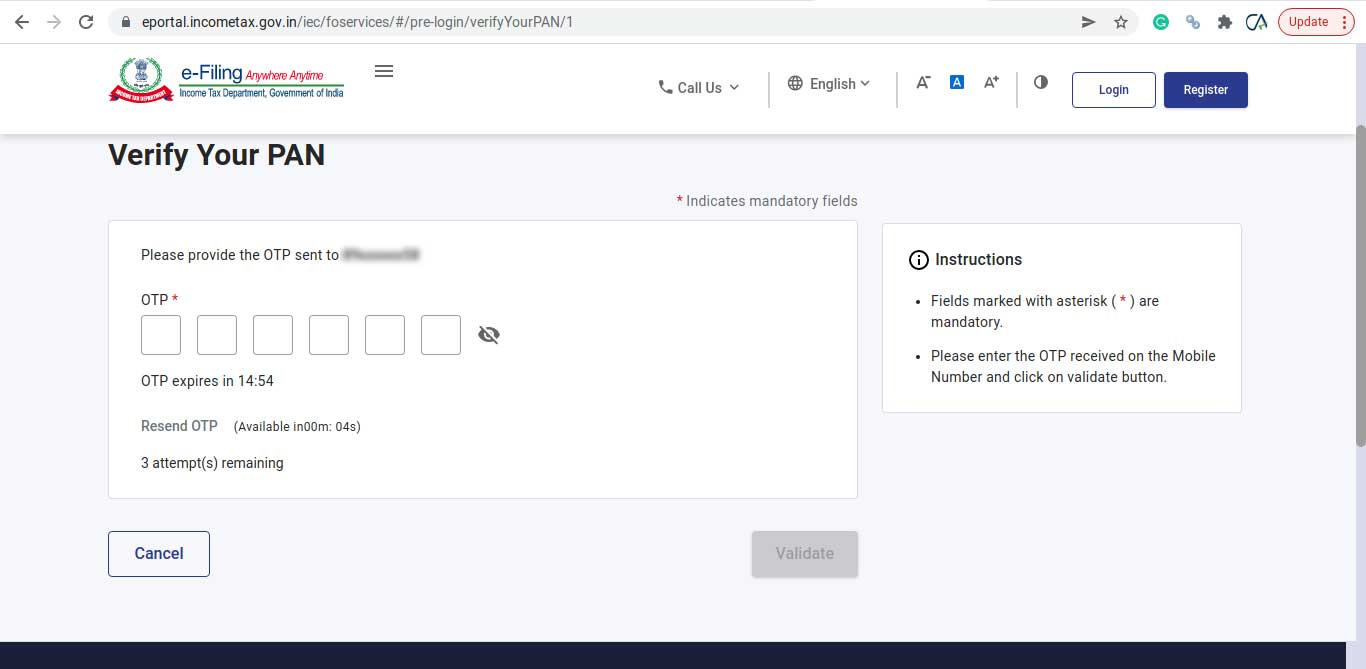

Third step: After submitting the form, an OTP will be sent to your registered mobile number for e-verification, which is valid for 15 min.

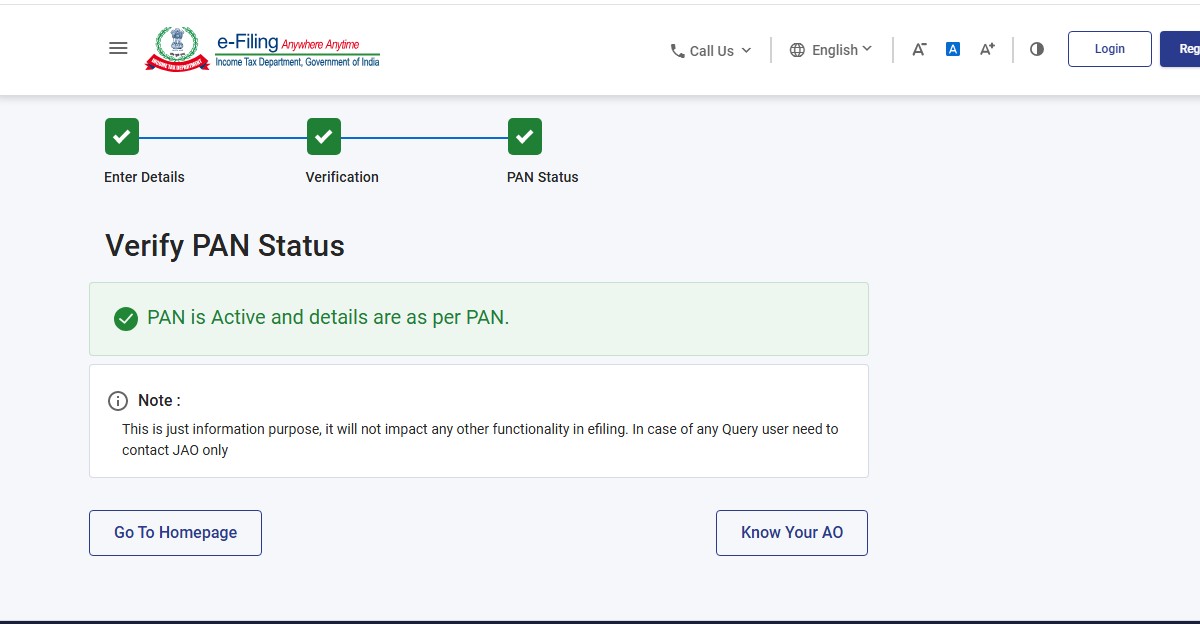

Fifth Step: After correct OTP input, the page will load into a new status window of PAN card, where you can check your PAN card status under remarks. This will tell you whether your PAN card is active or not.

Refund not received. Name as per PAN and bank account number is corrected

Is my pan card active or not.plz.reply

If this site is not working why don’t you close this site. Why are you wasting the public’s previous time

When my pan card

Yes

How to check pan card is active Or inactive

Active deactive checking how is it

How I can know whether my pan is active

“PAN (BMXXXXXX7N) entered by you is not in proper status in Income Tax Department Database.”

“PAN (BMXXXXXX7N) entered by you is not in proper status in Income Tax Department Database.”

PAN SURROUNDING PROCESS

Hello sir, Madam Namastay

I want active my pan number

I applied this day morning who much time it will take sir, madam

Pan card working or nonworking status send me

Pan card

serious and severe action should be immediately taken in those fake / deleted / blocked P A N

card holders ; shortg notice may be sent to all those , and their all bank a/c s should be

confiscated by the govt. for use for beneficial purposes of common poor people ,

particularly senior citizens .