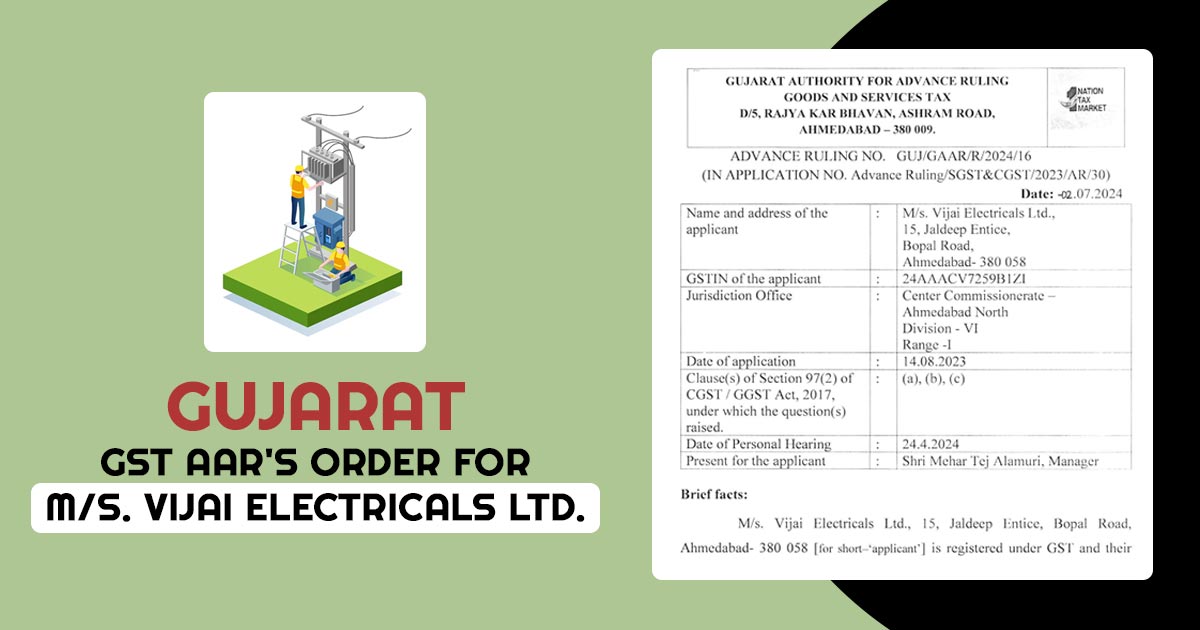

The new guideline has mandated for tax base division between the centre and the states by the Goods and Services Tax (GST) Council. The move is taken to make the clear distinction between authorities and for better implementation of administration in the new Indirect tax system.