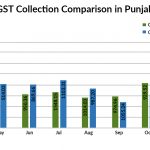

Due to coronavirus, the shortage is imposed in Punjab by 43%. The union government is ignoring to provide the goods and services (GST) compensation. The state is still starving over Rs 9,044 cr i.e 43% so to engage the yearly target of Rs 15,868 cr GST collection. However, the union government has given Rs 1385.96 […]