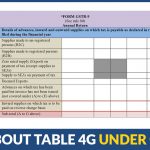

GSTR 1 is a return filing for all taxpayers that includes all the outward supplies given in the transactions of the business dealings. Here we will discuss Table 6A of the GSTR 1 form for regular taxpayers which is basically for the refund on exports. To claim the refunds, the exporter has to file Table […]