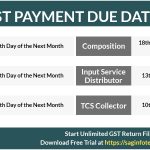

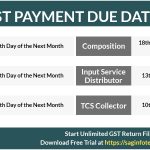

Goods and Service Tax is an ambitious tax regime applicable from 1st of July 2017 made a number of indirect taxes subsumed into it. The government has now revealed the due dates for the payment of GST.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

Goods and Service Tax is an ambitious tax regime applicable from 1st of July 2017 made a number of indirect taxes subsumed into it. The government has now revealed the due dates for the payment of GST.

Food Chain Companies such as Dominos and Pizza Hut who offer freebies to consumers will suffer huge losses due to the implementation of GST as they are required to pay taxes on free items as well. Packaged products and food service provider companies have stopped their ‘buy-one-get-one-free offers’ immediately after the implementation of Goods and Services Tax (GST) from 1st July.

The goods and services tax has been into the economic structure of the nation from the last two weeks and now it’s time to review everything for a better control in upcoming prospects. The GST Council will be meeting today to have an overview of the goods and services and all the work done by the tax scheme.

The GST regime is a new way tax by the means of filing returns, tax brackets and classifications. The new scheme of tax will still take some time to get easy within the structure of the Indian economy and taxpaying community. People are under the confusion and dilemma over various points being introduced within the wide prospect of GST.

GST council and central board of excise and customs have undertaken a very good step in order to spread awareness in the context of the goods and service tax to all the business community across the nation.

The Jammu and Kashmir legislative assembly finally passed the resolution in order to adopt the newly incorporated goods and services tax into their constitution.

Latest GST Circulars/orders from the official head office of CBEC and commissioner GST is available up to date for the notification purpose of GST India. The Goods and service tax is the biggest reform by the Indian government to tackle the complex tax rate structure that was followed until now. It has been assumed that […]

GST notification is a source for all the latest updates and notifications regarding Central, Integrated, Union Territory and their respective taxes applicable. The following latest notifications with accordance with proper laws, rules, and rates is a must for every trading and business unit and will keep the tradition in a proper managerial way. Goods and […]

Ever since the goods and services tax was applied throughout the market, it was open for the first time after it on Monday. But still, the traders were in the confusion related to the GST.