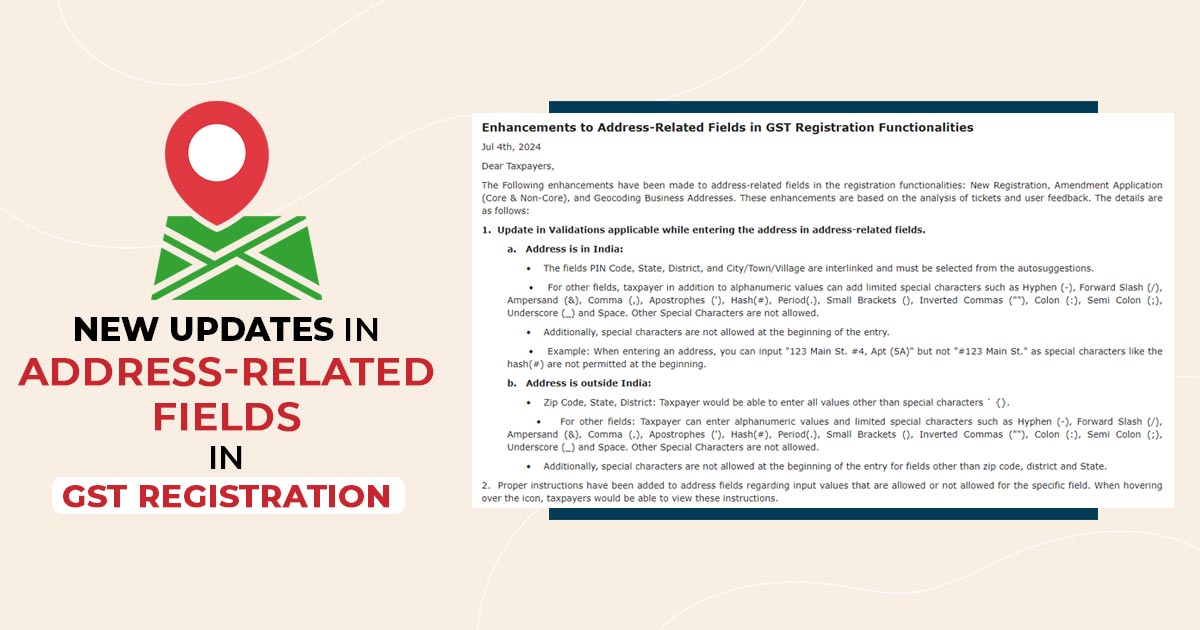

Amid ongoing concerns about tax notices and the strain on High Courts due to litigation, experts in the industry emphasize the necessity of establishing Goods and Services Tax (GST) Appellate Tribunals. The imminent presentation of the sixth Union Budget by Finance Minister Nirmala Sitharaman, under the Modi government on February 1, 2024, arrives amidst the […]