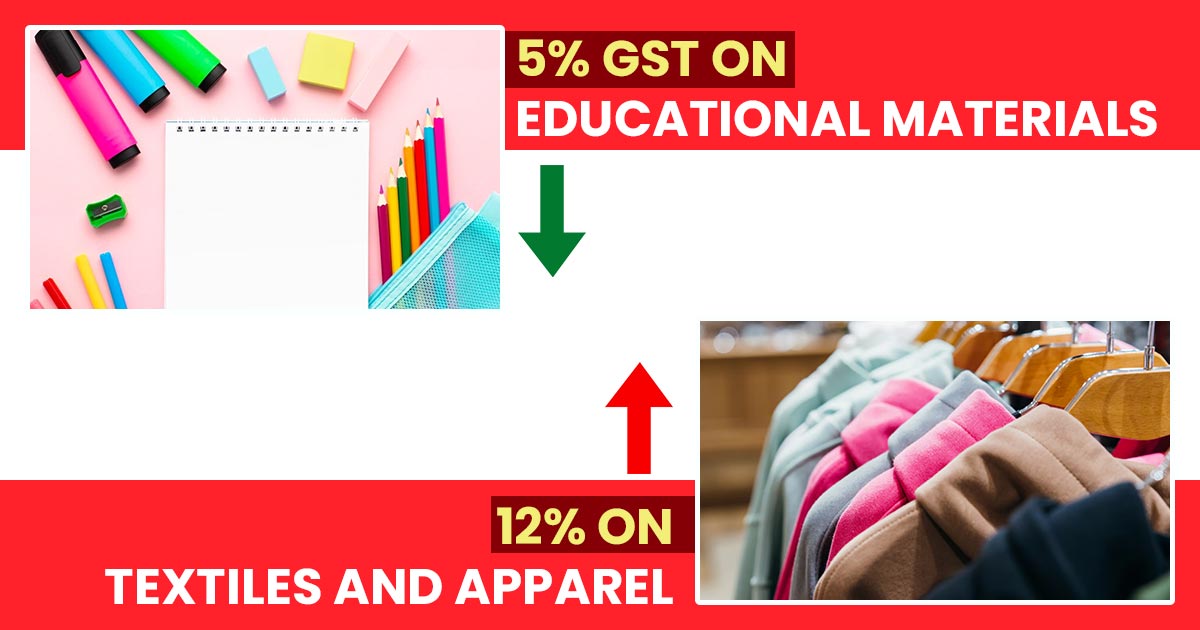

The equivocation in rates on some products under Goods and services tax (GST) is making the natural Rubber industry to go down. Here are the reasons impacting the rubber industry:

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

The equivocation in rates on some products under Goods and services tax (GST) is making the natural Rubber industry to go down. Here are the reasons impacting the rubber industry:

The government releases the GST return forms details which are mandated to be filed according to the due dates under GST mentioned in the attached notification. The submission and uploading of the returns are totally online. We have mentioned all the GST return filing due dates along with their respective associated GST forms such as […]

GSTR 2 is a tax return form that is used for filing the details of inward supplies of goods or services for taxation purpose. The form will be filled online on the GST portal after registration

The GSTR 3B form is a return form declared by the Indian government for the return filing only for initial 6 months of GST implementation. The GSTR 3B form will be filled up for the month of July to December 2017 in the place of normal return forms – GSTR 1, 2 and 3

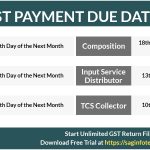

Goods and Service Tax is an ambitious tax regime applicable from 1st of July 2017 made a number of indirect taxes subsumed into it. The government has now revealed the due dates for the payment of GST.

Few days before the launching of GST Regime the government on Wednesday disclosed that the taxpayers are required to submit only one return in a month similar to the taxpayers do earlier.

GST is an added advantage to the tax compliance of the nation with its dynamic applicability in the current environment of the fast-paced economy.

The GST is approaching at a very fast pace and there are only 20 or fewer days left to tackle the issues which the traders are facing currently. According to the provisions, a taxpaying entity must be registered under GST if the turnover crosses the threshold limit of 20 lakh but there are very shortfalls on this point.

The upcoming GST scheme will be affecting a lot of financial services and this is due to new revised rate of 18 percent from the previous 15 percent being levied by the GST Council in its recent 14th meeting in the Srinagar. Although the differences are said to be marginally still there are various sectors, like banking, investments, insurance, real estate and mutual funds which are to be affected by the turmoil of GST.