The GSTN system handles the IT infrastructure for GST regime, is soon going to unveil an online application for claiming the refunds.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

The GSTN system handles the IT infrastructure for GST regime, is soon going to unveil an online application for claiming the refunds.

Income Tax Department is seeking information on past transaction details from banks and financial institutions. Through past transaction details, tax department will be able to determine Goods and Services Tax (GST) calculations.

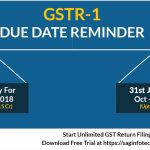

It is necessary for a large corporate business to the small one to be updated and file the GST returns very carefully because it can lead to errors which can cost a penalty or money hold with electronic cash ledger.

The centre is over-viewing the GST structures for small business and may allow them to file the quarterly returns instead of monthly GST returns.

After the implementation of Goods and Service Tax (GST) from 1st July, exporters are facing problem in the working capital due to delay in receiving the tax refund under GST. In view of this, they have demanded to provide tax exemptions previously instead of reimbursement mechanism.

The GST Council has released GST return forms which are duly filled up every month for the return purpose. Along the 11 return forms, there are three forms which are considered to be significant and are to be filled up every month regularly. However, the forms are equal to everyone and include all the traders and merchants alike.

Union Territory Tax (Rate) 1. Seek to reduce the rate of Central Tax, Union Territory Tax, on fertilisers from 6% to 2.5% and Integrated Tax rate on fertilisers from 12% to 5% 2. To notify the categories of services the tax on intra-State supplies of which shall be paid by the electronic commerce operator 3. […]

Integrated Tax (Rate) 1. Rescinding Notification No. 15/2017-Integrated Tax (Rate) dated 30.06.2017 2. Seek to reduce the rate of Central Tax, Union Territory Tax, on fertilisers from 6% to 2.5% and Integrated Tax rate on fertilisers from 12% to 5% 3. Notification for Exemption from Integrated Tax to SEZ 4. To notify the categories of […]

Integrated Tax 1. Seek to reduce the rate of Central Tax, Union Territory Tax, on fertilisers from 6% to 2.5% and Integrated Tax rate on fertilisers from 12% to 5% 2. Notification for Exemption from Integrated Tax to SEZ 3. To notify the categories of services the tax on inter-State supplies of which shall be […]