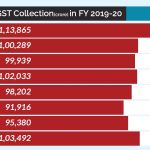

Finally, a rise in Goods & Service Tax (GST) collection in the month of November to INR 1.03 lakh crore has brought good news for GST officials who have been constantly working for measures to improve GST collection. This rise by 6% seems to reverse the last two month’s fall in GST collection. Experts are […]