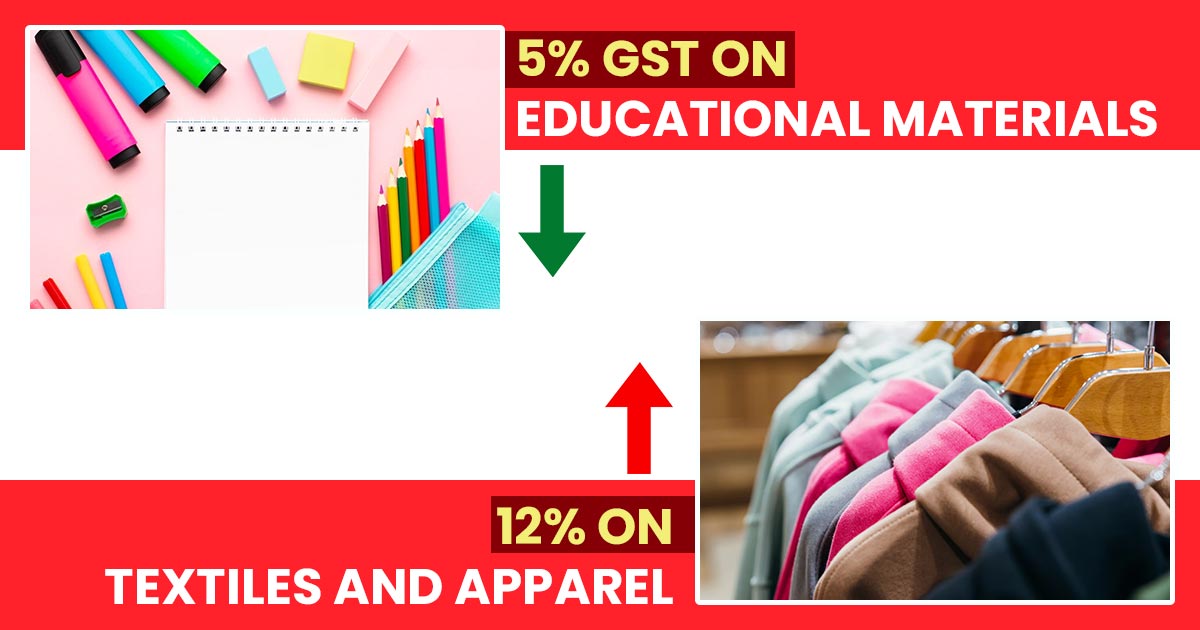

Against the bogus invoices, the government has taken measures. The government has started questioning the assessee that why they on their own paid the taxes since GST was incorporated. The question affects the taxpayers who are already facing a hard time due to pandemics. Beneath the GST the assessee can release the outstanding tax liability […]