GST has not only increased the indirect tax base but also revealed the hidden face of Indian economy. GST has opened many folds after analyzing the facts and put shocking data in front of India.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

GST has not only increased the indirect tax base but also revealed the hidden face of Indian economy. GST has opened many folds after analyzing the facts and put shocking data in front of India.

The Indian FMCG market is finally on the road to recovery after the double jolts of GST and Demonetisation. Emami, a major FMCG firm, in a statement, said that the demands from the rural markets are slowly gaining momentum.

According to critics, GST is badly implemented tax as it is fighting against constant changes in rates and returns. But is it a truth or reality is different or just a self-flagellation from some groups?

With the exclusion of electricity from the GST, Indian consumers will be paying Rs 30,000 crore extra in a year as a spending on power consumption. The power producers are not able to get credit for taxes and cess paid and this can be burdensome for them.

FMCG Company Hindustan Unilever (HUL) stated that it will be soon to say that due to the implementation of Goods and Services Tax, the unorganized sector is at the risk of losing all the business.

The increase in domestic tourism, the number of foreign visitors and passengers travelling through airlines is a clear indication that 2018 will be a year of increased revenue and profit margins for the hospitality industry of India.

Resulting from the 25th GST council meeting, the government has reduced the GST rates for home and local services startups to 5% from existing 18%.

The exponential growth of e-commerce in the last few years coupled with the Gst tax regime has escalated the demands for commercial vehicles.

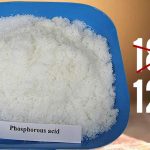

According to ICRA rating agency, the fertilizer manufacturers are likely to be benefited with the reduction in tax rates under the GST as the tax rates on phosphorus acid reduced from 18 percent to 12 percent.