Reckitt Benckiser, the British consumer goods major said, due to the implementation of goods and service taxes in India and the cyber attacks across the world, the business of the company has been affected in the quarter ended June.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

Reckitt Benckiser, the British consumer goods major said, due to the implementation of goods and service taxes in India and the cyber attacks across the world, the business of the company has been affected in the quarter ended June.

The Federation of Indian Chambers of Commerce and Industry (Ficci) recently commented on the conditions of goods and services tax in the logistics sector as it considered it to be positive for the industry but various other issues have covered up all the better points of

The GST Council is thinking to revise the return filing procedure and simplify the rules further to make easy compliance and enhance government revenues.

Consumers are in distress as e-commerce sites and retail stores are selling the discounted products with the addition of GST above the discount price, as revealed in a poll by Local Circles with the engagement of 8,845 people.

As the central government spends approximately Rs. 3 trillion every year for centrally sponsored schemes. But the outcome is very poor concerning the reasons like poor implementation capacity, lack of political will, and a larger structural issue.

Recently in a finding of African tourism reports, it was suggested that in the year 2017, there were a lesser number of tourists from India visited Africa, probably due to the recent demonetisation and goods and services tax.

There may be good times awaiting for the Indian commercial vehicle industry as the centre is pitching for a zero tax rate on the sale of second hand or the old commercial vehicles under the goods and services tax.

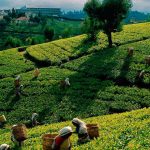

The tea industry figured slow growth at the auction centres instead of global and domestic signal working in favour of the Indian market. The reason behind the confusion is generated after goods and services tax (GST) implementation in India.

As of now the Indian public is not sure of the future benefits of GST and have considered it to be disruptive for the business community in the recent polls conducted.