Today, an official said that the GST Council will look after in finalizing the simpler version of GST return filing module that is proposed by Nandan Nilekani on the 26th meeting that will be going to held on March 10th.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

Today, an official said that the GST Council will look after in finalizing the simpler version of GST return filing module that is proposed by Nandan Nilekani on the 26th meeting that will be going to held on March 10th.

The Federation of Indian Chambers of Commerce and Industry (Ficci) recently commented on the conditions of goods and services tax in the logistics sector as it considered it to be positive for the industry but various other issues have covered up all the better points of

According to critics, GST is badly implemented tax as it is fighting against constant changes in rates and returns. But is it a truth or reality is different or just a self-flagellation from some groups?

In the recent communication held with DataWind, a mobile device manufacturing company stated that the tablet PCs are now going expensive due to the higher tax rates of 12 percent and 18 percent.

The technical issues of GST Network (GSTN) coupled with errors in invoice matching have brought in criticism from all corners.

Iron Handicraft industry, which exports products to foreign countries and earns foreign currencies in crores, is in dilemma after Goods and Services implementation as due to various anomalies in IGST and GST, they are suffering from an economic slowdown.

IGST Refund – Under the GST law, exporters must have to pay the Integrated Goods and Services Tax (IGST) while exporting the goods from one place to another.

Many traders want to file GST but due to lack of computer awareness, they have to hire lawyers and accountants at a higher cost which is the main cause of delay in filing returns.

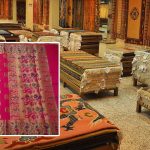

Banarasi Saree and carpet Industry in a dilemma due to issues with GST procedures. Specifically, the constituency of the PM Narendra Modi, Varanasi and nearby areas are facing problems in continuing the business.