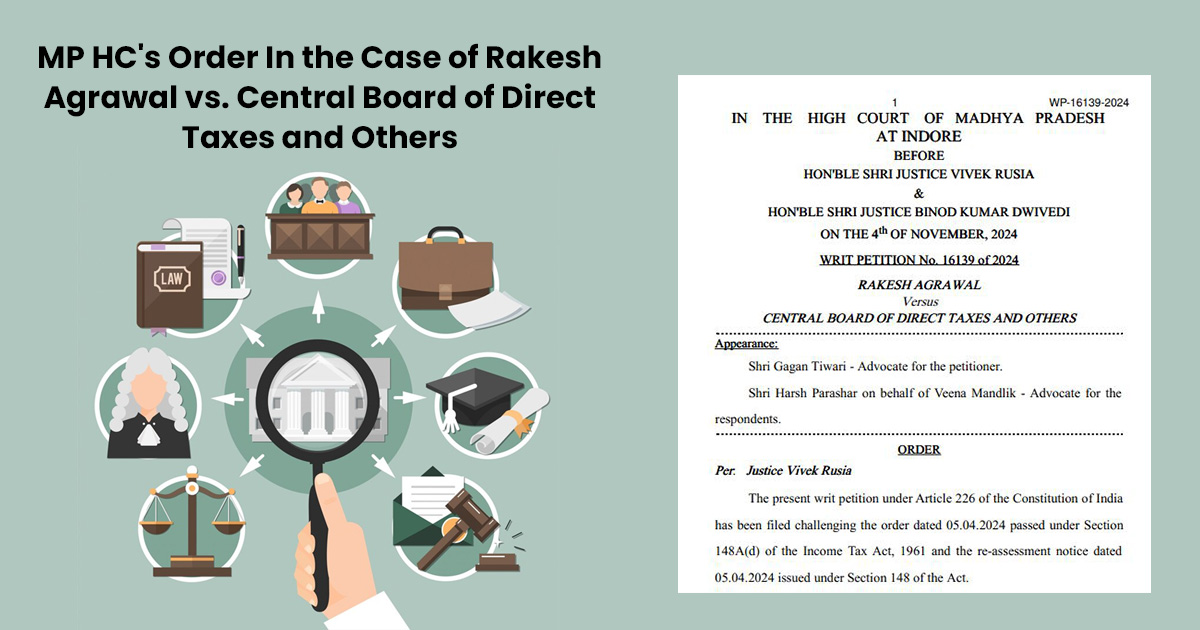

The CBDT which stands for The Central Board of Direct Taxes provided a big relief to all the taxpayers. CBDT through an order directed all the authorities to not send any adverse message and letters to any tax assessee for mistakes during the first quarter of Financial Year 2020-21. CBDT with this step reflecting that […]