Maharashtra has mentioned that it would surge the cap for e-way bill threshold limit for goods and services supplies within states considering GST norms from existing Rs 50,000 limit to Rs 1 lakh.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

Maharashtra has mentioned that it would surge the cap for e-way bill threshold limit for goods and services supplies within states considering GST norms from existing Rs 50,000 limit to Rs 1 lakh.

As per the figures of Employees’ Provident Fund Organisation (EPFO), it came out that 4.1 million job applications were generated between September 2017 to April 2018.

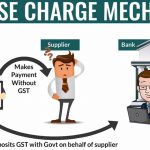

The reverse charge mechanism is soon going to be implemented across the country starting from 1st July, exactly one year after the implementation of the most popular tax regime i.e. GST.

The technological fabric of GST intertwined with compliances complexities and multiple-stage taxing has spelt doom for the once flourishing Textile and Powerloom Industry of Surat.

Logistic Efficiency is paramount for profitable business operations. The 18-20% decrease in turnaround time for road transport sector post GST introduction are good omens for business operations.

The Indian GST is a very complex form of indirect tax. The discrepancies in GDP growth and per capita income growth meant that the One Nation One Tax Policy unfolded as a complex fabric of multiple tax slabs intertwined in a fabric of cess and other indirect taxes.

Online food delivery service providers are in hard situations as the decision of withdrawal of input tax credit provision from the restaurants had become an extra burden on both the eatery and service provider.

A total of 9 days passed since daily wage labourers from the sandstone industry of Rajasthan to get a employment for a day in the dry land of Bhilwara by lifting sandstone slabs.

Authority of Advance Ruling (AAR), Andhra Pradesh gave clear instructions mentioning that the GST will be applicable on the items supplied to merchant’s vessels from the Customs warehouse and the experts will inspect and have a close look on such supplies.