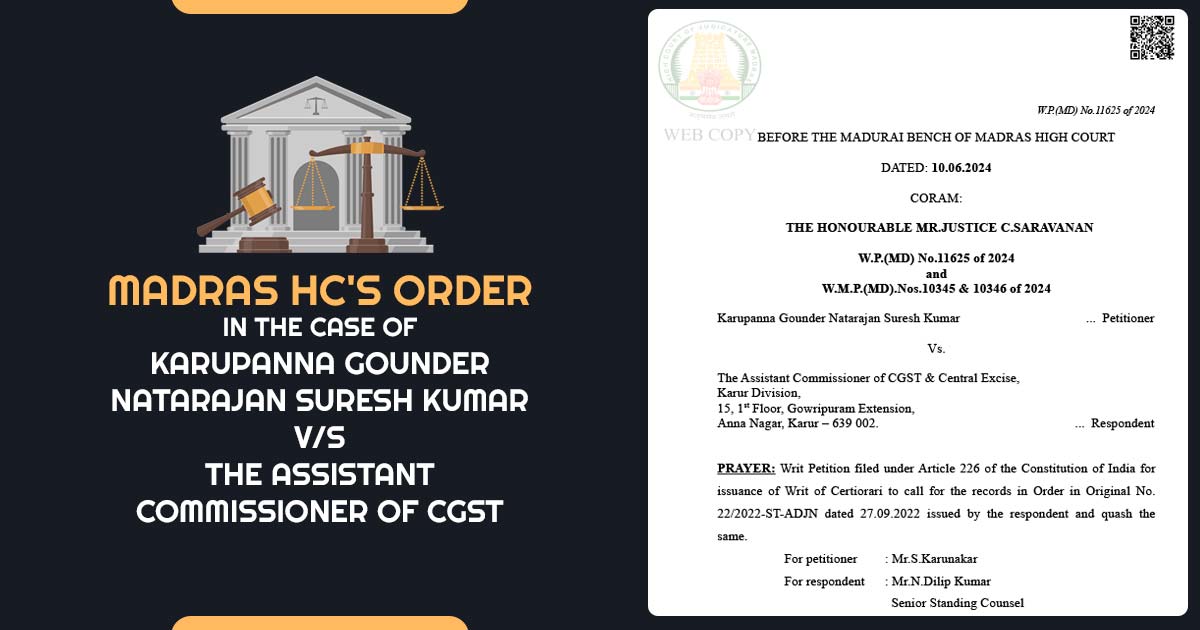

The Kerala High Court has instructed the Assessing Authority to review the petitioner’s arguments based on Circular No.183/15/2022-GST dated 27.12.2022 from the Government of India, Department of Revenue. This directive was prompted by the petitioner’s denial of legitimate Input Tax Credit (ITC), which was solely due to variations in ITC figures between the GST returns […]