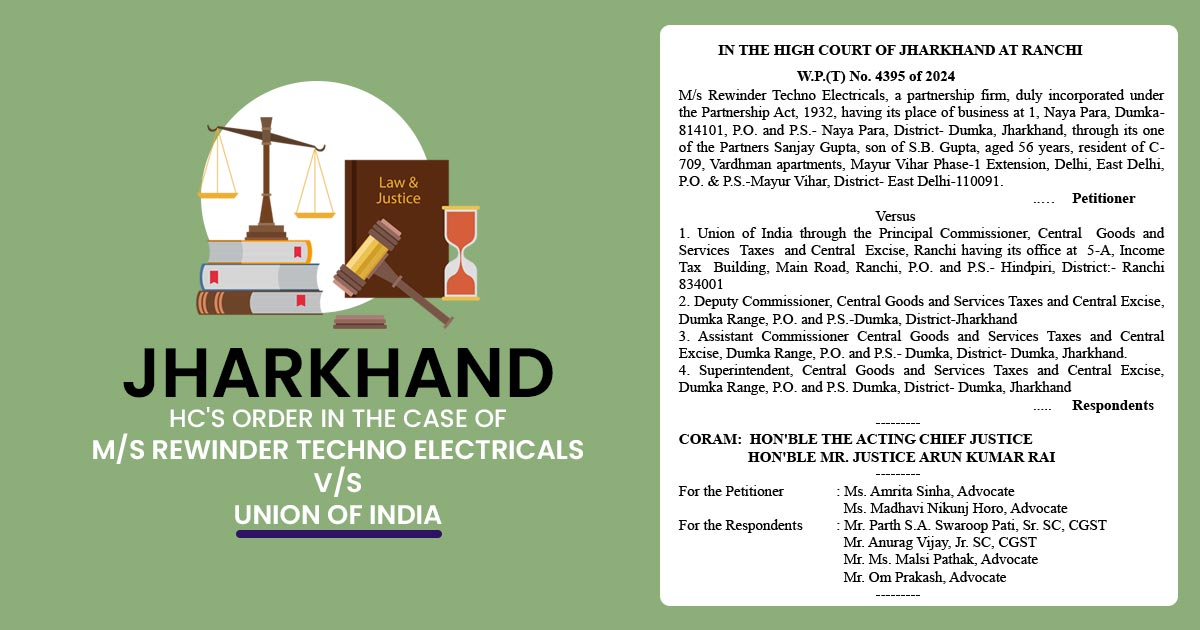

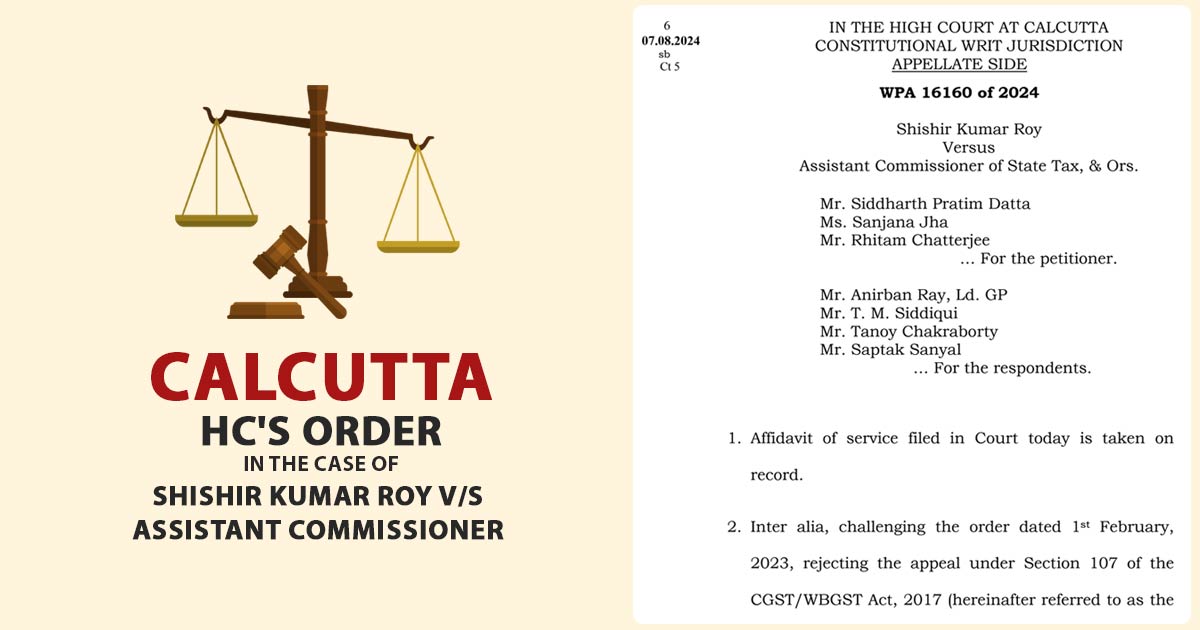

When the Goods and services tax (GST) regime was made on July 1, 2017, the commercial tax department recognized an 85% rise in the number of assessees who denied filing the returns. The council also mentioned a rise in the number of cases in which tax left still not have been furnished from the last […]