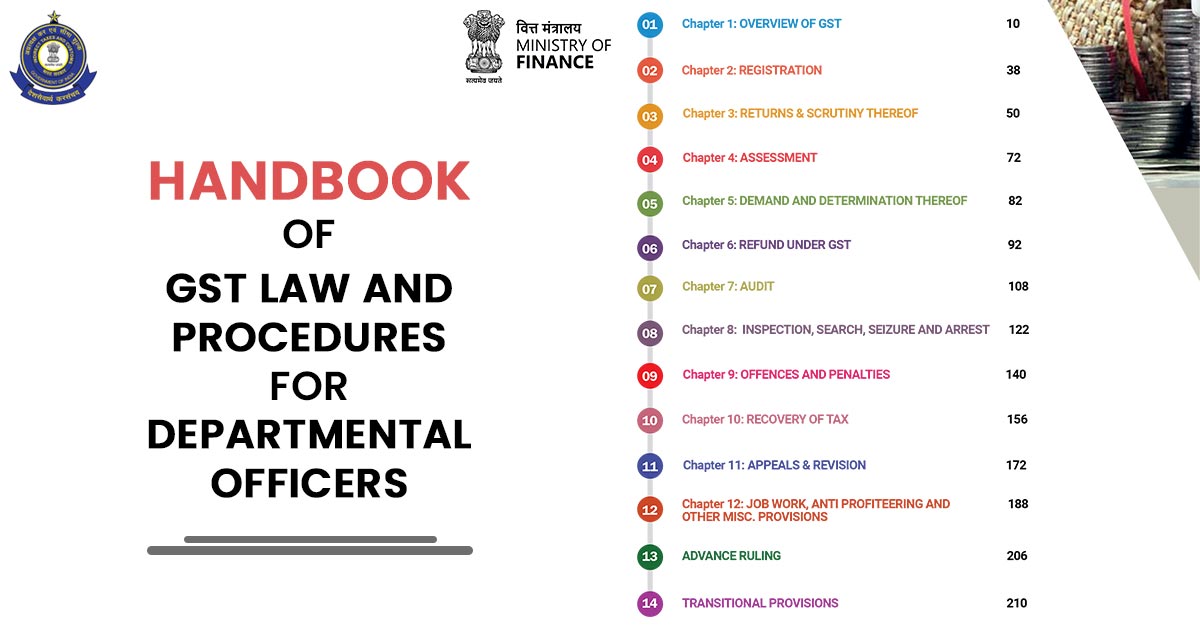

To develop an internal method desired to eliminate duplicate Goods and Services Tax ( GST ) notices sent to companies and individuals already under investigation by state goods and services tax authorities is been directed by the Central Board of Indirect Taxes ( CBIC ) to its field officers. Some instances show that the taxpayers […]