According to the media report, it is being observed that Tamil Nadu is one of the states in India which has received good revenue collection for the first time after the 18 months of GST implementation.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

According to the media report, it is being observed that Tamil Nadu is one of the states in India which has received good revenue collection for the first time after the 18 months of GST implementation.

In response to the Finance Secretary Hasmukh Adhia’s written concern over the poor performance of the central tax officials when compared to their state tax counterparts

It is expected that the goods and services tax can touch a skyhigh of 95000 crores of revenue collection this March 2018 when the return will be filed by April 20.

After the beginning of new tax regime- goods and services tax (GST), Gujarat government has said, the main reason of the revenue growth is stamp duty, electricity duty and vehicle tax as these taxes will help the Gujarat government to collect 18.5 percent more tax revenues in 2017-18.

The tweaks in GST tax rates affected the revenue collection of the government. The total calculated loss stands at Rs. 10,000 Crore comparing the last month collection. Finance Ministry told that the collection received till 27 November generated Rs. 83,346 Crore while the collection was of Rs. 95,131 Crore in October and Rs. 93,141 Crore in September.

Vanaja N Sarna, Chairperson of Central Board of Excise and Customs (CBEC), said that the tax collected under the new tax regime is deviating from the expected figure and there are no targets in line to tweak the annual revenue goals.

According to the tax official, it is expected that the GST Council may reduce the taxes on items of common consumption if the government will earn good collection from the new tax regime over the coming few months.

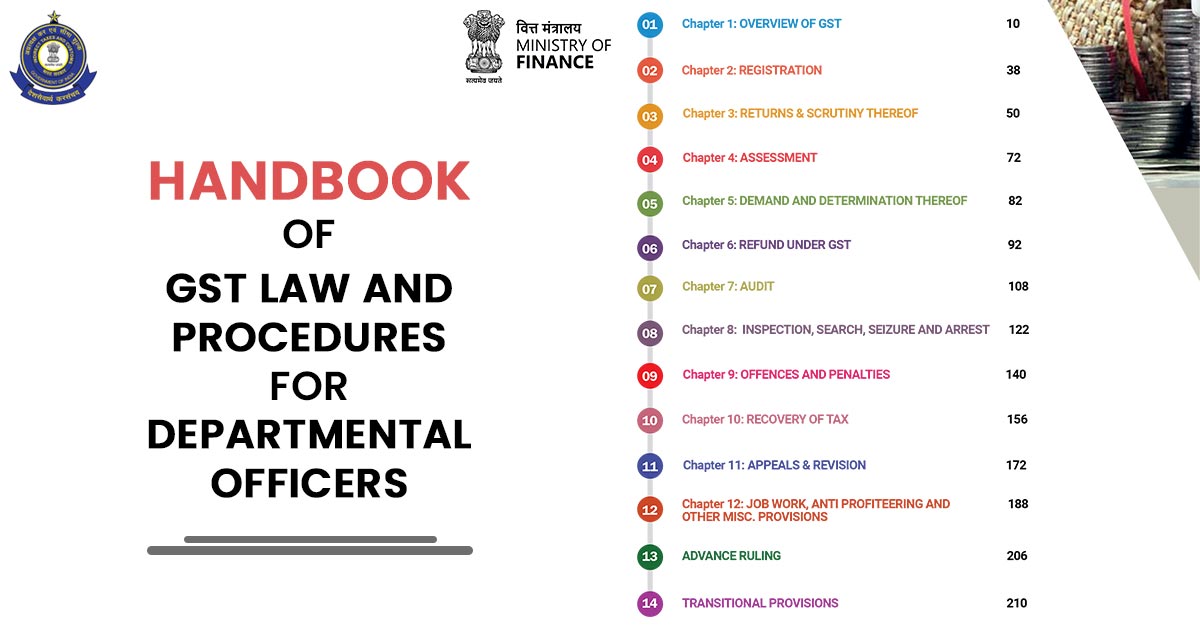

Goods and Service Tax is well ahead of many other significant issues currently running through the ministry and Parliament business and one thing industry expert are sure about is that GST will bring along some benefits including tax collection growth on the sidelines of implementation.

It seems that an emerging sector named e-commerce is now in a dooms period as the latest GST provision covering for the fact that the TCS will be collected on the behalf of sellers and must be submitted to the government for the proper continuation of the companies in the current tax structure.