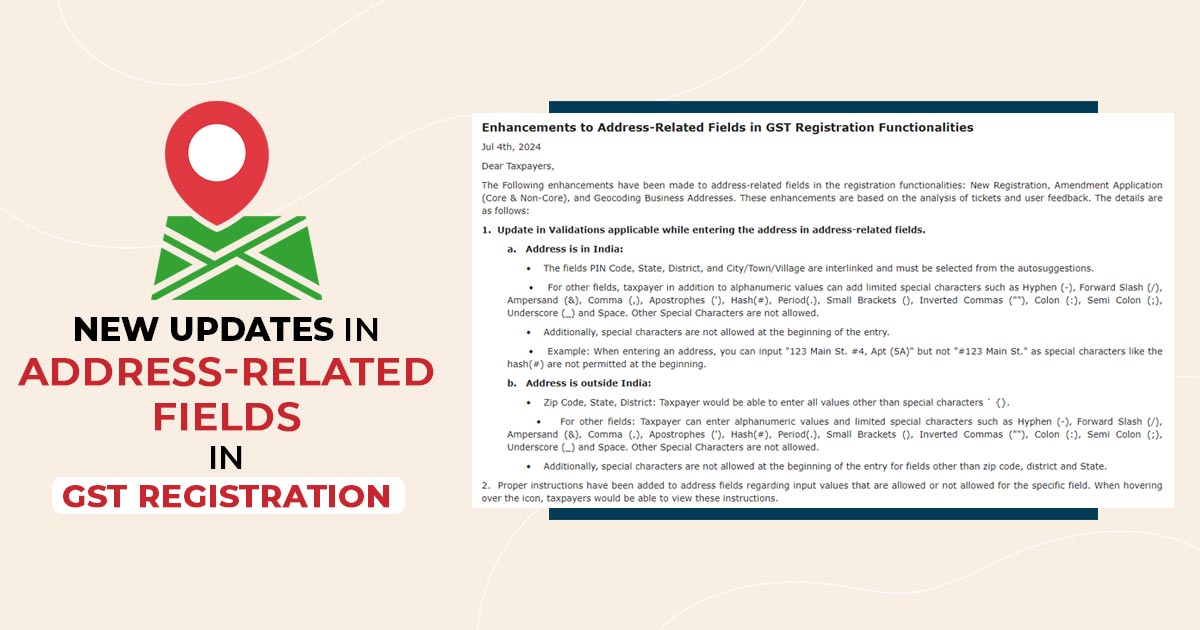

A circular via the GST department might be furnished to address the dispute of the spate of notices sent before the Indian arms of the foreign firms asking for the tax salaries filed to immigrants via the local unit. As per the circular input tax credit (ITC) must not be held back from 2017 to […]