The provision under Section 80C and 80D of the Income-tax Act is that specified taxpayers could claim for deductions to the Insurance company on the total amount paid to them for specified insurance schemes.

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

The provision under Section 80C and 80D of the Income-tax Act is that specified taxpayers could claim for deductions to the Insurance company on the total amount paid to them for specified insurance schemes.

The Indian government has recently notified the PDF format of all the Income Tax Return (ITR) forms for AY 2025-26 under the tax regime. All the taxpayers in India must file their returns on time as per the government rules and guidelines. However, to make the tax compliance process relatively easy, the income tax department […]

The first income tax rate in newly independent India was as high as 97.75% with 11 tax slabs. Reducing this sky-high tax rate was a major challenge for the country. Over time, India witnessed a significant decline in tax rates, from 97.75% with 11 slabs to 30% with just three slabs. The country has come […]

In a bid to make the National Pension System (NPS) more appealing for potential investors, the government has decided to make NPS withdrawals 100% tax-

All eligible individuals are required to file their income tax returns in compliance with the regulations. The 2024-25 financial year has brought new modifications to the Income Tax Rules, which will be implemented from April 1, 2024. The new fiscal year (FY) 2024-25 begins on April 1, and the pronouncements made by Union Finance Minister […]

ITR-1 Sahaj Form is filed by the taxpayers and the individuals having the residential status of ordinary and not other than ordinary, accruing income from salaries or, one house property and other capital gain sources i.e. Interest etc. up to INR 50 lakh per annum.

Many small and medium scale companies were panic-struck upon receiving notices from the Indirect Direct Tax Department.

The Union Finance Ministry has lodged a formal request in the Parliament seeking permission to spend an additional amount of Rs 85,315 crore in the ongoing financial year.

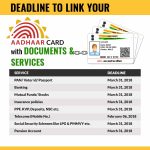

Aadhaar, as the name suggests, has become the basis of all important documents and bank accounts and the government has mandated all the documents to be linked with Aadhaar till 31st March 2018.

Aadhaar, as the name suggests, has become the basis of all important documents and bank accounts and the government has mandated all the documents to be linked with Aadhaar till 31st March 2018.