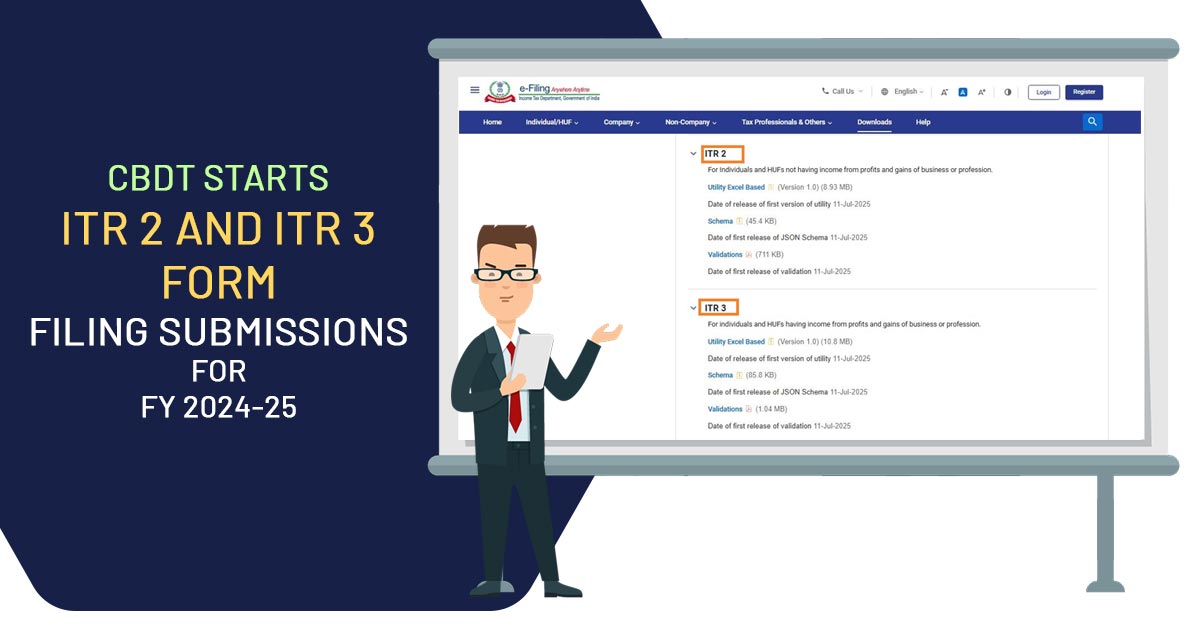

From 20 March 2020 to 29 November 2020 Central Board of Indirect Taxes and Customs (CBIC) has prolonged the last date of GST compliance View the due dates of GST return filing forms of GSTR 1, GSTR 3B, GSTR 4, GSTR 5, GSTR 6, GSTR 9, GSTR 9C, etc. The dates are according to the […]