The AAR Karnataka order dated April 24 ruled that the testing services performed by the laboratories outside India are exempted from IGST. The come from AAR in a case that comes under 97(2)(e) of the SGST Act. In this case, the applicant is M/s DKMS BMST Foundation India, the Foundation is a non-profit organization registered under GST Act

M/s DKMS BMST Foundation India filed an application for Advance Ruling under Section 97 of the CGST Act, 2017 concerning rule 104 of the same and also Rule 104 section 97 of the KGST Act, 2017. The applicant asked whether they are liable to pay Integrated Goods and Service Tax (IGST) on the Human Leukocyte Antigen (HLA) testing services offered by the overseas laboratory outside India on the human buccal swabs sent by them (foundation) from India.

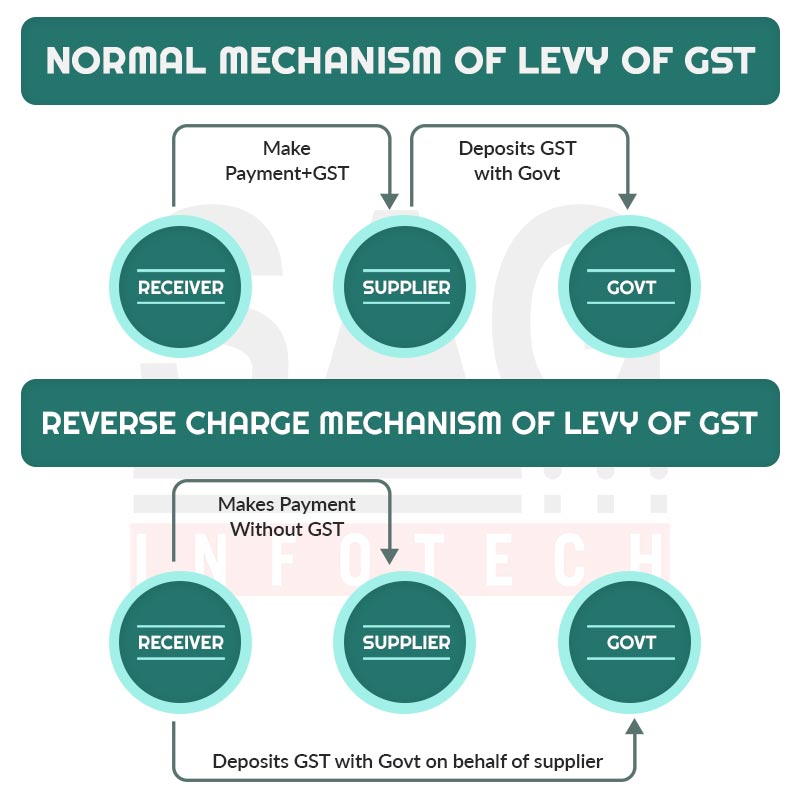

In this case, the ruling has been given by the authority consisting of members Dr. M.P. Ravi Prasad and Mashood Ur Rehman Farooqui. They stated that the service of Human Leukocyte Antigen (HLA) typing received by DKMS BMST Foundation India from the overseas laboratory falls under the definition of “health care services by the clinical establishment” and therefore these are tax (IGST) leviable thereon and accordingly not taxable under reverse charge mechanism

The authority further added, “The applicant is not liable to pay Integrated Goods and Service Tax (IGST) on the testing services performed by the overseas laboratory outside India on the human buccal swabs sent by DKMS BMST from India,”. Download and view the official order no. 24/2020 by the Karnataka Authority of Advance Ruling (AAR)