What is NFRA?

NFRA stands for “The National Financial Reporting Authority”. This government Authority was constituted on 01st of October 2018, under the provisions of Sub Section (1) of Section 132 of the Companies Act, 2013.

The primary reason for the constitution of this entity by the central government in India is to set up an independent and separate regulatory body that will provide its contribute to framing & enforcement of specific laws & regulations concerning accounting & auditing, as well as improving the investor & public confidence in the financial reporting of an entity.

The recent corporate scams have led to the formation of this body in India.

Some of the key roles, responsibilities, and functions handled by NFRA include:

- Provides key recommendations for laying down the accounting & auditing policies and standards for companies in India

- Continually monitor and ensure compliance with accounting & auditing standards;

- To monitor and observe the quality of service of the professions engaged in ensuring compliance as per the devised auditing standards and measures suggested by NFRA;

- Perform other functions & duties that are vital to fulfilling the above tasks.

One must note that before the formation of NFRA, all the accounting standards prescribed by the central government were based on the guidelines or suggestions received from the ICAI. The ICAI, on their part, consult with the National Advisory Committee on Accounting Standards (NACAS) before recommending such accounting standards & practices to the central government.

Now, after the formation of NFRA, the ICAI would be obliged to consult with NFRA, instead of NACAS, for the same. NFRA officially take over the duties of the National Advisory Committee on Accounting Standards regarding the same.

On the ICAI part, it will continue to undertake its role & responsibilities concerning training & qualifying chartered accountants (CAs), offering them a licence to practice, and regulating CAs, including scrutinising audit quality. The disciplinary jurisdiction of ICAI will not be replaced by NFRA in any case.

What is the NFRA 1 Form?

NFRA-1 Form is for reporting the details of an appointed auditor by the Company to the National Financial Reporting Authority (NFRA) within 15 days of their appointment.

If there is a change in auditor, a fresh NFRA-1 must be filed again within 15 days of the new appointment.

Eligibility to File NFRA Form 1

The list of companies covered by Rule 3 of the NFRA rules to file NFRA Form 1 are:-

- Companies whose stocks are listed on any of the stock exchanges in India.

- Unlisted Public Companies that have paid capital not less than INR 500 crores or annual turnover of INR 1000 crores and above, or total aggregate outstanding loans, debentures or deposits not less than INR 500 crores as on the 31st March of the immediately preceding financial year.

- Insurance companies, banking companies, and other companies that are actively working in the electricity generation or supply of electricity.

- Companies governed by any special Act for the time being in force or bodies corporate incorporated by an Act as per the clauses (b), (c), (d), (e) and (f) of sub-section (4) of section 1 of the Act;

- Any corporation, person, or company that has been suggested by the central government to the NFRA.

- Body Corporate that is

- Registered outside India and is a subsidiary company or an associate company of the company that is registered in India as per the aforementioned points.

- The income or net worth exceeds 20% of the consolidated net worth or consolidated income of such company.

The list of companies that do not need to file NFRA Form 1 is given below:

- Private Companies

- Unlisted public companies that have a paid-up capital or turnover or aggregate of loans, debentures and deposits below the prescribed limit

- Limited Liability Partnership (LLP)

Filing Requirements for NFRA Form 1

Disclosure by companies about the Appointment of Auditors

Now, the companies (excluding the ones that are mentioned under section 2(20)) governed by the NFRA must also report to the NFRA within 15 days after the appointment of an auditor. The companies or body corporates are required to furnish the particulars of the auditor to the authority.

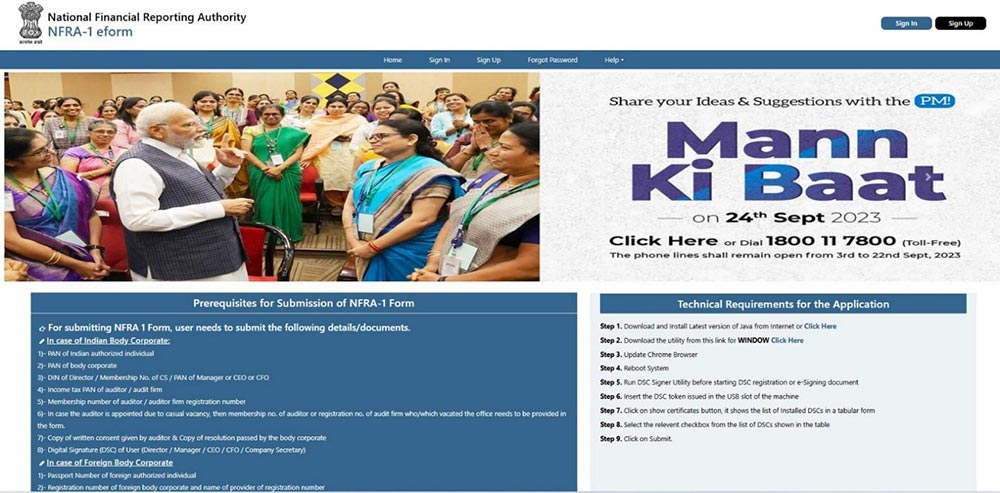

Prerequisites for Submission of NFRA-1 Form

For Indian Body Corporates or Companies:

- PAN Details of the authorised Indian individual

- Body corporate PAN Details

- Director/Membership No. of CS/PAN of Manager or CEO or CFO

- Auditor/audit firm income tax PAN number

- Membership number of auditor/auditor firm registration number

- In case the auditor is appointed due to a casual vacancy, then the membership no. of the auditor or registration no. of the audit firm/which vacated the office, needs to be provided in the form.

- Written consent copy that is given by the auditor

- Copy of the resolution passed from the Body Corporate side

- User (Director/Manager/CEO/CFO/Company Secretary) digital signature (DSC)

For Foreign Companies

- Foreign authorised individual Passport Number

- Foreign body corporate Registration number & registration number provider Name

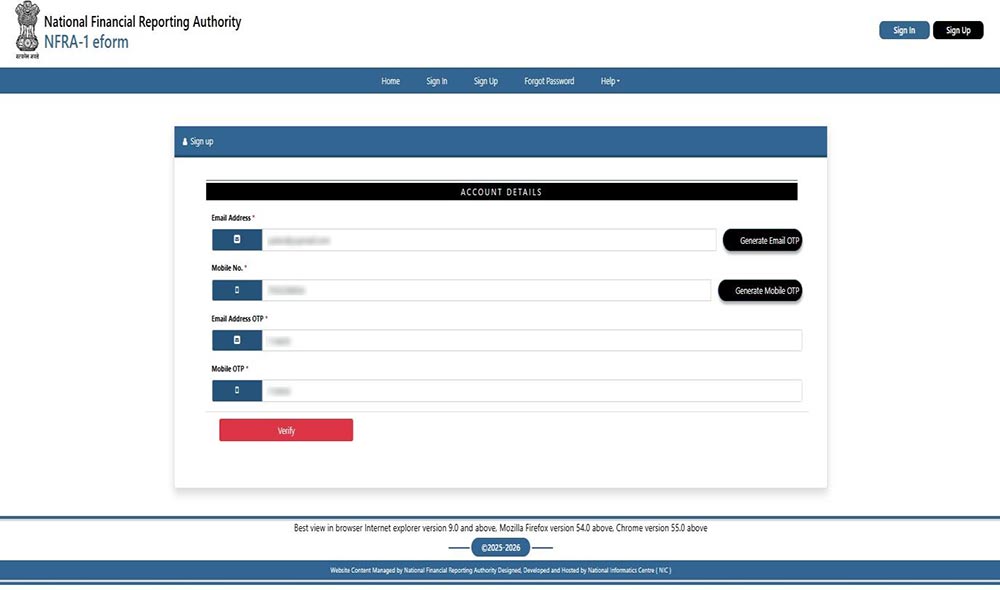

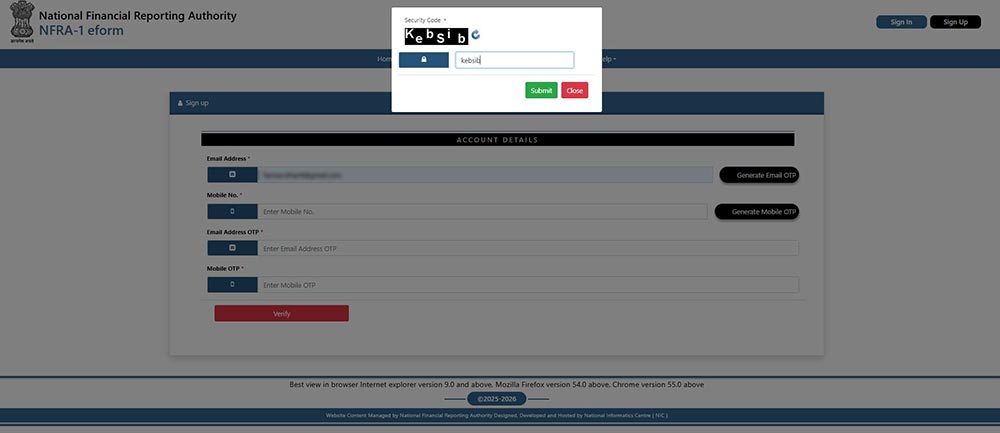

User Registration Procedure for Form NFRA-1

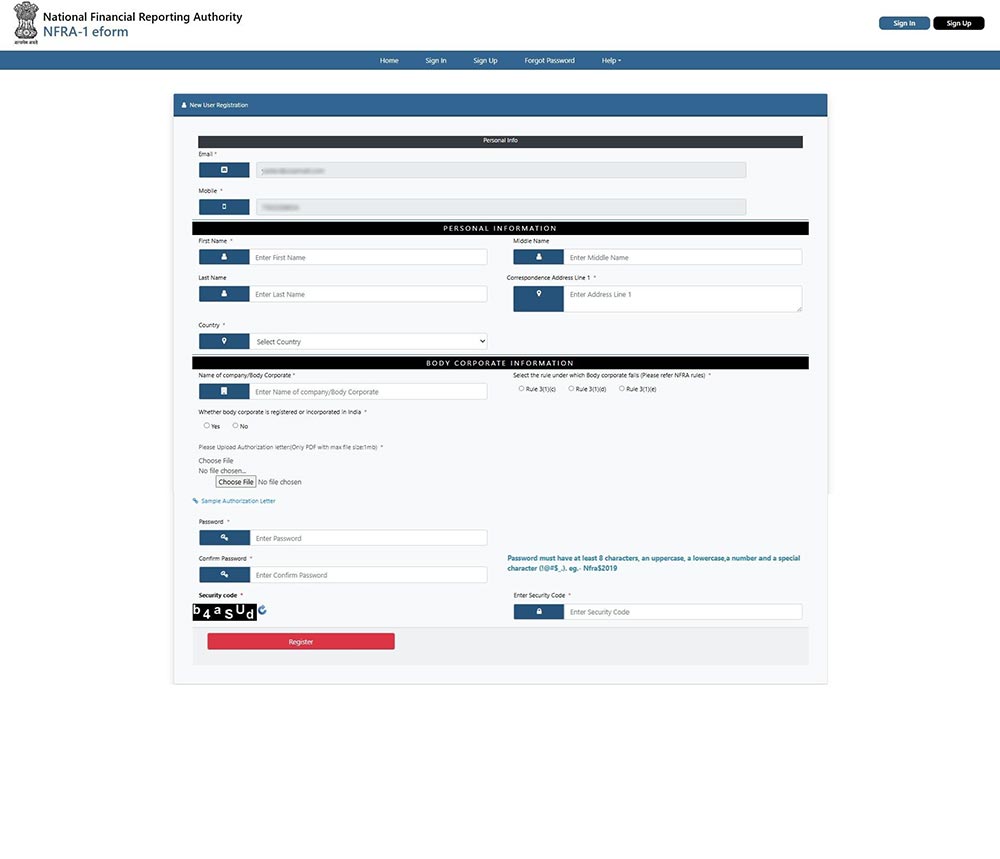

The user registration procedure to file Form NFRA-1 has been explained in a step-by-step manner below:

Step 1: Enter the URL: https://eformnfra1.nic.in/nfra1. The Home page will be displayed. Refer to Screenshot 1

Step 2: Verification of Email and Mobile number.

Step 3: Personal information and Body corporate information (e.g., first Name, address and Pan Card, etc.) and authorisation letter.

Step 4: Email/SMS notification by the application to the user.

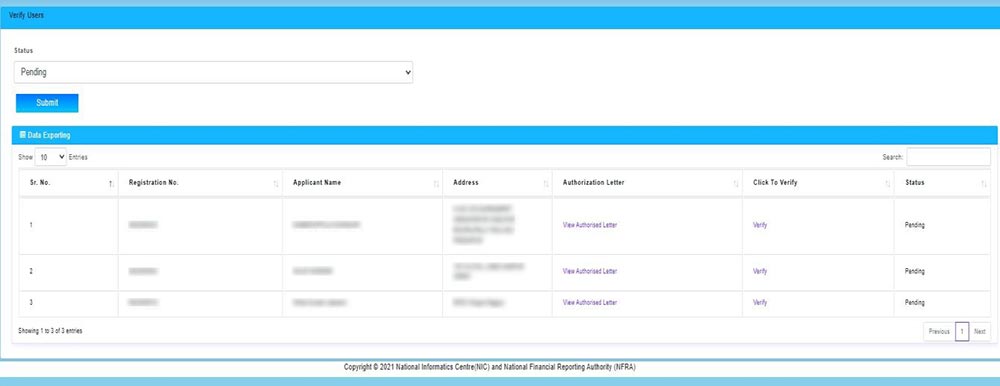

Step 5: NFRA officials do verification and approve the account using NCAS.

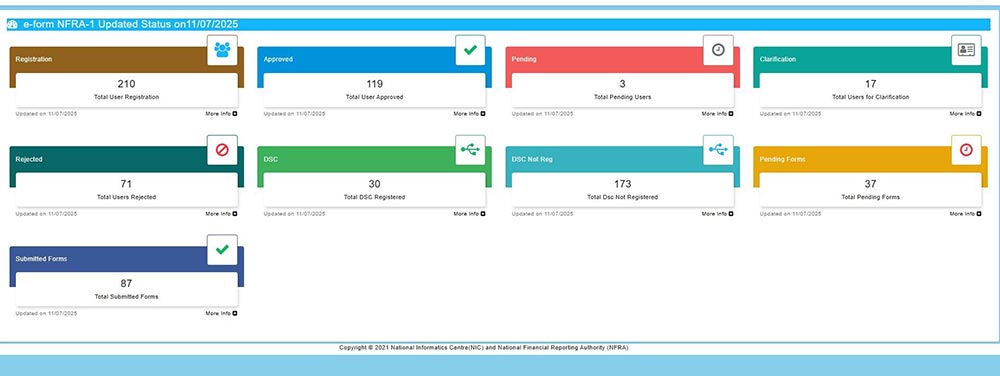

Step 6: NCAS Dashboard

Who Should File Form NFRA-1

This particular form needs to be filed by companies and other bodies corporate to inform NFRA about the appointment of the auditor, along with details of the company/body corporate and the auditor.

Punishment in Case of Non-compliance NFRA Form 1

If any company or any officer of a company or auditor, or any other person who falls under the provisions of NFRA Rules contravene any of these rules are bound to get punished according to the provisions of section 450 of the Companies Act, 2013.

Brief on Form NFRA-2

Auditor of the Company (i.e. Company which is required to file Form NFRA-1) has to file Form NFRA-2 on or before 30th November of the immediately preceding financial year to inform the following information:-

- Audit assignments undertaken

- Audit report qualifications

- Disciplinary actions (if any)

- Audit fees received, etc. Procedure to file form NFRA-2 is given at following link – https://eformnfra2.nic.in/docs/NFRA%202%20User%20Registration%20Instru ctions_v%201.pdf