After a certain time interval, the assessee who has deducted the TDS is required to file the return for the same. With the inception of online filing, the process of managing taxation has become quite easy and simple. The newly revised procedure for E-FILING of TDS returns is here as follows:

Registration with E-filing Website for TDS Return

NOTE: The registration beneath only requires if the assessee is not yet registered as a tax deductor and collector.

- The assessee who wants to file the returns must fill in the details after logging into ‘TRACES’ (https://www.tdscpc.gov.in/app/login.xhtml).

- The page window shows ‘Register for E-filing’ in the left corner. Click on that.

- After clicking the page, it gets navigated to the ‘E-FILING’ portal of the IT department, which asks to register as a tax deductor and collector by using the default ID of the TAN of the assessee.

- The opened document will contain necessary details which the assessee has to fill up and he/she needs to create a password after mentioning the details of an authorized person such as designation, mobile number, email address and a few other information of the organization including address, landline number, fax number etc. After filling in the details, submit the form.

- Via the help of the assessee’s PAN, password, and date of incorporation/ birth, log on to the ‘EFILING’ portal and get the TAN registration approved by traversing to the ‘For Your Action’ tab positioned at the top-right window.

- When it is approved, the assessee’s email ID, which has been mentioned in Step 3, will get a link and a PIN will be sent to the mentioned mobile number.

- To complete the registration process, click on the link share the received PIN number and submit the form.

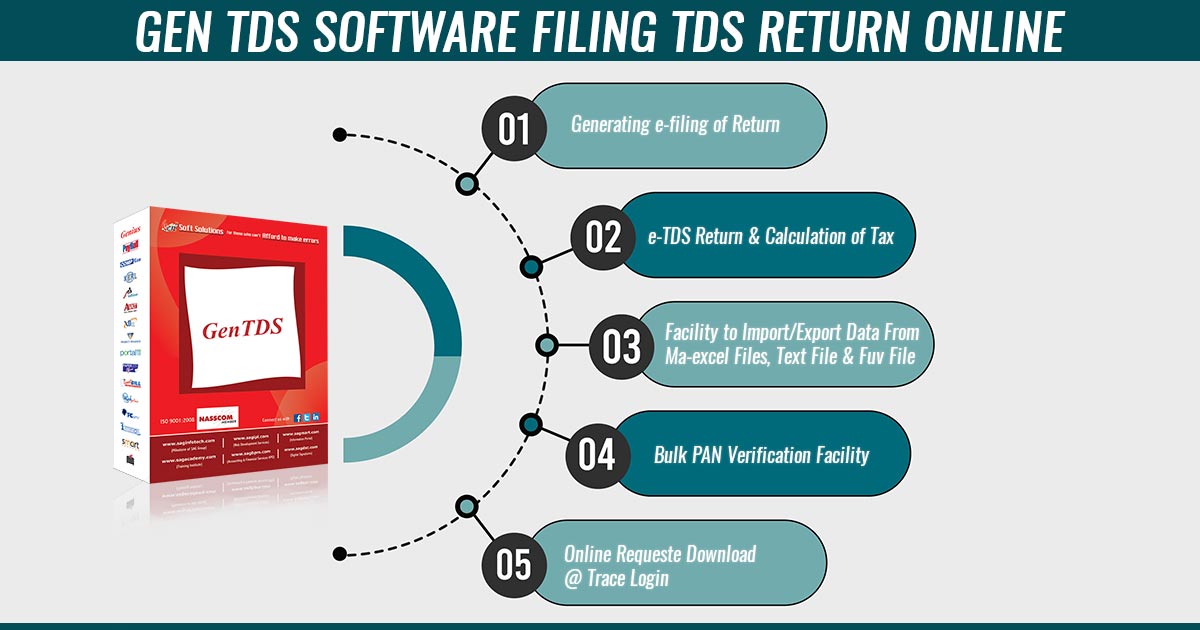

Read Also: Easy Guide to Filing TDS Returns by Gen TDS Software

DSC Registration

- The first step includes downloading of DSC Management Utility. After that, go to the ‘Register/Reset Password’ tab.

- Put on the TAN of the Organization and PAN number of the DSC holder, select from the drop-down the DSC type (.pfx or USB token), generate the signature file after selecting DSC and save it.

- After the ID gets created, log into the ‘EFILING’ portal with the same and visit the ‘Profile Settings-Register DSC’ to upload the recently created DSC file. Submit it. Your DSC registration is completed now.

NOTE: Registration of DSC is required only once.

Filing TDS Return

- Fill in the TDS return data in the Return Utility Software (RPU) of NSDL or in the software and process it.

- Choose to upload the return to the ‘E-FILING’ option of the ITD. A zip file will be generated. Save it.

- At the DSC Management Utility, select the ‘Bulk Upload’ option, attach the previously generated zip file, fill in the TAN of the assessee and PAN of the DSC holder, select the DSC option (.pfx/USB Token), select the digital signature certificate and generate a DSC file. After the whole process, save it.

- Open the IDS panel with the login ID of the tax deductor and collector and from the given TDS tab, upload the select TDS return option. Fill up all the given details such as financial year, FVU version, quarter, form type etc., and submit the same. Attach both the files created in the above two steps and submit them.

- This generates a token number that the assessee can check from the ‘view filed return’ option given on the web portal. The process of filing a TDS return online is completed here.

Source: Caclubindia.com

HOW TO REPLACEMENT DEDUCT PAN NO CHANGES REPLACEMENT ERROR

My form no 16 2019-20 provided. please