Tax Penalty u/s. 271D and 271E of the Income Tax Act, 1961 cannot be charged if the assessment proceedings are quashed.

Under section 147 of the Act, the matter of the taxpayer was reopened on the grounds of the data obtained from the office of, ACIT, Central Circle-2(4), Ahmedabad. An investigation was performed at the premises of Dharmadev Infrastructure Limited, and 36 benami accounts were discovered from which one of them belonged to the taxpayer.

Cash deposits were comprised in this account. AO in the identical reassessment proceedings has alleged that particular transactions of loan have been taken and repaid, undertaken by the taxpayer in breach of section 269SS and 269T of the Act. Dissatisfied with the taxpayer’s explanation and therefore started the penalty proceedings under sections 271D and 271E of the act. Thereafter a penalty order was passed establishing the penalty.

The taxpayer had contested the reassessment proceedings u/s. 147 of the Act before Hon’ble Mumbai ITAT. The taxpayer before the Hon’ble ITAT had opted for a specific foundation for the charged penalty.

The reassessment order has been quashed by the Hon’ble ITAT carrying that any material discovered at the time of the search can be applied to initiate proceedings under section 153C of the Act, not under section 147 of the Act.

The taxpayer against the penalty order has filed a petition to the CIT(A) in which it was claimed that when the reassessment preceding itself has been quashed then the penalty proceedings that the AO executed must not endure, the charged penalty needs to get deleted. The taxpayer’s claim does not get considered by the CIT(A) and confirms the penalty levy.

The taxpayer before the Hon’ble ITAT argued the measure of CIT(A). The taxpayer laid on the Hon’ble Supreme Court’s decision in the matter of CIT vs. M/S Jayalakshmi Rice Mills [2015] 379 ITR 521 (SC). DR claims that penalty imposition under sections 271D and 271E of the Act are not dependent on the consequence of the assessment order and the penalty proceedings are varied from the assessment proceedings despite originating from the assessment proceedings.

The Hon’ble ITAT removed the imposed penalty under sections 271D and 271E of the Act relying on the decision of M/s. Jayalakshmi Rice Mills (supra) wherein it was carried that when the original assessment order itself was set aside, the satisfaction recorded therein for initiation of the penalty proceeding under section 271E shall also not prevail.

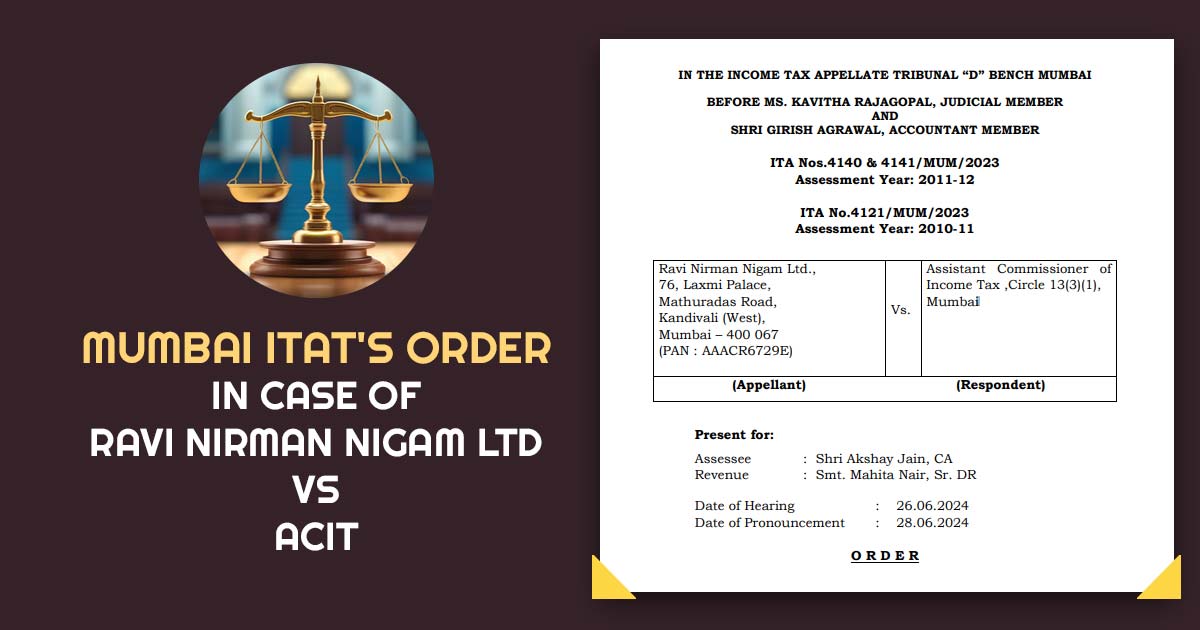

| Case Title | Ravi Nirman Nigam Ltd Vs. Assistant Commissioner of Income Tax |

| Case No. | ITA Nos.4140 & 4141/MUM/2023 |

| Date | 28.06.2024 |

| Assessee by | Shri Akshay Jain, CA |

| Revenue by | Smt. Mahita Nair, Sr. DR |

| Mumbai ITAT | Read Order |