It was ruled by The Mumbai Bench of Income Tax Appellate Tribunal (ITAT) that no reopening can take place after the expiry of four years from the end of the relevant assessment year unless any income levied to tax has escaped assessment for the reasons of the failure on the taxpayers part to reveal truly and wholly all material facts necessary for the assessment.

The bench of Amit Shukla (Judicial Member) and Gagan Goyal (Accountant Member) has noted that the assessment was completed earlier under section 143(3) by the order on March 20, 2016.

On some Income Tax Business Application (ITBA) databases the matter has been reopened where the parties from whom the taxpayer has made purchases were discovered to be non-filers of GST, and based on this information, the assessment has been reopened u/s 148 to make the addition as per the purchases that already stood reviewed before as they are under trading amount.

The petitioner has engaged in the business of builders and developers constructing affordable houses for the public. It has declared its total income. The assessment was finished, accepting the trading results, purchases, and sales.

Read Also: Income Tax Assessments Based Solely on Unverified 3rd-Party Statements Unlawful

On the ground that there were certain payments to various parties as per some fake bills the matter has been reopened. One purchase was made from M/s. Shah Steel Corporation and another was from M/s. Swarn Rerolling Mill Pvt. Ltd. From the data in the public domain, it was encountered that these entities were non-filers, and consequently, purchases made by two parties still need to be elaborated.

The objection of the taxpayer to reopen without even discussing it in the assessment order has been disposed of by the AO. The AO ruled that the taxpayer did not provide any substantial material proof to prove the genuineness of the transaction, and therefore, he added the entire purchase.

While permitting the petition the tribunal ruled that the time duration to reopen and the assessment as was applicable during the issuance of the reassessment notice is three years from the end of the relevant assessment year.

The time limit for 10 years has not been furnished until AO has in his possession books of account or other documents or proof that shows that the income levied to tax, shows in the form of an asset that has escaped the assessment amounts to or is seems to the amount to Rs 50,00,000 or more for that year. No document or proof was there that shows the income levied to tax in the form of an asset.

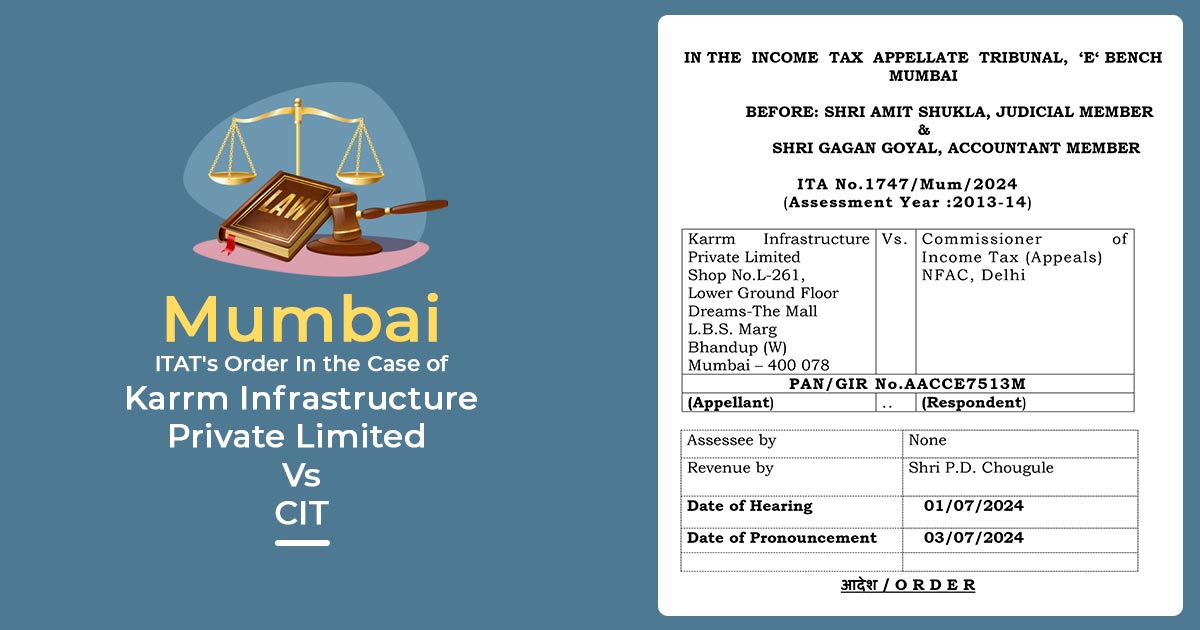

| Case Title | Karrm Infrastructure Private Limited Vs CIT |

| Case Number:- | ITA No.1747/Mum/2024 |

| Date | 03.07.2024 |

| Counsel For Assessee by | None |

| Counsel For Respondent | Shri P.D. Chougule |

| Mumbai ITAT | Read Order |