The income tax assessment order has been quashed by the Mumbai Bench of Income Tax Appellate Tribunal (ITAT) as of the absence of higher authority approval u/s 151 of the Income Tax Act, 1961 for the reopening beyond three years.

The taxpayer Sunil Harischandra Keni, filed a return claiming an income of Rs. 16,42,210 for the Assessment Year 2017-18. The taxpayer during the year, purchased a property worth Rs. 70 lakhs. However, Rs. 1,69,12,500 was the stamp duty value of the property.

The income tax department has regarded the taxable u/s 56(2)(vii)(b) of the Income Tax Act, categorizing it as income from other sources. The department reopened the assessment u/s 148 of the Income Tax Act, 1961 based on the assumption that the income did not undergo the assessment due to the undervaluation.

U/s 148 a notice was been issued before the taxpayer. The assessment order was passed adding the difference of Rs 92,12,500 to the total income of the taxpayer as income from other sources.

The taxpayer challenged this addition to the Commissioner of Income Tax (Appeals) claiming that the sanction for reopening was received u/s 151(i) but since more than 3 years had passed, it must have been accomplished u/s 151(ii).

The counsel of the taxpayer laid on the taxpayer’s case ruling via the Bombay High Court which has quashed the reassessment as of the inappropriate sanction. The Commissioner of Income Tax (Appeals) has agreed with the taxpayer and removed the addition of Rs 92,12,500.

The aggrieved revenue contested this decision before the ITAT, claiming that the case reopening was warranted due to credible reasons suggesting that income had evaded assessment.

The two-member bench, Amarjit Singh (Accountant Member) and Sandeep Singh Karhail (Judicial Member) investigated the Bombay High Court order in the case of taxpayer issued in W.P. (L) No. 15147 of 2024 dated 6th May 2024.

Provided that the Bombay High Court had ruled in favour of the assessee on this issue earlier, the ITAT discovered no reason to interrupt the previous decision made by CIT(A), which had followed the ruling of the High Court.

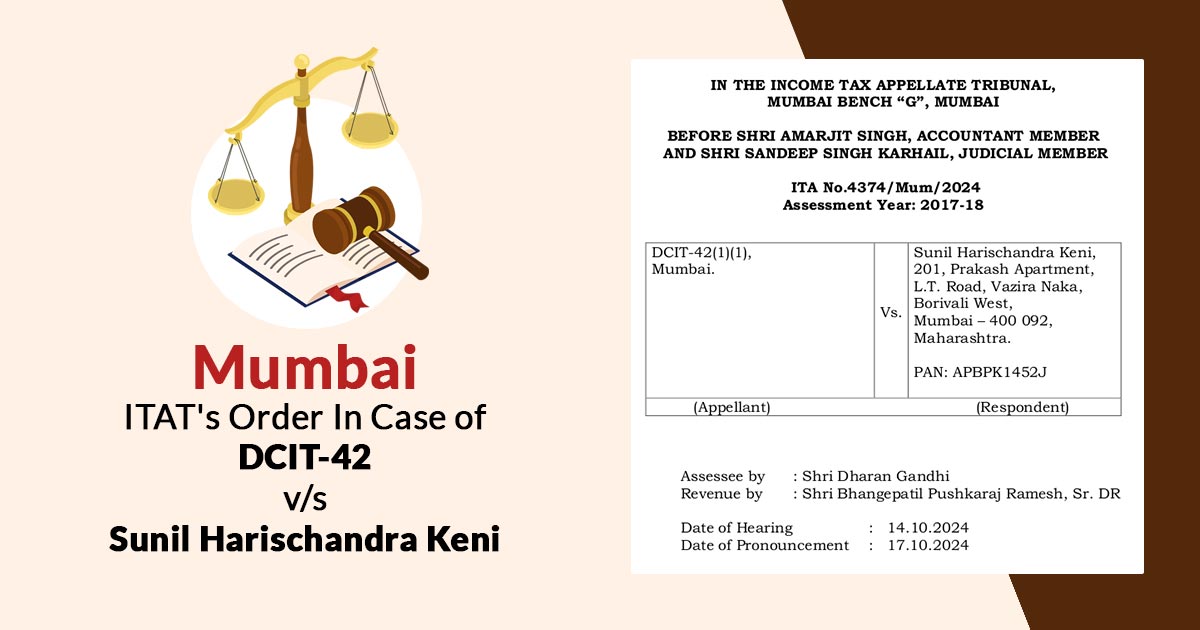

| Case Title | DCIT-42 Vs. Sunil Harischandra Keni |

| Citation | ITA No.4374/Mum/2024 |

| Date | 17.10.2024 |

| Assessee by | Shri Dharan Gandhi |

| Revenue by | Shri Bhangepatil Pushkaraj Ramesh, Sr. DR |

| Mumbai ITAT | Read Order |