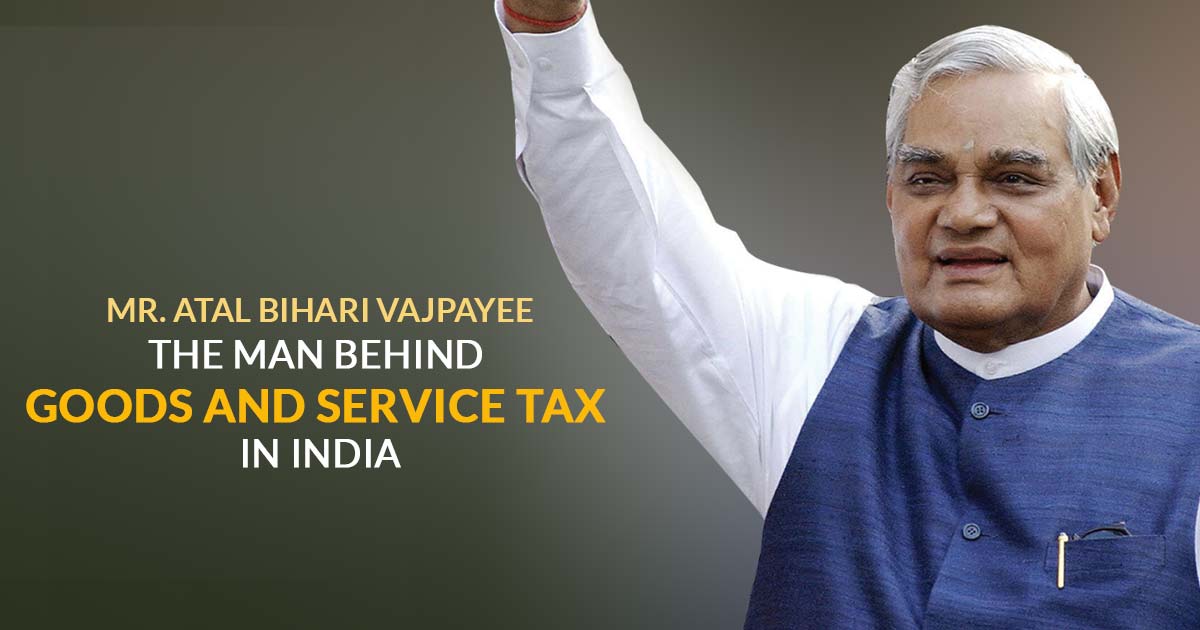

It is very sad to know that the great man and prestigious politician of modern times in India, Mr Atal Bihari Vajpayee has done with the life and left its complete comrade of the political family behind.

If the goods and services tax is to study from the formation, there is a deep connection of Vajpayee and GST as to say that the Atal Bihari had already made a presentation to implement GST in India back in the year 1999.

He is considered to be the first man who had started the research over the presently implemented indirect tax regime and finally actualized by the Narendra Modi in the year 2017.

He was the man who dreamed of GST and made every possible of his role and power to expand the idea of GST within the country and fellow mates. When in the starting of GST inception the Atal Bihari Vajpayee discussed the effects and procedure to implement GST extensively.

After which in the year 2003, finance minister Jaswant Singh initiated the amendment in the service tax provision and laws to include GST in some form. The finance minister asked his assistant and ex-finance minister to implement fiscal responsibility and budget management act.

The minister and the team presented a detailed report on the GST which was implemented in other foreign countries and was discussed as to how the same indirect tax can be implemented in India.

Read Also: 10 Secret GST Benefits that Everybody Wants to Know

The report stated that the centre should have 5 per cent while the states must implement 7 per cent GST. Overall the long-term struggle to implement GST in India was started by the three times elected prime minister, and a very humble man, the late Shree Atal Bihari Vajpayee.