Electronic waybill or e-way is used for the movement of goods. The same bill is made on the e-way bill portal. For transporting goods in a vehicle, the transporter is required to be a GST enrolled individual. The goods whose worth exceeds Rs 50,000 (Single Invoice/bill/delivery challan) would not be carried without an e-way bill that is made on the e-way bill portal at e-waybillgst.gov.in.

There would be a provision for generating or refusing the e-way bill via SMS, or from the Android App. Every generated e-way bill has a 12-digit unique E-Way Bill Number (EBN). the same is given to all three parties supplier, receiver, and transporter. The bill might be refused for distinct causes like glitches in the movement, amendment in goods, and exceeding. Learn more about the e-way bill cancellation.

Procedure to Update Transporter ID on GST E-Way Bills

The original transporter or seller who has generated the e-way bills would amend or re-assign the Transporter ID by only substituting the current transporter with the new transporter. Once the assigned transporter assigns another transporter then the seller shall not create these e-way bill modifications.

Below is the procedure for the re-assignment of another transporter:

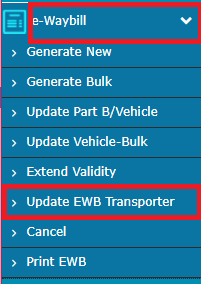

Step 1: Choose the ‘Update EWB Transporter’ sub-option under the ‘E-waybill’ option prompted on the left-hand side panel of the dashboard.

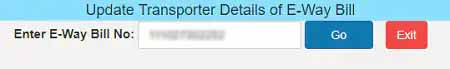

Step 2: Enter the e-way bill number and tap Go.

Note: Enter Transporter GSTIN or Transporter enrolment ID.

Step 3: After that, enter the Transporter ID and select ‘Submit’.

The updated e-way bill would prompt on the screen. Choose the Print option to print the e-way bill.

Note that the e-way bill number stays the same even after the modifications inside the transporter information.

What is the Method to Reject the E-way Bill?

An assessee secures access to eject the e-way bills generated by the other parties on the former GST Identification Number (GSTIN).

For instance, when the consignment would not arrive at the allocated destination as of its revocation on the way, the e-way bill for that might be rejected by the recipient.

Prerequisites:

- Date of e-way bill generation

- E-way bill number that you want to reject

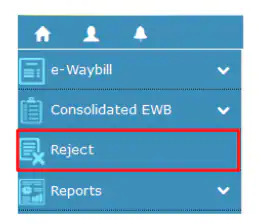

After you log in, check the ‘Reject’ section on the dashboard and tap on it.

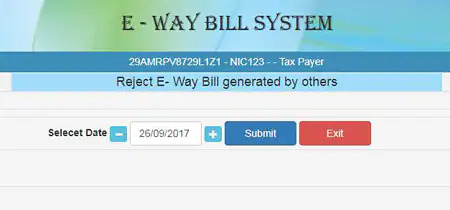

After you tap on to reject the mentioned screen prompts:

Tap on submit after the date on which the bill has been generated. Post to inserting the date you will get the list of bills that were made on the date.

Tick mark with respect to the related e-way bill which you like to reject on the right side. A message would be obtained to you on the screen rejecting the e-way bill.

GST E-Way Bill Cancellation Procedure

Towards any cause when the goods were never transported or not being transported according to the information prescribed in the e-way bill, then the generator might revoke the e-way bill via complying with the mentioned below process.

GST E-way Bill Cancellation Factors

Step 1: The e-way bill cancellation period is 24 hours after generating the bill.

Step 2: Once balanced, it is illegal to use the same e-way bill.

Step 3: The bill shall not be canceled when it gets verified by the empowered officer.

Mentioned Below is the Procedure

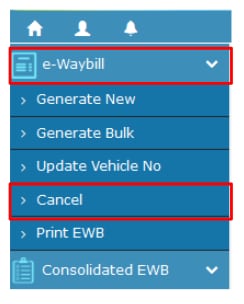

Step 1: Tap on ‘e-way bill’ / ‘Consolidated EWB’. A drop-down emerges, choose ‘Cancel’ from that.

Step 2: Input the e-way number of the bill that requires to be revoked, tap on ‘Go.

Modification of GST E-Way Bill

- The e-way bill consists of two elements, that is Part-A and Part-B.

- There is no rule made that permits the modifications of Part A of the eway bill for irrelevant information that you entered. One needs to revoke the bill and regenerate a new one.

- In Part A when the consignor who has filed the data would assign the e-way bill number to another registered transporter who might update the data in Part B of form GST EWB-01. The same helps the further movement of goods.

What is the Method to Extend the Validity Duration of the e-Way Bills?

The generator of the e-way bills would extend the duration of validity of e-way bills either four hours prior to or after the expiry of the bills.

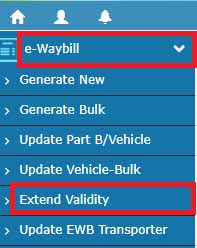

Step1: Login and choose the ‘Extend validity’ under the ‘E-waybill’ option shown on the dashboard.

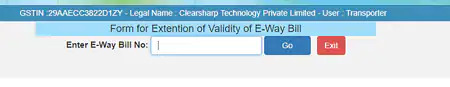

Step 2: Enter the e-way bill number of the e-way bill you want an extension.

Step 3: The e-way bill form prompts, now choose Yes with respect to the question Do you want to get an extension for the EWB? At the downside of your screen.

One might re-enter the total distance, dispatch location, and the location of delivery of the goods that get transported. After the extension of validity, the new e-way bill number gets assigned substituting the old one.

The businesses that are engaged in the transportation of goods should mandate an e-way bill. Thus business owners should know the importance of generating an eway bill for faster and easier operations.