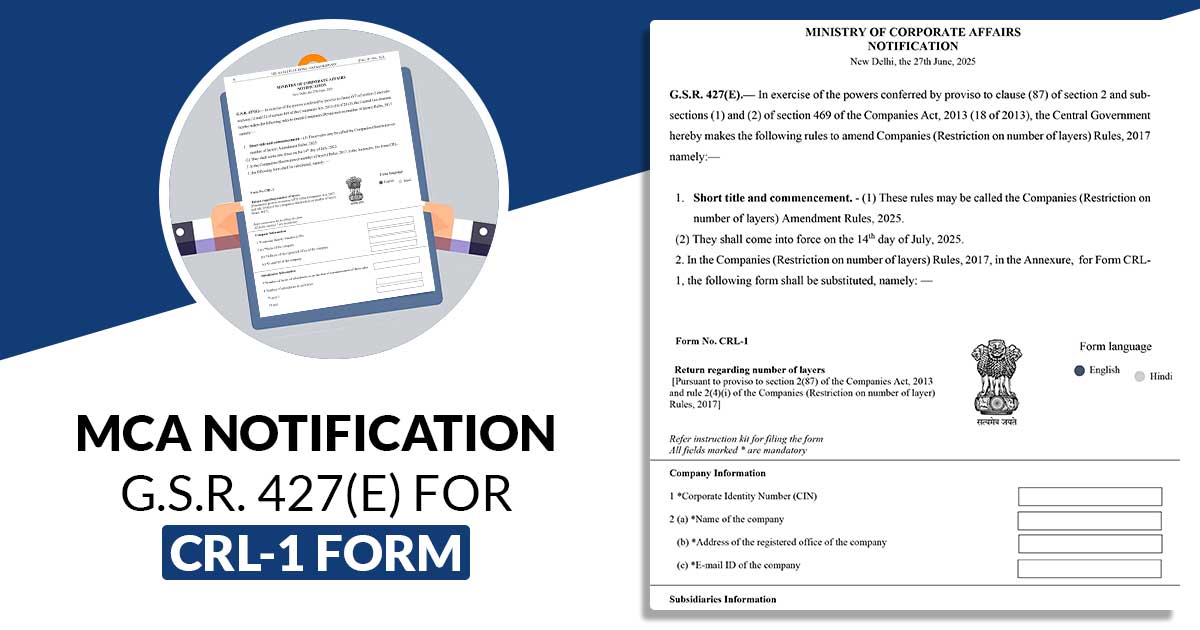

An official notification number G.S.R. 427(E) dated June 27, 2025, has been issued by the Ministry of Corporate Affairs (MCA), stating that the Central Government of India has introduced amendments to certain provisions of the Companies (Restriction on Number of Layers) Rules, 2017, in exercise of the powers conferred under the proviso to clause (87) of section 2 and subsections (1) and (2) of section 469 of the Companies Act, 2013 (18 of 2013). The amendments are as follows:

- These updated revised rules will be officially called the Companies (Restriction on Number of Layers) Amendment Rules, 2025.

- The amended rules will be effective from July 14, 2025.

In a new and updated version, the main amendment introduced in the current Form CRL-1 has been replaced. Form CRL-1 is a legal document used u/s 230(1) of the Companies Act, 2013, in India, when a company desires to convert itself into a Limited Liability Partnership (LLP).

The form is utilised when a company desires to move its structure from a regular company to an LLP; the company should obtain approval from the central government. Companies file the CRL-1 form with the RoC to notify the government.

The same form is a formal request made to the Indian government requesting permission to convert the company into an LLP.

Read Also: Easy Guide to Convert LLP into a Private Limited Company

In the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i), vide notification number G.S.R. 1176(E), dated September 20, 2017, the principal rules were published.

Download Updated MCA Form CRL-1

What is Form CRL-1?

Form CRL-1 is a document that some companies must fill out to provide information about their subsidiary structure. This is necessary when a company has multiple levels of subsidiaries, meaning they own other companies that also have their own subsidiaries. This form helps regulators understand how many layers of ownership are involved.