According to Section 137 of the Companies Act, 2013, the company and its three directors were penalised for failing to file financial statements for the fiscal years 2016–17 through 2020–21.

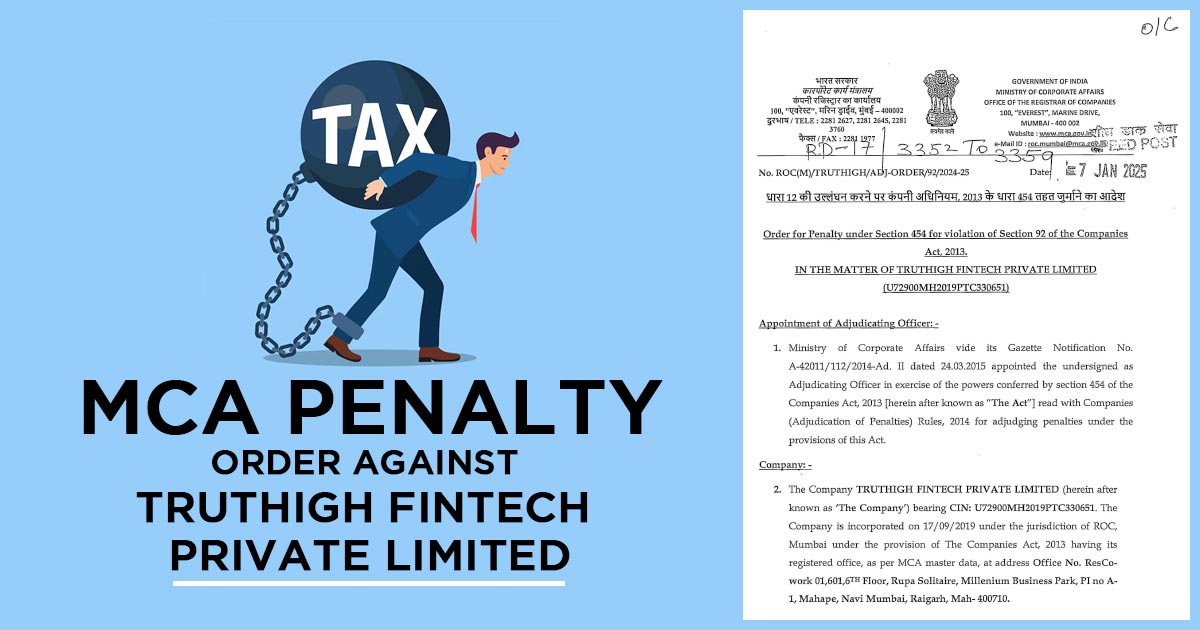

The Ministry of Corporate Affairs (MCA) Registrar of Companies issued this judgment under Section 454 of the Companies Act, 2013, as part of the adjudication process.

Truthigh Fintech Private Limited was registered as a private company under the Companies Act, 2013, on September 17, 2019.

Arriving at the facts of the present case, an inquiry u/s 206(4) of the Companies Act, 2013, was performed for the irregular operations of the company. At the time of the inquiry, it was discovered that the company had breached section 137 of the Act.

It is marked that u/s 137, the company was obligated to submit its Financial statements within 30 days of the Annual General Meeting (AGM) conducted u/s 96 of the Companies Act. Though the company was unable to submit the financial statements for FY 2020-2021.

Section 137(1) of the Companies Act, 2013, cited that: “A copy of the financial statements, including consolidated financial statements, if any, along with all the documents which are required to be or attached to such financial statements under this Act, duly adopted at the annual general meeting of the company, shall be filed with the Registrar within thirty days of the date of the annual general meeting in such manner, with such fees or additional fees as may be prescribed.”

In 2024, the business and its officers received a Show Cause Notice (SCN). Nevertheless, no answer was given. According to Section 454 of the Companies Act, 2013, the adjudicating authority assessed a total penalty of Rs. 4.56 lakhs because the company and its officers did not reply to the SCN.

According to the adjudicating body, the corporation broke Section 137 of the Companies Act from December 31, 2021, to August 19, 2024. Consequently, the company and its seven directors have been hit with a penalty of Rs 4,56,200.

The levy penalty was provided in the table of the order.

B. Mishra, Registrar of Companies & Adjudicating Officer, Maharashtra, Mumbai, has issued the order.