The demand has been quashed by the Madras HC concerning the input tax credit (ITC) mismatch as the department still needs to consider certificates obtained by buyers.

The bench of Justice Senthilkumar Ramamoorthy witnessed that important records, like the supplier’s and the chartered accountant’s certificates, were not considered in the issuance of the demand order. Interruptions with the order are warranted because the same crucial evidence is being overlooked.

An SCN has been obtained for the petitioner. The SCN was answered by expressing that the cause for the discrepancy between the GSTR 3B return of the applicant and the auto-populated GSTR 2A was the belated filing of GSTR 1 by the supplier concerning one invoice. The petitioner said that he was not able to upload the reply on the portal. The demand order was issued.

It was argued by the department that the applicant was furnished with a reasonable chance to contest the tax demand and was unable to provide a response via the GST portal.

The applicant argued that it has placed on record a certificate from Fivestar Impex India Private Limited stating that the supply was made under an invoice dated November 1, 2017. A certificate from Prabhakaran & Associates, Chartered Accountant, was also placed on record.

Read Also: Free Download Chartered Accountant Software for Tax Firms

The certificate furnishes the information of the invoice on November 1, 2017, for a total value of Rs. 18,82,000. The documents were regarded while issuing the order.

The demand order has been set aside by the court and remanded the case back to the respondent department for reconsideration. It allowed the applicant to provide a response to the Show Cause Notice (SCN) within 15 days from the date of receipt of a copy of the same order by holding all the pertinent documents. The respondent on receipt was asked to furnish a reasonable chance to the applicant along with the personal hearing and issue a fresh order within 2 months from the date of receipt of the response of the applicant.

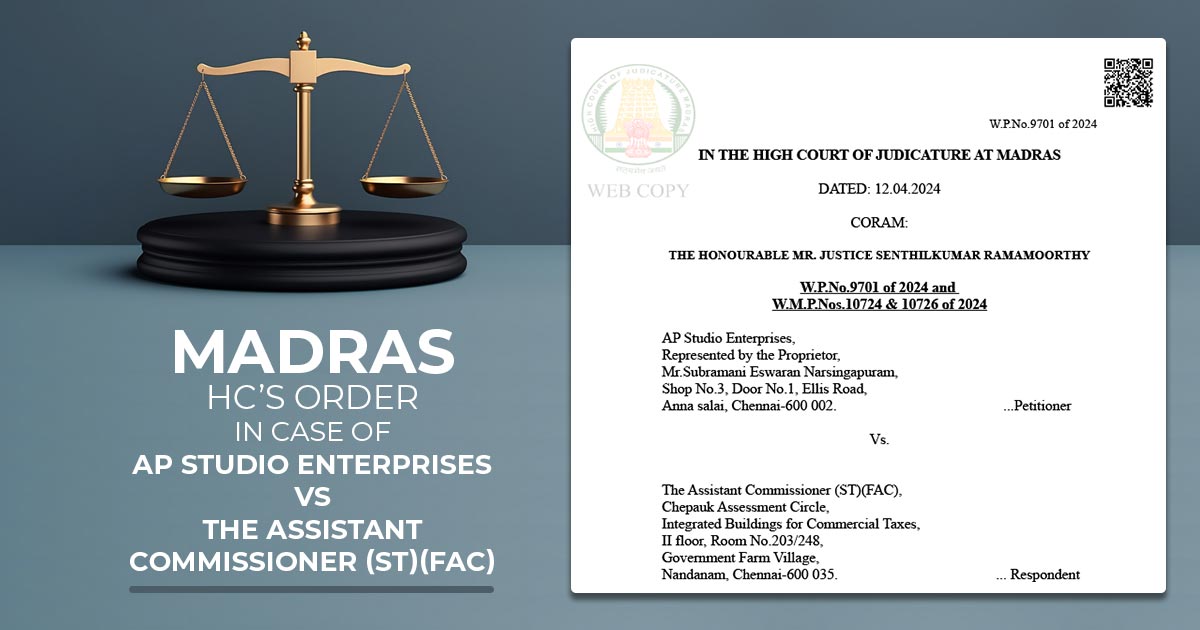

| Case Title | AP Studio Enterprises Vs. The Assistant Commissioner (ST)(FAC) |

| Case No. | W.P.No.9701 of 2024 and W.M.P.Nos.10724 & 10726 of 2024 |

| Date | 12.04.2024 |

| For Petitioner | Mr.B.Sivaraman |

| For Respondent | Mr.T.N.C.Kaushik, |

| Madras High Court | Read Order |