The Madras High Court in a ruling, set aside the penalty of 300% mentioning that the GST department did not consider the same High Court ruling that Section 27(4) Tamil Nadu Value Added Tax (TNVAT) cannot be invoked for belated filing of returns.

The applicant, Clean Switch India, contested an order on March 18, 2024, which imposed both tax and a penalty concerned with the delayed filing of returns and the subsequent reversal of the Input Tax Credit (ITC). On September 3, 2019, the assessment order for the FY 2016-2017 was originally issued.

Clean Switch India did not challenge the assessment either via a statutory appeal or a writ petition. The applicant on February 6, 2023, filed a rectification application, which was subsequently rejected by an order on August 17, 2023. The same rejection directed the applicant to file a writ petition contesting the order.

On December 21, 2023, the High Court set aside the rectification rejection on the foundation that it was a non-speaking order. Consequently, the case was remanded for reconsideration directing to the issuance of the impugned order.

The applicant’s counsel claimed that while the GST department accepted the rectification of the applicant for the wrong ITC claim amounting to Rs 40,15,403, it was not able to address the problem of the late return filing.

The applicant asked the copies of the returns along with the letter on August 8, 2019, however, the department affirmed the tax proposal without furnishing these documents, thereafter denying to rectify the penalty, asserted counsel, Mr.Rajkumar P.

Read Also:- Madras HC Permits Transition of Unutilized Tax Paid Under VAT to Tamil Nadu GST Act.

The applicant’s contention centred around the application of Section 27(4) of the TNVAT Act, which the applicant claimed should not have been invoked only for the late filing of returns.

The applicant mentioned a Division Bench ruling in M/s. Shree Laxmi Jewellery Limited v. The State of Tamil Nadu (Tax Case (Revision) stated that such a penalty provision ought not be applied under these cases. The department failed to consider or cite it in the impugned order despite presenting this precedent.

The former order was set aside as it was non-speaking and the applicant had located the old documents in question, the counsel of the department submitted. Also, the High Court remarked that the respondent did not furnish the returns to the petitioner, therefore denying them a proper chance to defend against the penalty.

The tax component has been carried by the bench of Justice Senthilkumar Ramamoorthy however discovered that the levying of a 300% penalty was not explained because the department failed to consider the binding precedent.

Read Also:- Alert! Heavy Penalties on Such Types of Tax-Evading Methods

The penalty has been set aside by the HC and remanded the case for reconsideration, directing the respondent to provide a fresh order post furnishing the applicant with a reasonable chance to represent their matter along with the personal hearing.

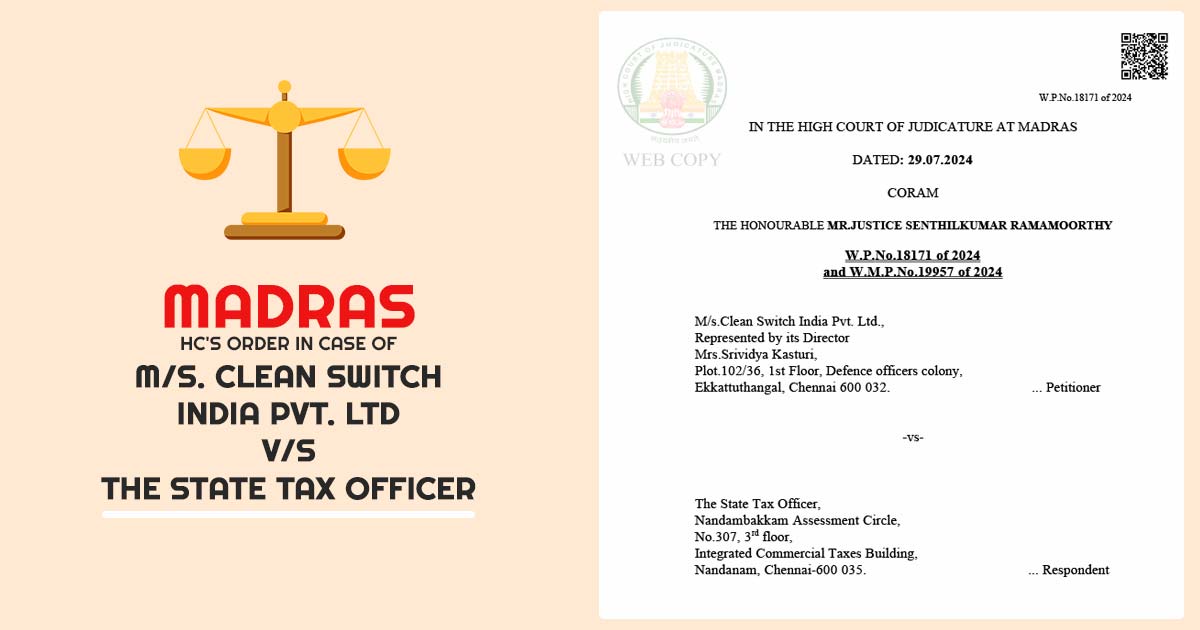

| Case Title | Clean Switch India Pvt. Ltd. V/S The State Tax Officer |

| Citation | W. P.N o.18171 of 2024 |

| Date | 29.07.2024 |

| Counsel For Petitioner | Mr.Rajkumar P. |

| Counsel For Respondent | Mr.C.Harsha Raj, AGP (T) |

| Madras High Court | Read Order |