The LLP Form 11 Annual Return is mandatory for Limited Liability Partnerships (LLP) registered under the LLP Act, 2008 in India. All LLPs are required to file the particular form every year, regardless of turnover or profit. Therefore, even LLPs without any activity must file this form or pay a penalty of Rs.100 for each day they delay in filing it. In this article, we will discuss how to file LLP Form 11 using Gen Complaw Software.

What is LLP Form 11 for Annual Return Filing?

Limited Liability Partnership (LLP) Form 11 is the Annual Return. Each year, the MCA requires that the return be e-filed to maintain compliance. Filing an LLP annual return electronically and keeping a record of it is required. LLP Form 11 Annual Returns cannot be resubmitted if the information provided is incorrect.

An LLP Form 11 cannot be filed if an e-Form 4 (Notice of appointment, cessation, and change in designation of a designated partner or partner) is pending for payment of a fee or if an e-Form 4 is pending with the MCA. Therefore, it is important to file any e-Form 4 well before the due date for the LLP Annual Return.

Documents Must be Needed for MCA LLP Form 11

Here is a list of all the facts and documents to be required when filing the LLP 11 form just like similarly LLP form 8 Return:

- LLP Name

- Identification Number for Limited Liability Partnership

- Principal company actions of the LLP

- Registered office address of the LLP

- Details of Designated Partners and Partners of the LLP

- Multiple Business Category of LLP (Profession, Business, Occupation, Service, Others)

- Details of penalties levied on the LLP if any

- The complete burden of the assistance of members of the LLP

- Overview of Designated partners and partners

- Particulars of compounding offences, if any

- Total assistance/contribution obtained by all members of the Limited Liability Partnership

- Details of Limited Liability Partnership or firm in which Partner/Designated Partner are a Director/Partner (It is compulsory to connect this attribute in case any Partner/Designated Partner is a partner in any LLP and Director in any business)

The LLP Annual Return 11 form cannot be resubmitted once it is filed. It must reflect the total contributions received by all Partners listed on LLP Form 8 Statement of Accounts & Solvency due by 30th October. Hence, it is essential to obtain an experienced person to help while organising and filing the LLP Annual Return Form.

Why Choose Gen CompLaw Software for LLP Form 11 Annual Return Filing?

The Gen Complaw software is used to complete ROC e-Forms, XBRL files, Resolutions, Minutes, Registers, and other statutory reports. The software is developed by SAG Infotech for companies, directors, etc. to speed up and simplify the filing process. With Gen Complaw, XBRL (MCA/ROC Filing) is updated with the latest E-forms, XBRL-IAS tool, and XBRL AS-XBRL. There are several electronic forms are filed under the Companies Act 1956/2013, including MGT-7, ADT-1, DPT-3, AOC-4, LLP-8, CHG-4, LLP-11, LLP-3, DIR-3, DIR-12, CHG-1, 23AC, 23ACA, etc. A further feature of this software allows you to import forms with others so you can receive faster responses.

With this software, all ROC forms’ E-filings are performed on time without any errors. The company is able to keep track of fixed assets only as part of the statutory compliances under the Companies Act, 2013. The service is reliable and gives a faster response in a short amount of time.

Step-by-Step Guide to File LLP Form 11 Via Gen Complaw Software

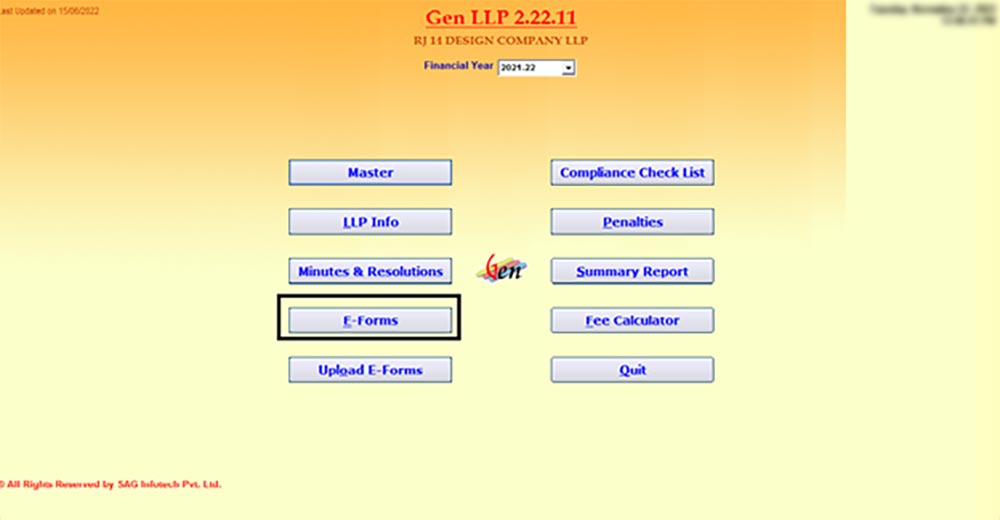

Step 1: Install and Open the Gen CompLaw software and Select the applicable financial year and ‘E-Forms’ option from the main screen as shown below.

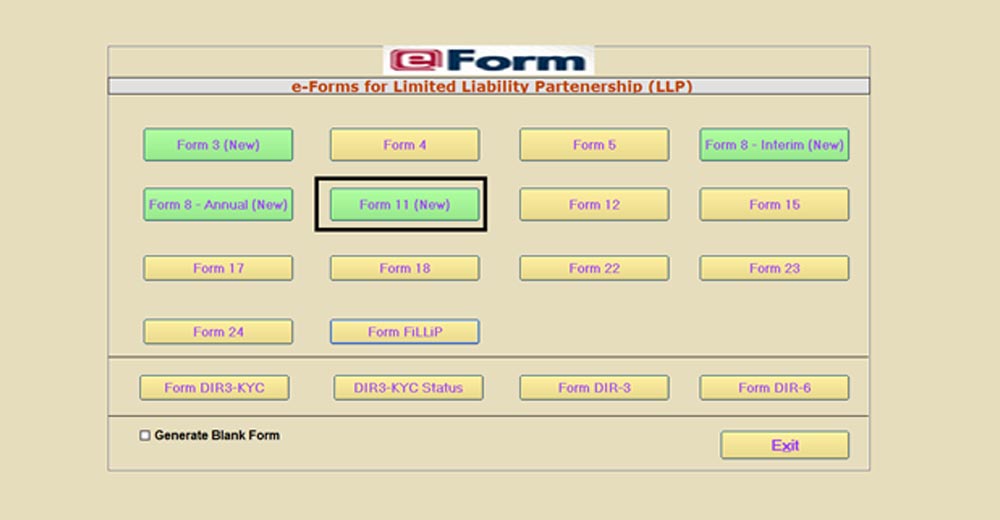

Step 2: Now Select ‘E-Form’ LLP 11

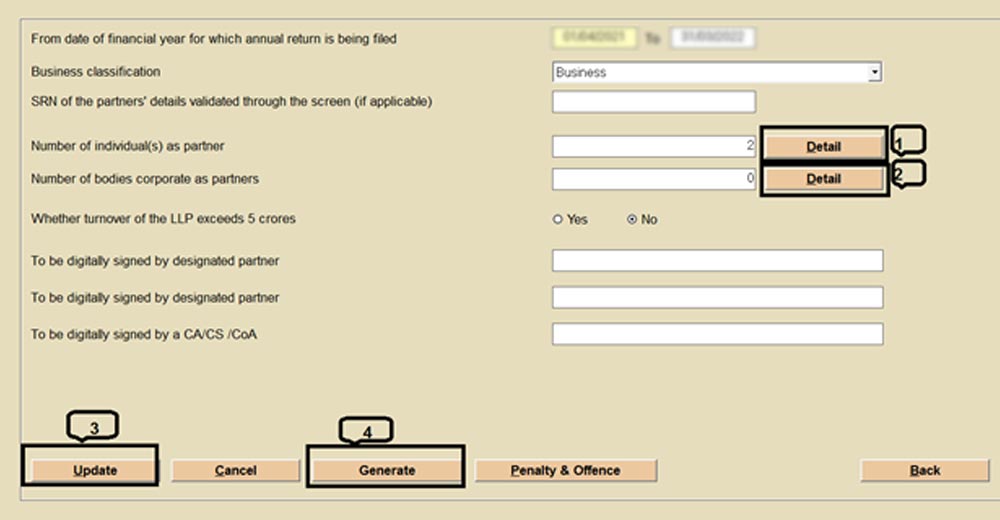

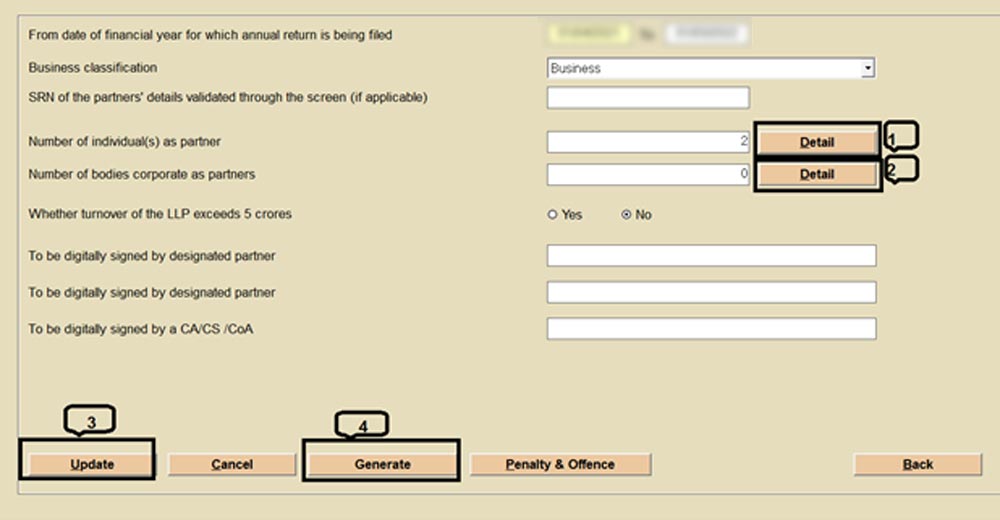

Step 3: Provide the details as required and then select options given as point 1 or 2

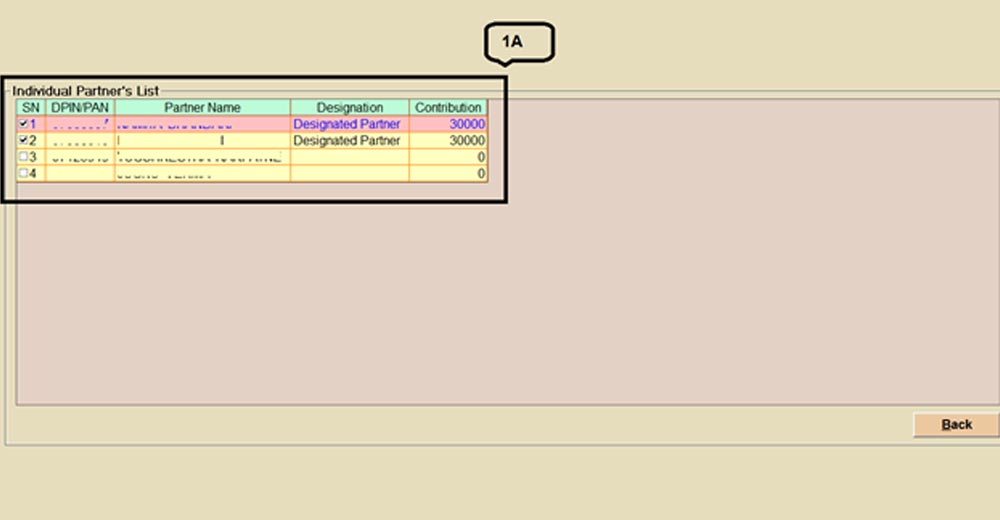

Step 4: After selecting the option given as point 1 or 2, click on the check box and then provide the relevant details. Go to the main page by selecting back.

Step 5: Now select the update option and save the details, after selecting the details click generate option to upload the form details on the MCA portal.

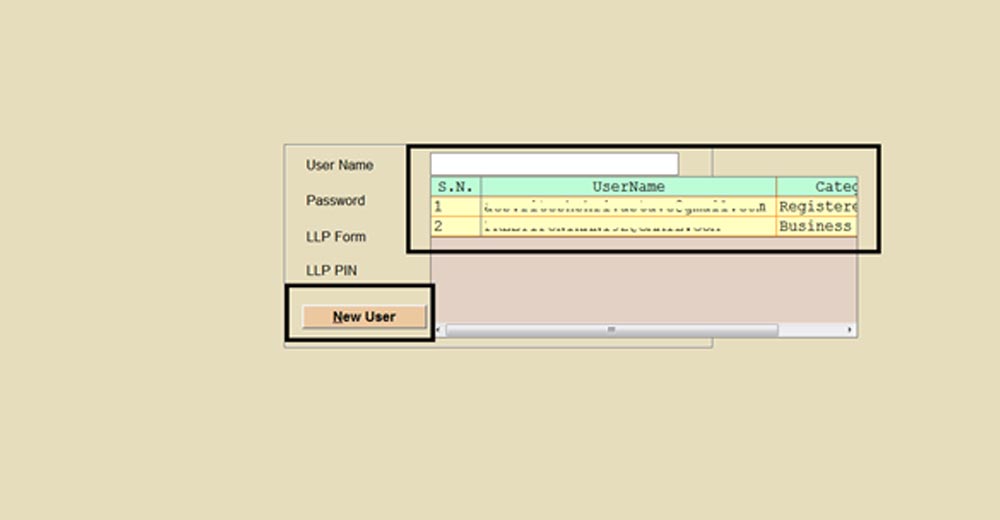

Step 6: Select the MCA ‘login id’ and ‘password’ of the user which you want to upload and then upload the forms on the MCA portal.

Step 7: Our software will redirect you to the MCA V3 Login page after uploading the same from the software by saving it on the portal. Afterwards, you have to edit the form and check and submit to proceed further.

Step 8: Once the form is submitted on the MCA portal SRN will generate. You can further download the form, affix DSC and upload it in the MCA V3 portal and proceed for payment.

Note: Our software will generate and save the Excel attachments as per the information provided in the software. You have to cross-check the same and upload the Excel in the form at the MCA V3 portal only.