LLP-31 form is said to be the application for compounding of an offence under the Act. For the Annual Return of a Limited Liability Partnership (LLP), Form 31 is used in India.

It is filled with the Ministry of Corporate Affairs (MCA) under the Limited Liability Partnership Act, 2008. Every LLP must submit the form, which is a separate legal entity, to report specific details about its activities.

LLP 31 Form Objective

The major goal of this is to file the amendments in the LLP agreement u/s 23(2) of the LLP Act, 2008. The other purpose of the LLP-31 form is to apply for the conversion from A Private Company into an LLP and an Unlisted Public Company into an LLP.

Due Date of Filing MCA LLP 31 Form

- Within 30 days of making changes in the partnership agreement.

- In the case of conversion, Form 31 is filed at the stage of applying for conversion.

Required Attachments

The attachment needed for this is the Amended LLP agreement copy and consent letters from partners. Along with that, Proof of the changes made (e.g., resolutions passed by partners). In case of conversion, take the consent of shareholders, also carry the Statement of assets and liabilities, and the details of pending cases or liabilities.

Easy Steps for Filing of MCA LLP Form 31

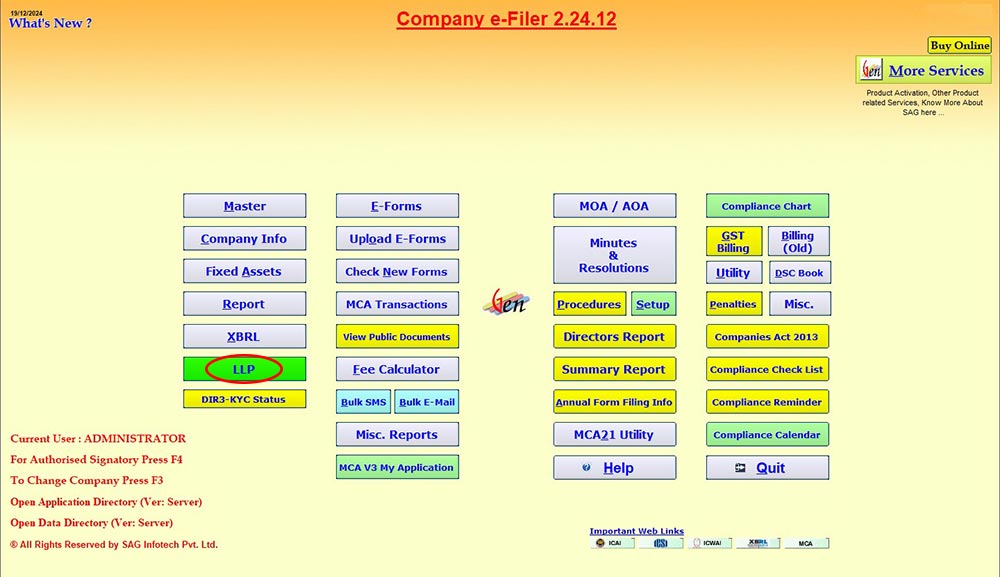

Step 1. Firstly, open the Gen Complaw software and click on the LLP button.

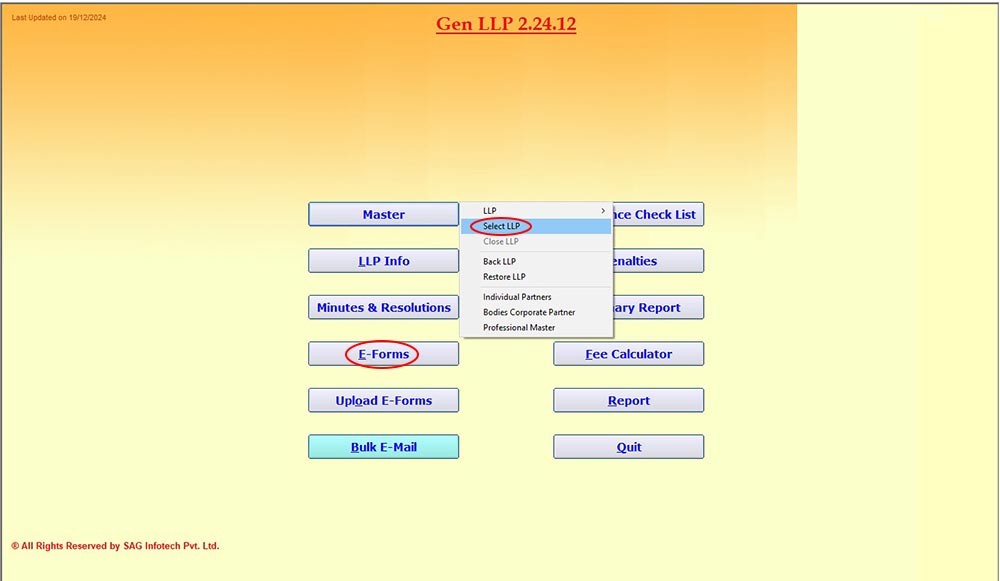

Step 2. Now move the cursor to the Master, then LLP, and click on Company to select.

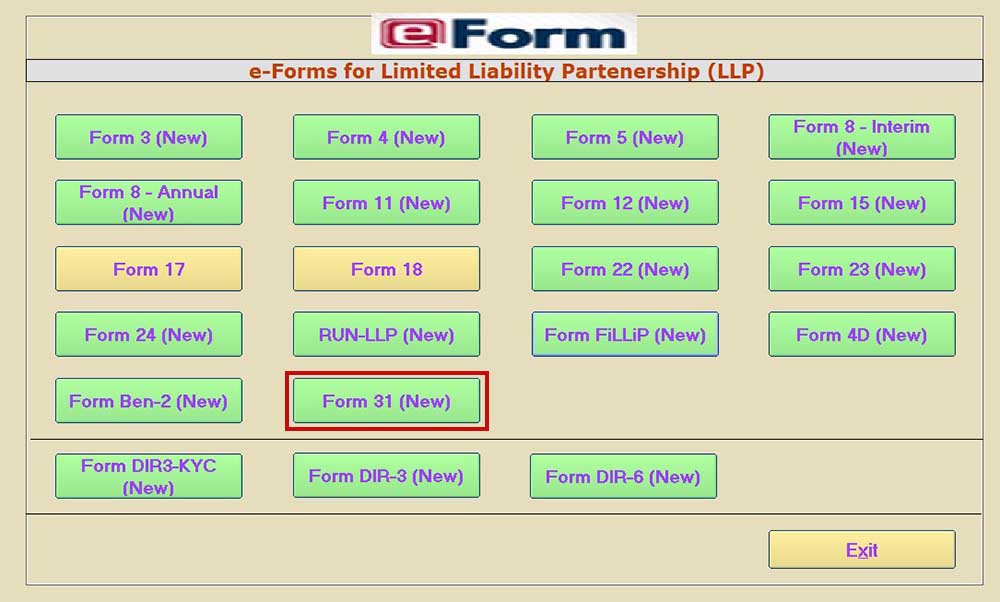

Step 3. After the company selection, move on to the E-forms to the LLP 31 form.

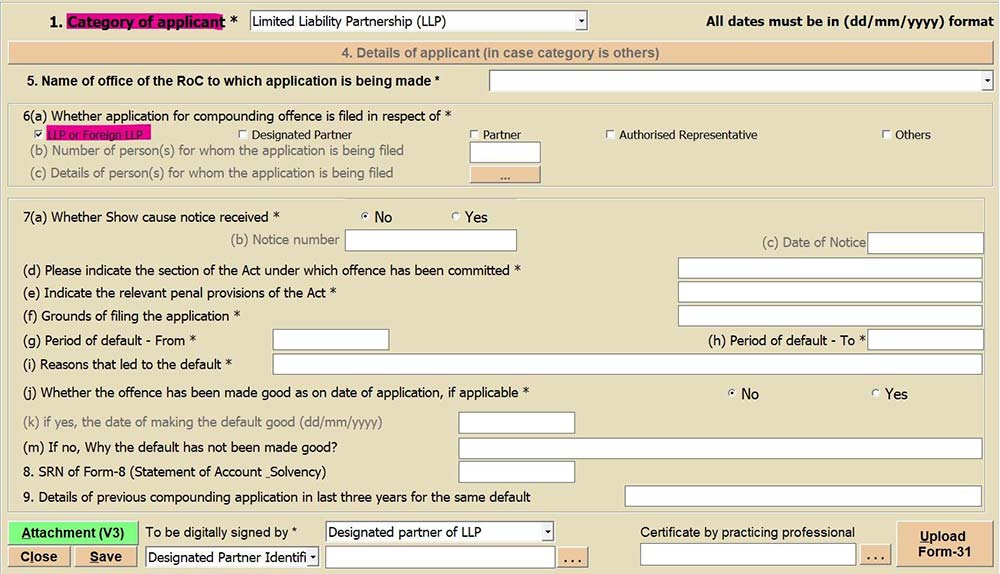

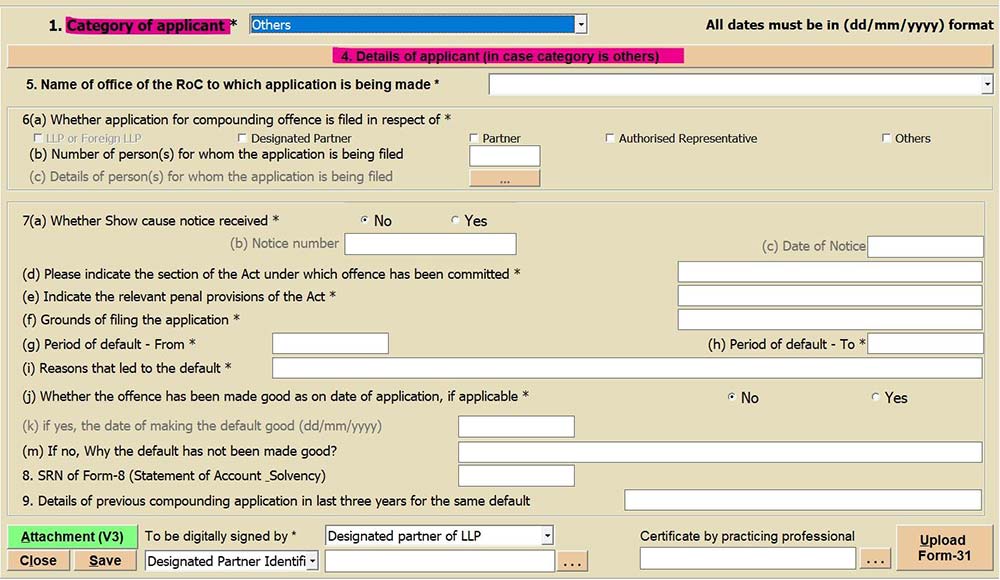

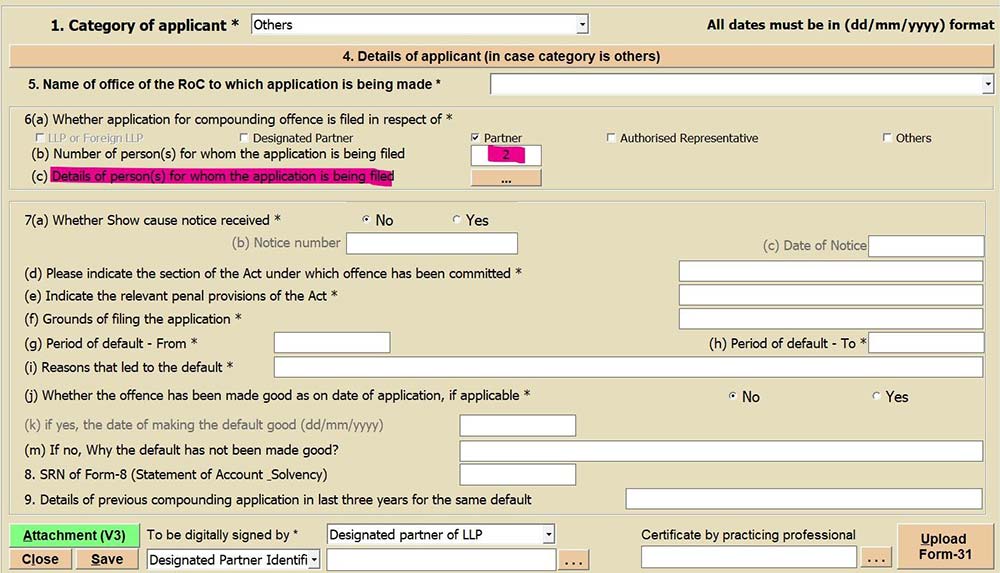

Step 4. Select the Category of Applicant from the dropdown list. (Please note that option “LLP/FLLP” under 6(a) will be enabled only in case LLP/ FLLP is selected in the Category of Applicant dropdown.)

(Point No. 4 Details of Applicant will be enabled only in case others are selected).

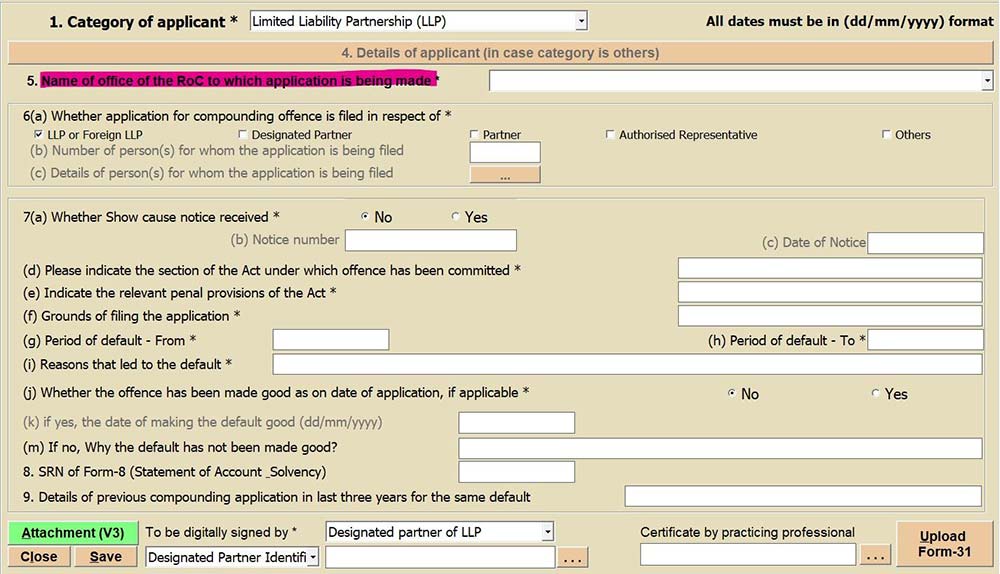

Step 5. The name of the ROC to which the application is made is to be selected afterwards.

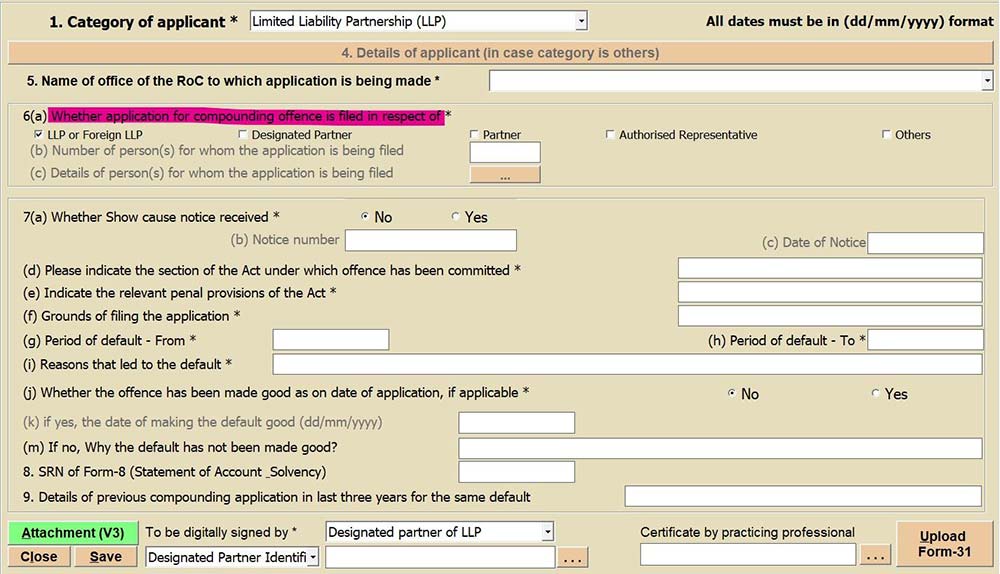

Step 6. Select “Whether application for compounding offence is filed in respect of” (Please note that option “LLP/FLLP” will be enabled only in case LLP/ FLLP is selected in the Category of Applicant dropdown.)

Step 7. Option 6(c) will be enabled based on the input given in option 6(b).

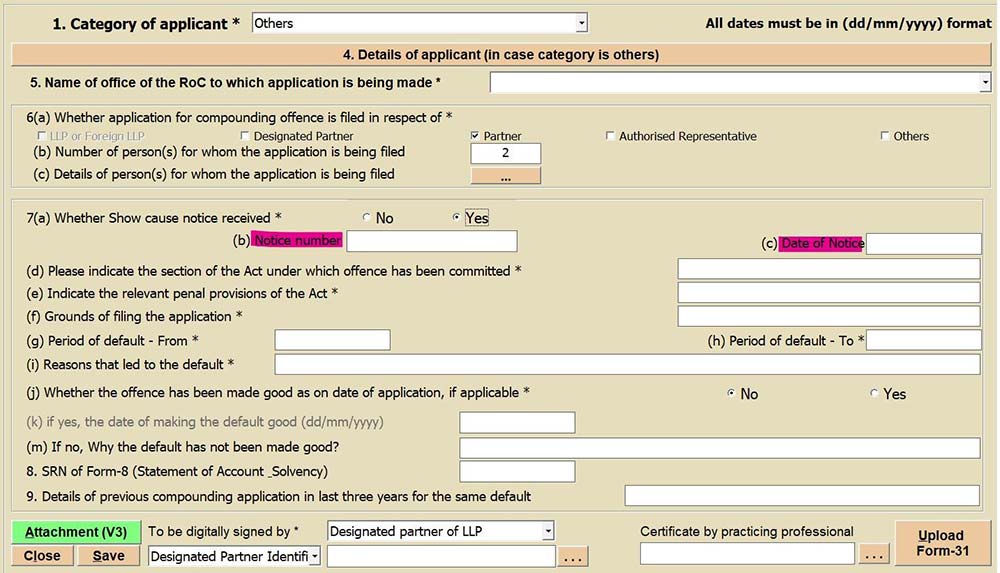

Step 8. Kindly enter the Notice number and date of notice if a show cause notice is received; otherwise, the option will be disabled.

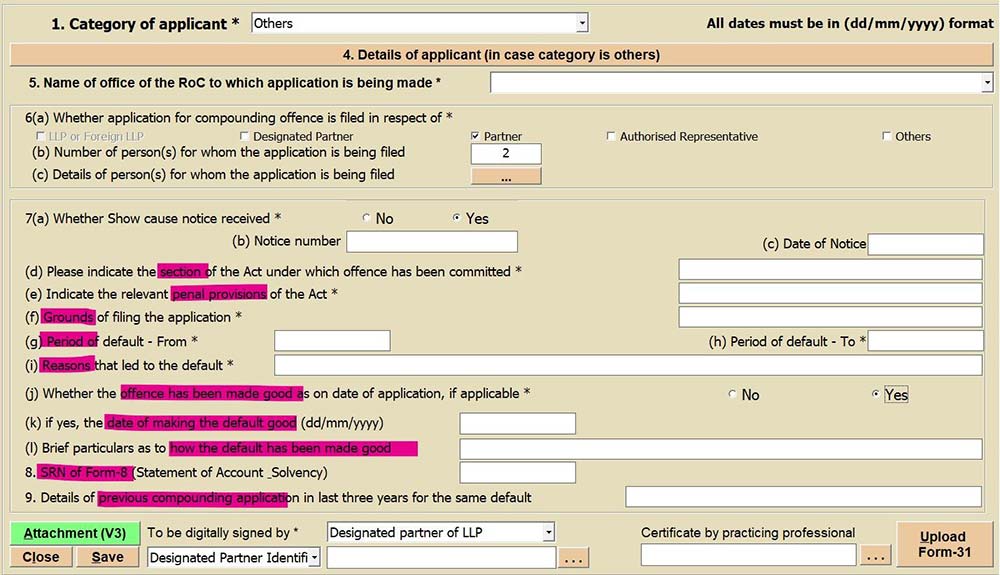

Step 9. The user is required to enter manually further details such as:

- The section under which the offence was committed.

- Penal provision.

- Grounds for filing the application.

- Period of default.

- Reasons that led to default.

- Whether default has made good (If yes, then mention the date and brief particulars of how the default made good, but if no is selected, then state the reason why the default has not made good yet.)

- SRN (Service Request Number) of Form 8.

- Details of previous compounding applications in the last three years.

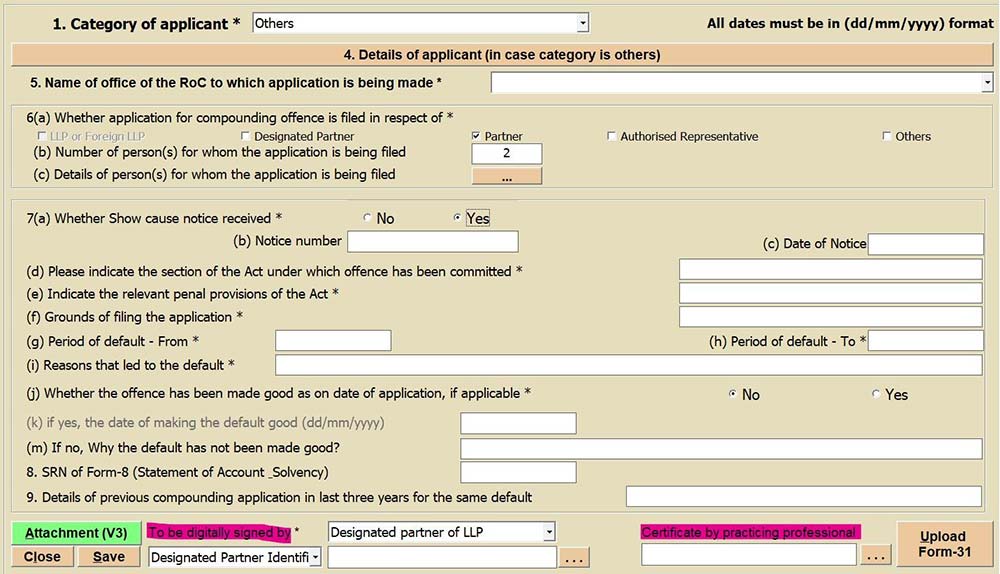

Step 10. Further, select the authorized signatory for signing from the dropdown list and accordingly, select the type of identification.

Step 11. Select a practising professional.

Step 12. Save the form and add attachments.

Step 13. Click on Upload Form 31 and select login.

Step 14. The software will display a message as “Data added successfully” and leave the user on the MCA portal after saving the form there.

Step 15. Afterwards, kindly click on the edit option on the saved form on the MCA portal, and proceed and submit.